Which of the following statements is true? O A. Profit margin is calculated by dividing total assets by sales. O B. Return on Equity rises if equity increases and net income remain constant. O C.A 10% increase in cash will lead to a greater Cash Ratio O D. The current ratio increases if the current liabilities increase QUESTION 8 Which of the following statements is false? O A. A positive cash conversion cycle means the company is paying its payables before receiving its receivables O B. A negative cash conversion cycle means the company is collecting its receivable before paying its payables. OC. The cash conversion cycle is the length of time required for the company to recieve its inventory and then receive cash from the sales of its inventory O D. All of the above statenents are true.

Which of the following statements is true? O A. Profit margin is calculated by dividing total assets by sales. O B. Return on Equity rises if equity increases and net income remain constant. O C.A 10% increase in cash will lead to a greater Cash Ratio O D. The current ratio increases if the current liabilities increase QUESTION 8 Which of the following statements is false? O A. A positive cash conversion cycle means the company is paying its payables before receiving its receivables O B. A negative cash conversion cycle means the company is collecting its receivable before paying its payables. OC. The cash conversion cycle is the length of time required for the company to recieve its inventory and then receive cash from the sales of its inventory O D. All of the above statenents are true.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter13: Valuation: Earnings-based Approach

Section: Chapter Questions

Problem 18PC

Related questions

Question

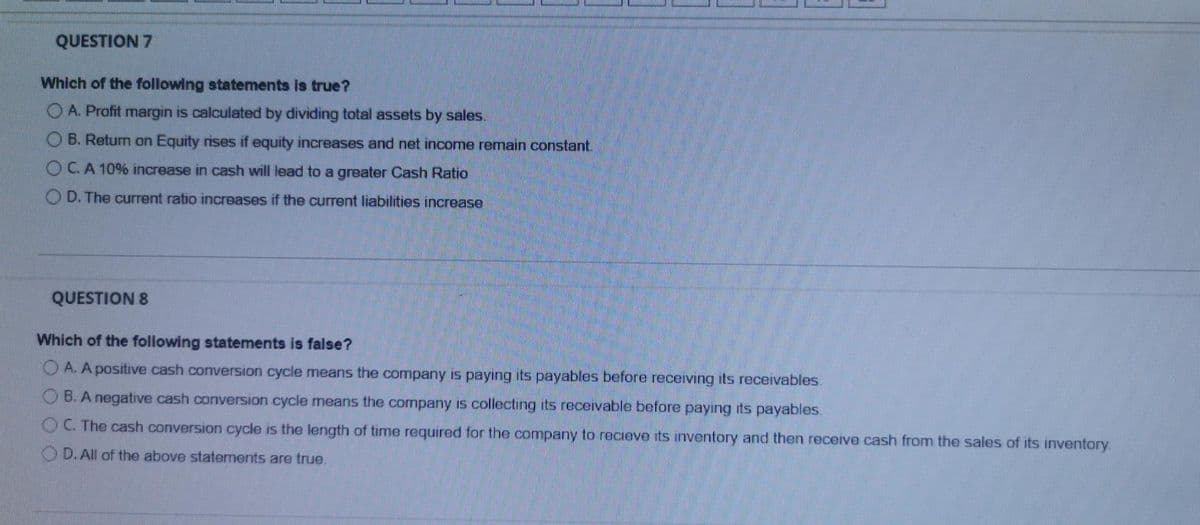

Transcribed Image Text:QUESTION 7

Which of the following statements is true?

O A. Profit margin is calculated by dividing total assets by sales.

OB. Return on Equity rises if equity increases and net income remain constant.

OCA 10% increase in cash will lead to a greater Cash Ratio

O D. The current ratio increases if the current liabilities increase

QUESTION 8

Which of the following statements is false?

A. A positive cash conversion cycle means the company is payıng its payables before receiving its recervables.

O B. A negative cash conversion cycle means the company is collecting its recervable before payıng its payables.

OC The cash conversion cycle is the length of time required for the company to recieve its inventory and then recerve cash from the sales of its inventory.

O D.All of the above statements are true.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning