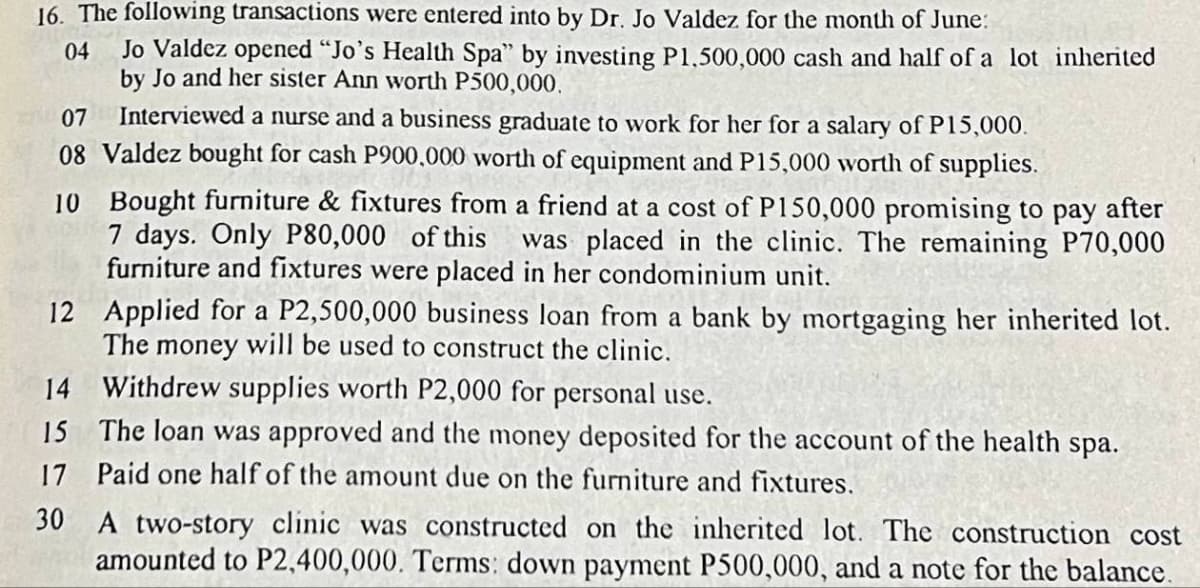

16. The following transactions were entered into by Dr. Jo Valdez for the month of June: 04 Jo Valdez opened "Jo's Health Spa" by investing P1,500,000 cash and half of a lot inherited by Jo and her sister Ann worth P500,000. 07 Interviewed a nurse and a business graduate to work for her for a salary of P15,000. 08 Valdez bought for cash P900,000 worth of equipment and P15,000 worth of supplies. 10 Bought furniture & fixtures from a friend at a cost of P150,000 promising to pay after 7 days. Only P80,000 of this was placed in the clinic. The remaining P70,000 furniture and fixtures were placed in her condominium unit. 12 Applied for a P2,500,000 business loan from a bank by mortgaging her inherited lot. The money will be used to construct the clinic. 14 Withdrew supplies worth P2,000 for personal use. 15 The loan was approved and the money deposited for the account of the health spa. 17 Paid one half of the amount due on the furniture and fixtures. 30 A two-story clinic was constructed on the inherited lot. The construction cost amounted to P2,400,000. Terms: down payment P500,000, and a note for the balance.

16. The following transactions were entered into by Dr. Jo Valdez for the month of June: 04 Jo Valdez opened "Jo's Health Spa" by investing P1,500,000 cash and half of a lot inherited by Jo and her sister Ann worth P500,000. 07 Interviewed a nurse and a business graduate to work for her for a salary of P15,000. 08 Valdez bought for cash P900,000 worth of equipment and P15,000 worth of supplies. 10 Bought furniture & fixtures from a friend at a cost of P150,000 promising to pay after 7 days. Only P80,000 of this was placed in the clinic. The remaining P70,000 furniture and fixtures were placed in her condominium unit. 12 Applied for a P2,500,000 business loan from a bank by mortgaging her inherited lot. The money will be used to construct the clinic. 14 Withdrew supplies worth P2,000 for personal use. 15 The loan was approved and the money deposited for the account of the health spa. 17 Paid one half of the amount due on the furniture and fixtures. 30 A two-story clinic was constructed on the inherited lot. The construction cost amounted to P2,400,000. Terms: down payment P500,000, and a note for the balance.

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 60P

Related questions

Question

pr3pare the journal entries.

Transcribed Image Text:16. The following transactions were entered into by Dr. Jo Valdez for the month of June:

04 Jo Valdez opened "Jo's Health Spa" by investing P1,500,000 cash and half of a lot inherited

by Jo and her sister Ann worth P500,000.

07

Interviewed a nurse and a business graduate to work for her for a salary of P15,000.

08 Valdez bought for cash P900,000 worth of equipment and P15,000 worth of supplies.

10

Bought furniture & fixtures from a friend at a cost of P150,000 promising to pay after

7 days. Only P80,000 of this was placed in the clinic. The remaining P70,000

furniture and fixtures were placed in her condominium unit.

Applied for a P2,500,000 business loan from a bank by mortgaging her inherited lot.

The money will be used to construct the clinic.

12

14

Withdrew supplies worth P2,000 for personal use.

15

The loan was approved and the money deposited for the account of the health spa.

17 Paid one half of the amount due on the furniture and fixtures.

30

A two-story clinic was constructed on the inherited lot. The construction cost

amounted to P2,400,000. Terms: down payment P500,000, and a note for the balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT