16. Rolfe set up an RRSP for a client when the client was account every month until they retired at age 60. Th return of 7.6% per year compounded annually. If the disbursement from the account starting at age 60 fo monthly disbursement be if the RRSP investment ret would have a zero balance? At a At age 60 N= N= 1% =

16. Rolfe set up an RRSP for a client when the client was account every month until they retired at age 60. Th return of 7.6% per year compounded annually. If the disbursement from the account starting at age 60 fo monthly disbursement be if the RRSP investment ret would have a zero balance? At a At age 60 N= N= 1% =

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 14PROB

Related questions

Question

Help me fast so that I will give good rating.....

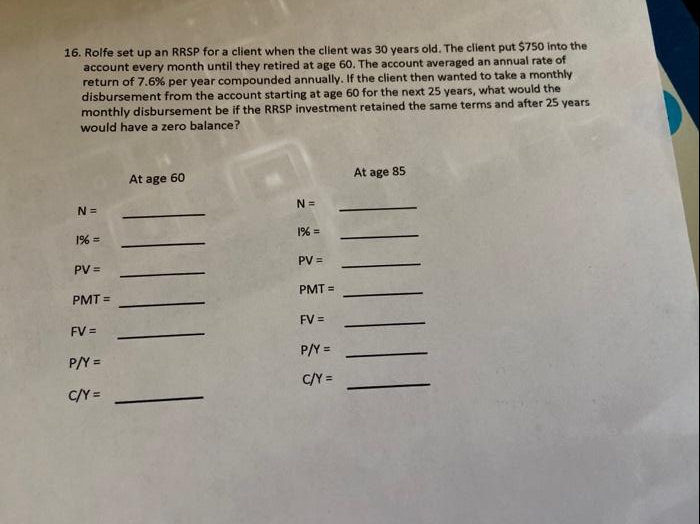

Transcribed Image Text:16. Rolfe set up an RRSP for a client when the client was 30 years old. The client put $750 into the

account every month until they retired at age 60. The account averaged an annual rate of

return of 7.6% per year compounded annually. If the client then wanted to take a monthly

disbursement from the account starting at age 60 for the next 25 years, what would the

monthly disbursement be if the RRSP investment retained the same terms and after 25 years

would have a zero balance?

At age 85

At age 60

N=

N =

1% =

1% =

PV =

PV =

PMT =

PMT =

FV =

FV =

P/Y =

P/Y =

C/Y =

C/Y =

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College