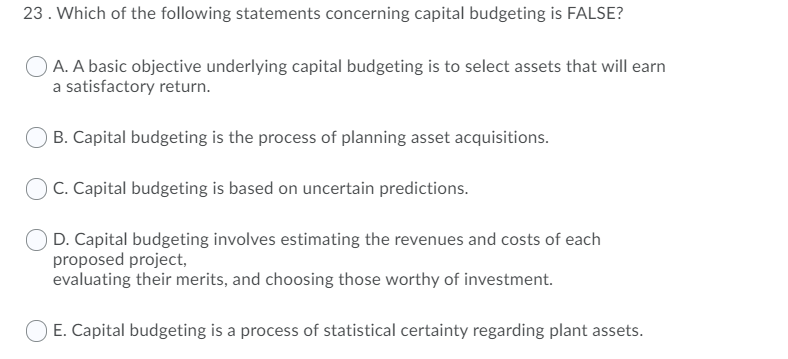

23. Which of the following statements concerning capital budgeting is FALSE? O A. A basic objective underlying capital budgeting is to select assets that will earn a satisfactory return. O B. Capital budgeting is the process of planning asset acquisitions. ) C. Capital budgeting is based on uncertain predictions. D. Capital budgeting involves estimating the revenues and costs of each proposed project, evaluating their merits, and choosing those worthy of investment.

23. Which of the following statements concerning capital budgeting is FALSE? O A. A basic objective underlying capital budgeting is to select assets that will earn a satisfactory return. O B. Capital budgeting is the process of planning asset acquisitions. ) C. Capital budgeting is based on uncertain predictions. D. Capital budgeting involves estimating the revenues and costs of each proposed project, evaluating their merits, and choosing those worthy of investment.

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3MC: The third step for making a capital investment decision is to establish baseline criteria for...

Related questions

Question

Transcribed Image Text:23. Which of the following statements concerning capital budgeting is FALSE?

O A. A basic objective underlying capital budgeting is to select assets that will earn

a satisfactory return.

B. Capital budgeting is the process of planning asset acquisitions.

C. Capital budgeting is based on uncertain predictions.

D. Capital budgeting involves estimating the revenues and costs of each

proposed project,

evaluating their merits, and choosing those worthy of investment.

E. Capital budgeting is a process of statistical certainty regarding plant assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT