16. Which of the following statements about capital budgeting is correct? A. The timing of cash flows is irrelevant in capital budgeting B. A company should use the same discount rate for all of its projects regardless of their risk C. Interest expense on an outstanding loan is a relevant cost for capital budgeting D. Proceeds forgone because a company used a building in a new project, rather than selling the building, is a relevant cost for capital budgeting 17. A financial analyst in Pitt's Sock Company prepared a capital budgeting analysis. The analyst calculated an NPV of $150,000 for the project. You just realized that the initial cash flow related to buying new equipment had a typo. The analysis was based on a purchase price of $10,000; however, the actual cost should have been $100,000. Which of the following is correct? A. If the analysis were rerun with the correct initial purchase price, the NPV would be a negative number B. If the analysis were rerun with the correct initial purchase price, the NPV would be $60,000 C If the analysis were rerun with the correct initial purchase price, the NPV would be $240,000 D. The impact on NPV cannot be calculated with the information above 18. What is the NPV of the following cash flows? The company uses an 11% discount rate. ($168,000) $25,000 Initial Cash Flow Year 1 Cash Flow $25,000 $25,000 Year 2 Cash Flow Year 3 Cash Flow Year 4 Cash Flow $0 Year 5 Cash Flow $75,000 Year 6 Cash Flow $75,000 Year 7 Cash Flow $80,000 Year 8 Cash Flow $80,000 $90,000 $100,000 Year 9 Cash Flow Year 10 Cash Flow A. $121,348.25 B. $146,456.34 C. $109,322.75 D. $131,942.65 12

16. Which of the following statements about capital budgeting is correct? A. The timing of cash flows is irrelevant in capital budgeting B. A company should use the same discount rate for all of its projects regardless of their risk C. Interest expense on an outstanding loan is a relevant cost for capital budgeting D. Proceeds forgone because a company used a building in a new project, rather than selling the building, is a relevant cost for capital budgeting 17. A financial analyst in Pitt's Sock Company prepared a capital budgeting analysis. The analyst calculated an NPV of $150,000 for the project. You just realized that the initial cash flow related to buying new equipment had a typo. The analysis was based on a purchase price of $10,000; however, the actual cost should have been $100,000. Which of the following is correct? A. If the analysis were rerun with the correct initial purchase price, the NPV would be a negative number B. If the analysis were rerun with the correct initial purchase price, the NPV would be $60,000 C If the analysis were rerun with the correct initial purchase price, the NPV would be $240,000 D. The impact on NPV cannot be calculated with the information above 18. What is the NPV of the following cash flows? The company uses an 11% discount rate. ($168,000) $25,000 Initial Cash Flow Year 1 Cash Flow $25,000 $25,000 Year 2 Cash Flow Year 3 Cash Flow Year 4 Cash Flow $0 Year 5 Cash Flow $75,000 Year 6 Cash Flow $75,000 Year 7 Cash Flow $80,000 Year 8 Cash Flow $80,000 $90,000 $100,000 Year 9 Cash Flow Year 10 Cash Flow A. $121,348.25 B. $146,456.34 C. $109,322.75 D. $131,942.65 12

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter13: Capital Budgeting: Estimating Cash Flows And Analyzing Risk

Section: Chapter Questions

Problem 13MC

Related questions

Question

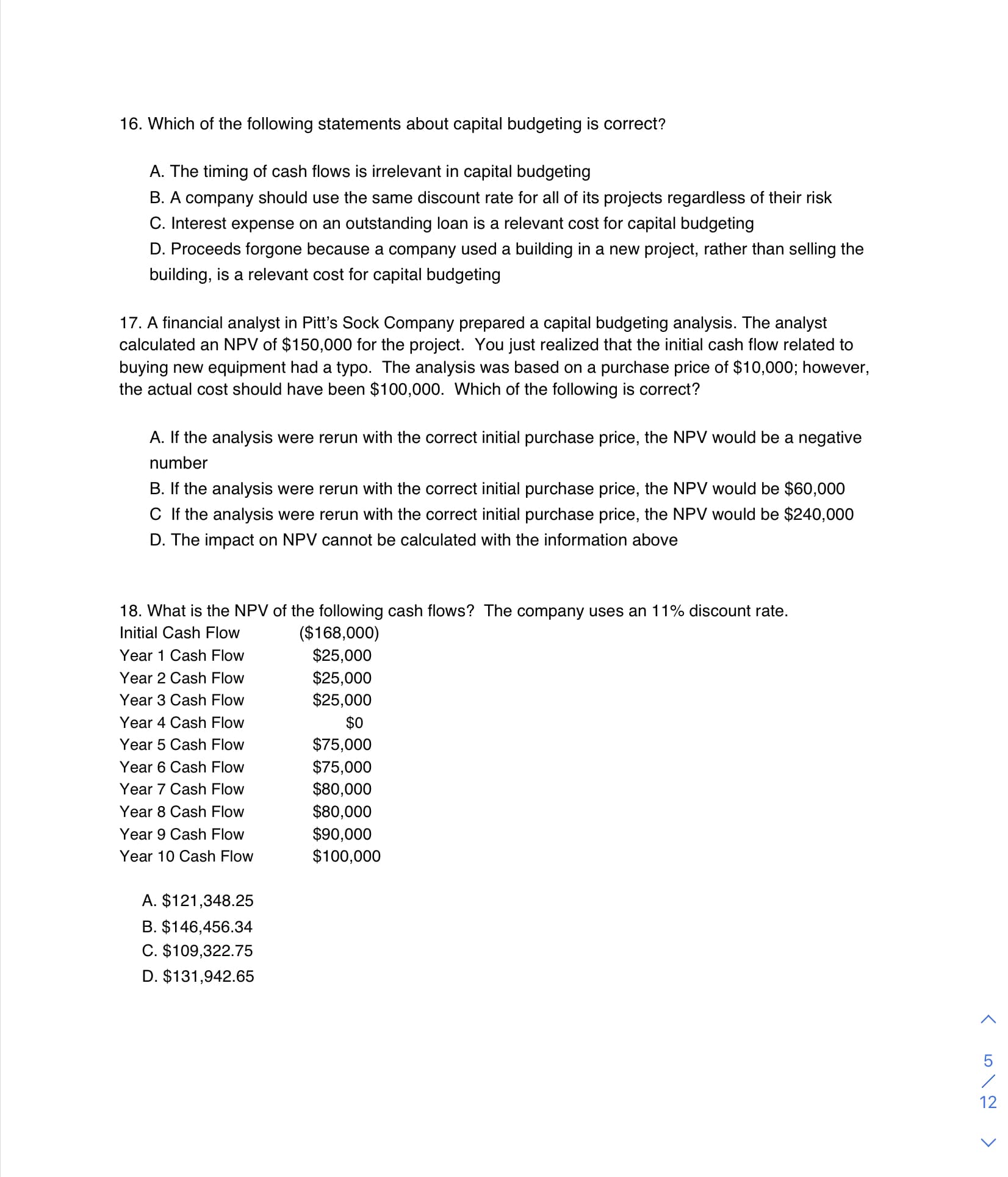

Transcribed Image Text:16. Which of the following statements about capital budgeting is correct?

A. The timing of cash flows is irrelevant in capital budgeting

B. A company should use the same discount rate for all of its projects regardless of their risk

C. Interest expense on an outstanding loan is a relevant cost for capital budgeting

D. Proceeds forgone because a company used a building in a new project, rather than selling the

building, is a relevant cost for capital budgeting

17. A financial analyst in Pitt's Sock Company prepared a capital budgeting analysis. The analyst

calculated an NPV of $150,000 for the project. You just realized that the initial cash flow related to

buying new equipment had a typo. The analysis was based on a purchase price of $10,000; however,

the actual cost should have been $100,000. Which of the following is correct?

A. If the analysis were rerun with the correct initial purchase price, the NPV would be a negative

number

B. If the analysis were rerun with the correct initial purchase price, the NPV would be $60,000

C If the analysis were rerun with the correct initial purchase price, the NPV would be $240,000

D. The impact on NPV cannot be calculated with the information above

18. What is the NPV of the following cash flows? The company uses an 11% discount rate.

($168,000)

$25,000

Initial Cash Flow

Year 1 Cash Flow

$25,000

$25,000

Year 2 Cash Flow

Year 3 Cash Flow

Year 4 Cash Flow

$0

Year 5 Cash Flow

$75,000

Year 6 Cash Flow

$75,000

Year 7 Cash Flow

$80,000

Year 8 Cash Flow

$80,000

$90,000

$100,000

Year 9 Cash Flow

Year 10 Cash Flow

A. $121,348.25

B. $146,456.34

C. $109,322.75

D. $131,942.65

12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning