16. Increases in current assets other than cash decrease cash, whereas decreases in these accounts increase cash. True / False 17. A simple rule to track how changes in assets and liabilities affect cash flow is that if something we own goes up, our cash goes up and vice-versa and if something we owe goes up, our cash goes down and vice-versa. 18. Financing activities include raising cash by issuing short-term debt, long-term debt, or stock. In torms of how its used ECE is the cosh flow ovoilobla for distribution to the True / False True / False 10

16. Increases in current assets other than cash decrease cash, whereas decreases in these accounts increase cash. True / False 17. A simple rule to track how changes in assets and liabilities affect cash flow is that if something we own goes up, our cash goes up and vice-versa and if something we owe goes up, our cash goes down and vice-versa. 18. Financing activities include raising cash by issuing short-term debt, long-term debt, or stock. In torms of how its used ECE is the cosh flow ovoilobla for distribution to the True / False True / False 10

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 5MCQ

Related questions

Question

Plz solve it within 40-50 mins I'll give you multiple upvote

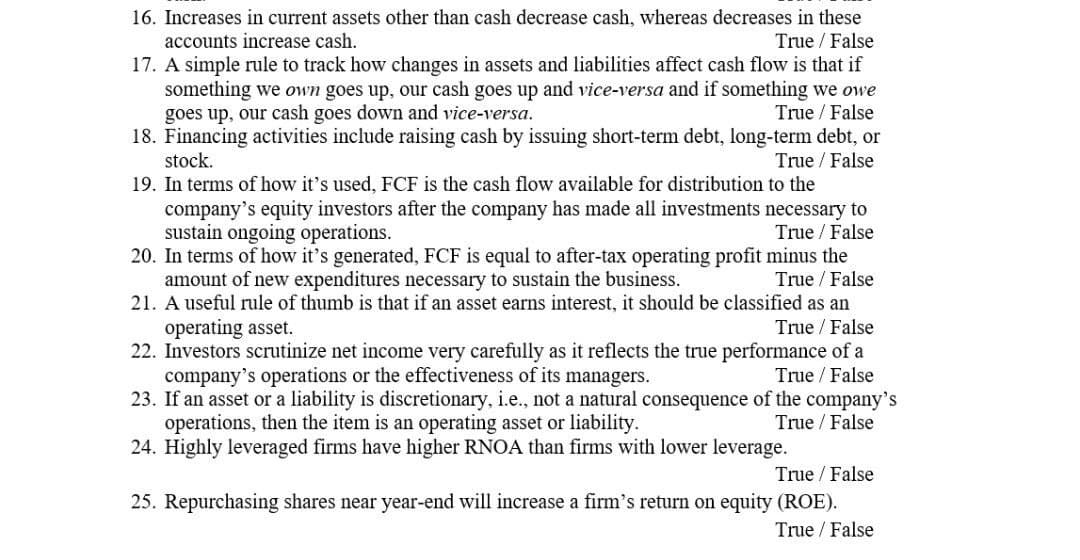

Transcribed Image Text:16. Increases in current assets other than cash decrease cash, whereas decreases in these

accounts increase cash.

17. A simple rule to track how changes in assets and liabilities affect cash flow is that if

something we own goes up, our cash goes up and vice-versa and if something we owe

goes up, our cash goes down and vice-versa.

18. Financing activities include raising cash by issuing short-term debt, long-term debt, or

stock.

19. In terms of how it's used, FCF is the cash flow available for distribution to the

company's equity investors after the company has made all investments necessary to

sustain ongoing operations.

20. In terms of how it's generated, FCF is equal to after-tax operating profit minus the

amount of new expenditures necessary to sustain the business.

21. A useful rule of thumb is that if an asset earns interest, it should be classified as an

True / False

True / False

True / False

True / False

True / False

True / False

operating asset.

22. Investors scrutinize net income very carefully as it reflects the true performance of a

company's operations or the effectiveness of its managers.

23. If an asset or a liability is discretionary, i.e., not a natural consequence of the company's

operations, then the item is an operating asset or liability.

24. Highly leveraged firms have higher RNOA than firms with lower leverage.

True / False

True / False

True / False

25. Repurchasing shares near year-end will increase a firm's return on equity (ROE).

True / False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning