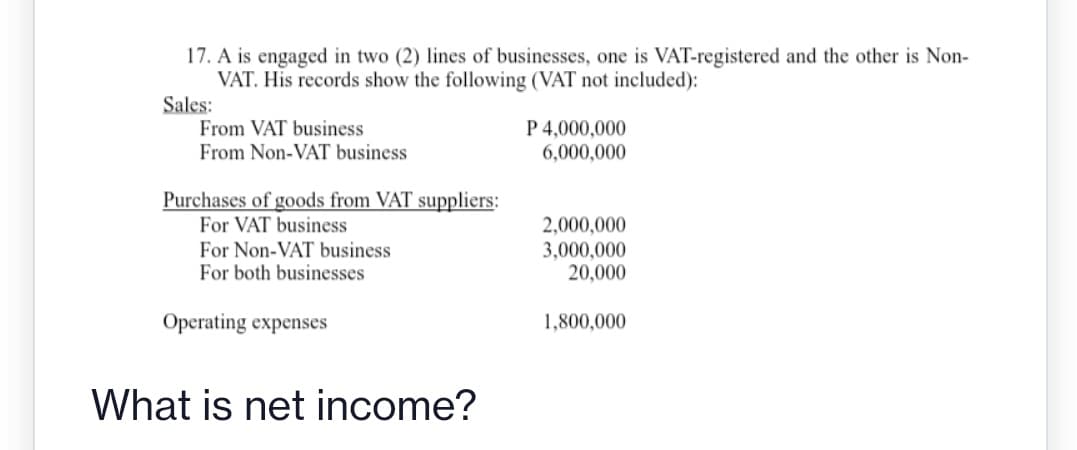

17. A is engaged in two (2) lines of businesses, one is VAT-registered and the other is Non- VAT. His records show the following (VAT not included): Sales: From VAT business P 4,000,000 From Non-VAT business 6,000,000 Purchases of goods from VAT suppliers: For VAT business 2,000,000 For Non-VAT business 3,000,000 For both businesses 20,000 1,800,000 Operating expenses at is net income?

Q: A lorry load of material of mixed goods was purchased for $.1,00,000 Later on these were sorted out…

A: Sales price is the actual price on which goods are being sold in the market. Cost of sales means…

Q: Exercise 1-10A (Algo) Interpreting information in an accounting equation LO 1-5 The financial…

A: Introduction:- A balance sheet is a statement of assets, liability, and equity. It is prepared after…

Q: This investment On July 1, 2021, Bird Inc., a private enterprise, acquired 1,250 shares of Duck Ltd.…

A: Journal entries are recorded in the books to make a complete and daily report of transactions of a…

Q: CASE 2 Harry Potter has been appointed as a divisional controller at the Electronics Division of…

A: Here discuss about the details of the decision which are taken by the Harry Porter to reduce the…

Q: What is the net tax consequences of these dispositions?

A: The disposition of the assets means sales, exchange, or donation of the assets. The disposition of…

Q: A. The following items were taken from the financial statements of Salley, Inc. over a three year…

A: Horizontal analysis is a type of financial statement analysis in which the financial items of one…

Q: Down Under Products, Ltd., of Australia, has budgeted sales of its popular boomerang for the next…

A: Ending inventory = 10% of next month sale April = 10% of May sale =…

Q: Required: Complete the table below to estimate the average cost of ending inventory and cost of…

A: The inventory can be valued using various approaches as Periodic or perpetual inventory systems.

Q: What will be the expected return and the beta of your portfolio after you purchase the new stock

A: Expected return is the return which is the return which has been expected by the investor to earn…

Q: Global trade increases dependence on one economy, increasing the economic risk for multinational…

A: Global Trade: The import and export of products and services that take place across international…

Q: Give a financial description of the Balance S

A: Balance Sheet : It is the sheet which shows the Assets, Liabilities and Equity and shows Assets =…

Q: 2. The earnings from a sales representative position are called compensation. Based on the following…

A: Commission is an important source of revenue for the employees along with basic salary. This is…

Q: If a person is not eligible for the health insurance premium tax credit because of

A: Tax is the charge which is charged on the taxable income of a taxpayer and each taxpayer wants to…

Q: Use the information provided for Harding Company to answer the question that follow. Harding Company…

A: Working capital is the amount that should be available for e normal working operation. It can be…

Q: On January 13, 20xx, Karl Co. sold on account goods with selling price of P300,000 with terms of…

A: The term FOB shipping point refers to the free on board, which means that the sale completes when…

Q: An item will need replacing in 6 years from now at a cost of ₱128,000.00. How much should the owner…

A: In the given question, the item will be replaced at the end of 6 years at a cost of P 128,000. In…

Q: ABOUT AUDITING The process of selecting and developing policies and procedures to help mitigate…

A: Audit Risk- Audit risk is the possibility that an auditor will issue an incorrect opinion on…

Q: In the audit of Beatles Company, the auditor had an appreciation of the following schedule and noted…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Rick Wing has a repetitive manufacturing plant producing automobile steering wheels. Use the…

A: Setup cost represents the cost incurred during the production to configure the machine or plant to…

Q: 10 Sold merchandise for cash, $54,000. The cost of the merchandise sold was $32,000.

A: Introduction: Journals: All the business transactions are to be recorded in Journals. Journals are…

Q: h of the following statements is inapplicable to qualified tuition programs? Up to $10,000 per year…

A: Qualified Tuition Programme : Its refers to the schedule 529 plan, which is established and…

Q: Compute basic and diluted earnings per share for the year ended December 31, 2021.

A: Basic EPS = (Net Income - Preferred Dividend )/ Outstanding Common stock Diluted EPS =…

Q: The first step in forming a sole proprietorship is filing out the appropriate paperwork and paying…

A: Note: As per the Policy, we’ll answer the first question since the exact one wasn’t specified.…

Q: B, C D are partners in a firm. Their Balance Sheet as on 31/12/2021 is as follow Liabilities R.O…

A: Explanation of Concept Partnership is the firm which is run by two or more partners on the basis of…

Q: Canco’s net income in its financial statements is $300,000. Included in this amount is a $40,000…

A: The sum a person or corporation obtains after subtracting expenses, allowances, and taxes is…

Q: $125,930 $125,930 The president of Anderson Company has asked you to close the books (prepare and…

A: The closing entries are prepared to close the temporary accounts of the business such as revenue and…

Q: Cost and Costing, as well as the importance of calculating costs in product management, may be…

A: Cost refers to the value of money that has been used to produce or manufacture something. It can…

Q: QUESTION 1 On 5 December 2021, J Mart bought merchandise on account from Jerai Ria. The selling…

A: Sales return refers to a situation when the goods sold are unfit or defective and the buyer returns…

Q: Deferred tax asset and deferred tax liability are based on future tax rates while current tax asset…

A: The concept of Deferred Tax arises due to the timing difference between income as per the accounting…

Q: Which of the following statement is false? The cost of an internally generated patent is confined…

A: The following statement is false: Goodwill is an intangible asset but not under PAS 38.

Q: Do you believe that contingency theory has made adequate contribution to management accounting? Why?…

A: According to the contingency theory of management accounting, there is no one-size-fits-all approach…

Q: Determine the effective rate of interest of the following nominal rates. a. nominal rates…

A: Effective interest rate formula When Compounded annually and quarterly (1+r/n) n - 1 r= nominal…

Q: Incorporate the following data into Bank X's revenue statement. Each item should be labelled and…

A: Financial Statement: financial statement is an organized information about the financial position…

Q: Data table Last month, CenterWare reported the following actual results for the production of 70,000…

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Petrus Framing's cost formula for its supplies cost is $1,790 per month plus $10 per frame. For the…

A: Supplies expense is the cost of consumables used during a fiscal quarter. This might be one of the…

Q: 184 Lola, a calendar year taxpayer subject to a 40% marginal Federal gift tax rate, made a gift of a…

A: Federal Tax- The amount of tax levied by the government on the profits earned by individuals and…

Q: OVE INC. has a policy of using non-current assets until they can no longer operate and are…

A: Explanation of Concept Deferred Tax Assets / Deferred tax Liability : are to be calculated when…

Q: A is now seeking to enforce the payment of rent by B and is claiming $40,000 in outstanding rent for…

A: B pays a rent of 5000 but entered into the agreement of $10,000 rent to claim deduction.

Q: How much should be recognized as the carrying value of investment in Yellow- FVPL account at Jan 2,…

A: Carrying value of Investment in Yellow- FVTPL account at Jan 2, 20X3: 1,860,000

Q: WOODBRICKS CORP. decided on September 1, 2021 to dispose of a component of business. The component…

A: As per IFRS 5, Non-current assets held for sale and discontinued operations, Discontinued operation…

Q: PJ, Ian, and Lemuel are partners in an accounting firm. Their capital account balances at year-end…

A: Lets understand the basics. Partnership is an agreement between two or more person who works…

Q: Calculated the annual rental expense to be recognized through profit or loss for the year ended…

A: The lease is a written contract between the two parties. In this one-party rents his equipment to…

Q: A stock is estimated to have a covariance with the market of 0.45. For the coming period, the market…

A: The Capital assets pricing model shows the relationship between the risk-free rate and the expected…

Q: Cove’s Cakes is a local bakery. Price and cost information follows: Price per cake…

A: Variable costs are costs which changes with change in activity level. Contribution margin is sales…

Q: Comprehensive Problem Set On July 1, Lula Plume created a new self-storage business, Safe…

A: Journal entries for company Safe storage company. No Date Account number Journal Debit ($) Credit…

Q: Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the…

A: Cost accounting is one of the important branch of accounting. Under this, various type of costs are…

Q: Jacobs is considering the purchase of a new machine for $10,700 that has a life of 6 years and would…

A: Present Value- The value of an investment or an amount today is referred to as its present value. It…

Q: In order to generate interim financial reports that contain a reasonable portion of annual expenses,…

A: a. an allocation of a portion of an annual bonus would be made as an interim adjustment

Q: E4-5 (Algo) Recording Adjusting Entries and Reporting Balances in Financial Statements LO4-1, 4-2…

A: Under the accrual basis of accounting, transactions are recorded as and when they occur irrespective…

Q: .Calculate the trends in the sales and cost of sales and comment on the information disclosed by…

A: Trend analysis is the analysis which is used by the company in order to anticipate and made an…

Step by step

Solved in 2 steps

- Entity A, a VAT-registered business, had total sales of ₱3,000,000 and total purchases of ₱1,200,000 (both exclusive of VAT) during 20x1. Show all your solutions 1. How much is the Output VAT? 2. How much is the Input VAT? 3. How much VAT should Entity A remit to the BIR? 4. What is the journal entry to record the sales? 5. What is the journal entry to record the purchases? 6. What is the offsetting entry needed in order to present the net VAT payable in the statement of financial positionStung, which is registered to account for sales tax, purchased furniture on credit at a cost of $8,000, plus sales tax of $1,200. What are the correct accounting entries to record this transaction? $ $ A Debit Furniture 9,200 Credit Supplier 9,200 B Debit Furniture 8,000 Credit Sales tax 1,200 Credit Supplier 6,800 C Debit Furniture 8,000 Credit Supplier 9,200 Debit Sales tax 1,200 D Debit Furniture 8,000 Credit Supplier 8,000Following are the transactions of HASF who operated his business in the name of HASF and company while his capital investment is 50,000 on May 1 2021 May 1 Purchased merchandise for cash 35,000 May 2 sales merchandise for cash 48,000 May 3 Purchase merchandise on account 6,000 May 3 sales merchandise on account 7,200 May 5 Return credit merchandise from customer 1,200 May 7 Return damaged merchandise ( credit ) to company 1,000 May 8 cash received from customers 5,500 May 9 paid salary expense 5,000 NOTE: No need to enter Currency Symbol, no comma between numbers, answer will be in whole number no decimal place required and no need to enter any sign like + and - (for example: $10,000.60=10000.6) 1. Find out the following ledger balance and total trial balance at end of May 30 Calculate Cash Calculate Capital Calculate Purchases Calculate A/c payable Calculate Purchas return Calculate Sales Calculate A/c receivable Calculate Sales return Calculate Salary expense Calculate Trial…

- Suppose your company sells goods for $450, of which $275 is received in cash and $175 is on account. The goods cost your company $155 and were paid for in a previous period. Your company also recorded salaries and wages of $145, of which only $45 has been paid in cash. How would I record the following activities in the journal?Nicanor, a businessman engaged in selling goods and services reported gross sales of 1,000,000 and gross receipts of 2,000,000. The company spent 150,000 for representation expenses. How much is the non-deductible representation expense? 125,000 105,000 25,000 150,000A VAT registered trader had the following transactions: Sales of good to private entities, net of VAT 2,500,000 Purchases of goods sold to private entities, gross of 12% VAT 896,000 Sales to GOCC, net of VAT 1,000,000 Purchases of goods sold to GOCC net of VAT 700,000 How much is the output tax?

- (5) The company "Z" displays in its accounting records the following costs for the goods purchased to reach safely its warehouses: Invoice value of goods 150.000€, discounts given on the invoice value of the purchase of 11.000 €, transport paid for the transport of goods from the warehouse of the supplier to the premises of the buyer 2.500 €, insurance premiums of goods 3.150 € were paid, packing costs for the transport 8.450 €, fees and customs clearance costs 7.780 €, commissions purchases 4.140 €, administrative expenses 5.550 €, salaries and wages 6.750 €, light-water-phone 3.150€, advertising-promotion costs 3.550€ and financial interest (debit) 1.485€. Requested: To determine the cost of purchase of the quantities purchased.The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to other businesses and occasionally to retail customers: Record on page 10 of the journal Mar. 2 Sold merchandise on account to Equinox Co., $18,900, terms FOB destination, n/30. The cost of the goods sold was $13,300. 3 Sold merchandise for $11,350 plus 6% sales tax to retail cash customers. The cost of the goods sold was $7,000. 4 Sold merchandise on account to Empire Co., $55,400, terms FOB shipping point, n/eom. The cost of the goods sold was $33,200. 5 Sold merchandise for $30,000 to retail customers who used MasterCard. The cost of the goods sold was $19,400. The printed receipts for retail customers included a coupon for $2 off the customer’s next purchase. It is estimated that 2,000 of the coupons will be redeemed. Create a compound journal entry for the sale and coupon payable estimate. 14 Sold $18,000 of merchandise to retail customers who…The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to other businesses and occasionally to retail customers: Record on page 10 of the journal Mar. 2 Sold merchandise on account to Equinox Co., $18,900, terms FOB destination, n/30. The cost of the goods sold was $13,300. 3 Sold merchandise for $11,350 plus 6% sales tax to retail cash customers. The cost of the goods sold was $7,000. 4 Sold merchandise on account to Empire Co., $55,400, terms FOB shipping point, n/eom. The cost of the goods sold was $33,200. 5 Sold merchandise for $30,000 to retail customers who used MasterCard. The cost of the goods sold was $19,400. The printed receipts for retail customers included a coupon for $2 off the customer’s next purchase. It is estimated that 2,000 of the coupons will be redeemed. Create a compound journal entry for the sale and coupon payable estimate. 14 Sold $18,000 of merchandise to retail customers who…

- The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to wholesalers and occasionally to retail customers:Mar. 2. Sold merchandise on account to Equinox Co., $18,900, terms FOB destination, 1/10, n/30. The cost of the merchandise sold was $13,300.3. Sold merchandise for $11,350 plus 6% sales tax to retail cash customers.The cost of merchandise sold was $7,000.4. Sold merchandise on account to Empire Co., $55,400, terms FOB shipping point, n/eom. The cost of merchandise sold was $33,200.5. Sold merchandise for $30,000 plus 6% sales tax to retail customers who used MasterCard. The cost of merchandise sold was $19,400.12. Received check for amount due from Equinox Co. for sale on March 2.14. Sold merchandise to customers who used American Express cards, $13,700. The cost of merchandise sold was $8,350.16. Sold merchandise on account to Targhee Co., $27,500, terms FOB shipping point, 1/10, n/30. The cost of merchandise sold was…The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to wholesalers and occasionally to retail customers: Mar. 2. Sold merchandise on account to Equinox Co., $18,900, terms FOB destination, 1/10, n/30. The cost of the merchandise sold was $13,300. 3. Sold merchandise for $11,350 plus 6% sales tax to retail cash customers. The cost of merchandise sold was $7,000. 4. Sold merchandise on account to Empire Co., $55,400, terms FOB shipping point, n/eom. The cost of merchandise sold was $33,200. 5. Sold merchandise for $30,000 plus 6% sales tax to retail customers who used MasterCard. The cost of merchandise sold was $19,400. 12. Received check for amount due from Equinox Co. for sale on March 2. 14. Sold merchandise to customers who used American Express cards, $13,700. The cost of merchandise sold was $8,350. 16. Sold merchandise on account to Targhee Co., $27,500, terms FOB shipping point, 1/10, n/30. The cost of merchandise…Huhu Company and Hihi Company engaged in the following transactions during the month of July 2021. On July 16, Huhu Company sold merchandise to Hihi Company for P6,000, terms 2/10, n/30. Shipping costs were P600. Hihi Company received the goods and Huhu Company’s invoice on July 17. On July 24, Hihi Company sent the payment to Huhu, which Huhu received on July 25. Additional Info: c. Both Huhu and Hihi use the periodic inventory system. d. The arrangement regarding the shipping costs are as follows: Shipping terms FOB Shipping Point, Freight Collect. Hihi paid the shipping costs on July 17 and Hihi remitted P5,880 on July 24. What is the balance of accounts payable after remittances?