The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Garcon Company $ 13,200 Finished goods inventory, beginning Work in process inventory, beginning Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net 16,300 8,000 30,000 23, 200 19,400 24,700 6,800 14,250 26,500 14,450 5,180 46,000 62,800 284, 280 27,000 13,800 Pepper Company $ 16,750 20,250 13,050 23,800 39,000 13,000 16, 200 7,400 17,250 54,500 13,940 1,800 58,000 55,900 384,990 17,700 19,950 1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended December 31. 2. Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended December 31.

The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Garcon Company $ 13,200 Finished goods inventory, beginning Work in process inventory, beginning Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net 16,300 8,000 30,000 23, 200 19,400 24,700 6,800 14,250 26,500 14,450 5,180 46,000 62,800 284, 280 27,000 13,800 Pepper Company $ 16,750 20,250 13,050 23,800 39,000 13,000 16, 200 7,400 17,250 54,500 13,940 1,800 58,000 55,900 384,990 17,700 19,950 1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended December 31. 2. Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended December 31.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter26: Manufacturing Accounting: The Job Order Cost System

Section: Chapter Questions

Problem 2SEB: SCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Sanchez Welding and...

Related questions

Question

Step by Step right Answer Please & Image not Allow Thanks

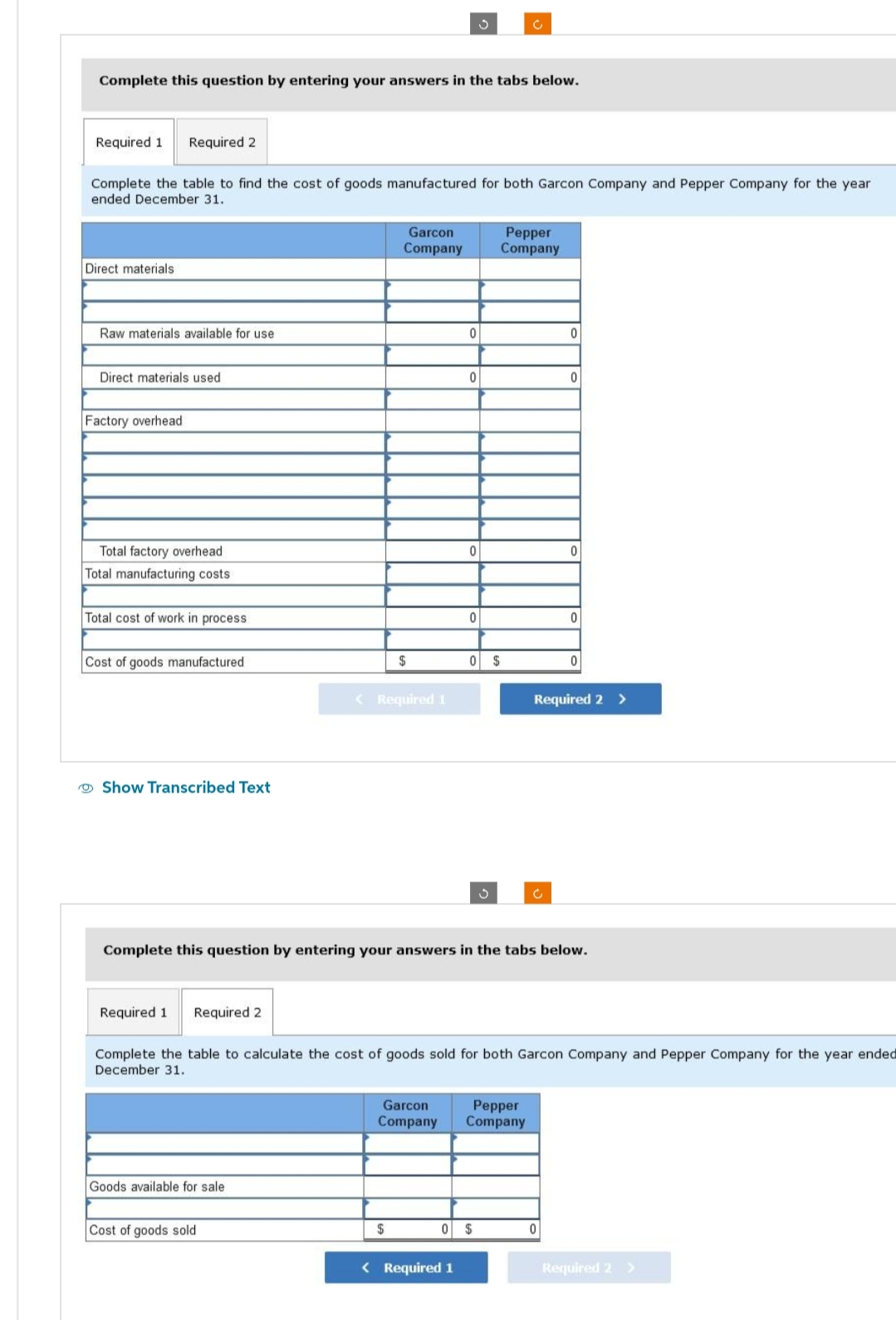

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year

ended December 31.

Direct materials

Raw materials available for use

Direct materials used

Factory overhead

Total factory overhead

Total manufacturing costs

Total cost of work in process

Cost of goods manufactured

Show Transcribed Text

Goods available for sale.

Garcon

Company

Cost of goods sold

$

< Required 1

$

0

0

0

0

< Required 1

0 $

c

S

Garcon

Pepper

Company Company

0 $

Pepper

Company

Ċ

Complete this question by entering your answers in the tabs below.

0

Required 1 Required 2

Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended

December 31.

0

0

0

0

Required 2 >

0

Required 2 >

![!

Required information

[The following information applies to the questions displayed below.]

The following data is provided for Garcon Company and Pepper Company for the year ended December 31.

Finished goods inventory, beginning

Work in process inventory, beginning

Raw materials inventory, beginning

Rental cost on factory equipment

Direct labor

Finished goods inventory, ending

Work in process inventory, ending

Raw materials inventory, ending

Factory utilities

General and administrative expenses

Indirect labor

Repairs-Factory equipment

Raw materials purchases

Selling expenses

Sales

Cash

Accounts receivable, net

Garcon

Company

$ 13,200

16,300

8,000

30,000

23, 200

19,400

24,700

6,800

14,250

26,500

14,450

5,180

46,000

62,800

284, 280

27,000

13,800

Pepper

Company

$ 16,750

20, 250

13,050

23,800

39,000

13,000

16, 200

7,400

17,250

54,500

13,940

1,800

58,000

55,900

384,990

17,700

19,950

1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended

December 31.

2. Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended

December 31.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F6e2ecb44-3acc-44a4-9a1e-0237508c1e1f%2F81ce462d-6ca3-46dc-bd37-88c2eb624928%2Ffenh9z_processed.jpeg&w=3840&q=75)

Transcribed Image Text:!

Required information

[The following information applies to the questions displayed below.]

The following data is provided for Garcon Company and Pepper Company for the year ended December 31.

Finished goods inventory, beginning

Work in process inventory, beginning

Raw materials inventory, beginning

Rental cost on factory equipment

Direct labor

Finished goods inventory, ending

Work in process inventory, ending

Raw materials inventory, ending

Factory utilities

General and administrative expenses

Indirect labor

Repairs-Factory equipment

Raw materials purchases

Selling expenses

Sales

Cash

Accounts receivable, net

Garcon

Company

$ 13,200

16,300

8,000

30,000

23, 200

19,400

24,700

6,800

14,250

26,500

14,450

5,180

46,000

62,800

284, 280

27,000

13,800

Pepper

Company

$ 16,750

20, 250

13,050

23,800

39,000

13,000

16, 200

7,400

17,250

54,500

13,940

1,800

58,000

55,900

384,990

17,700

19,950

1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended

December 31.

2. Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended

December 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning