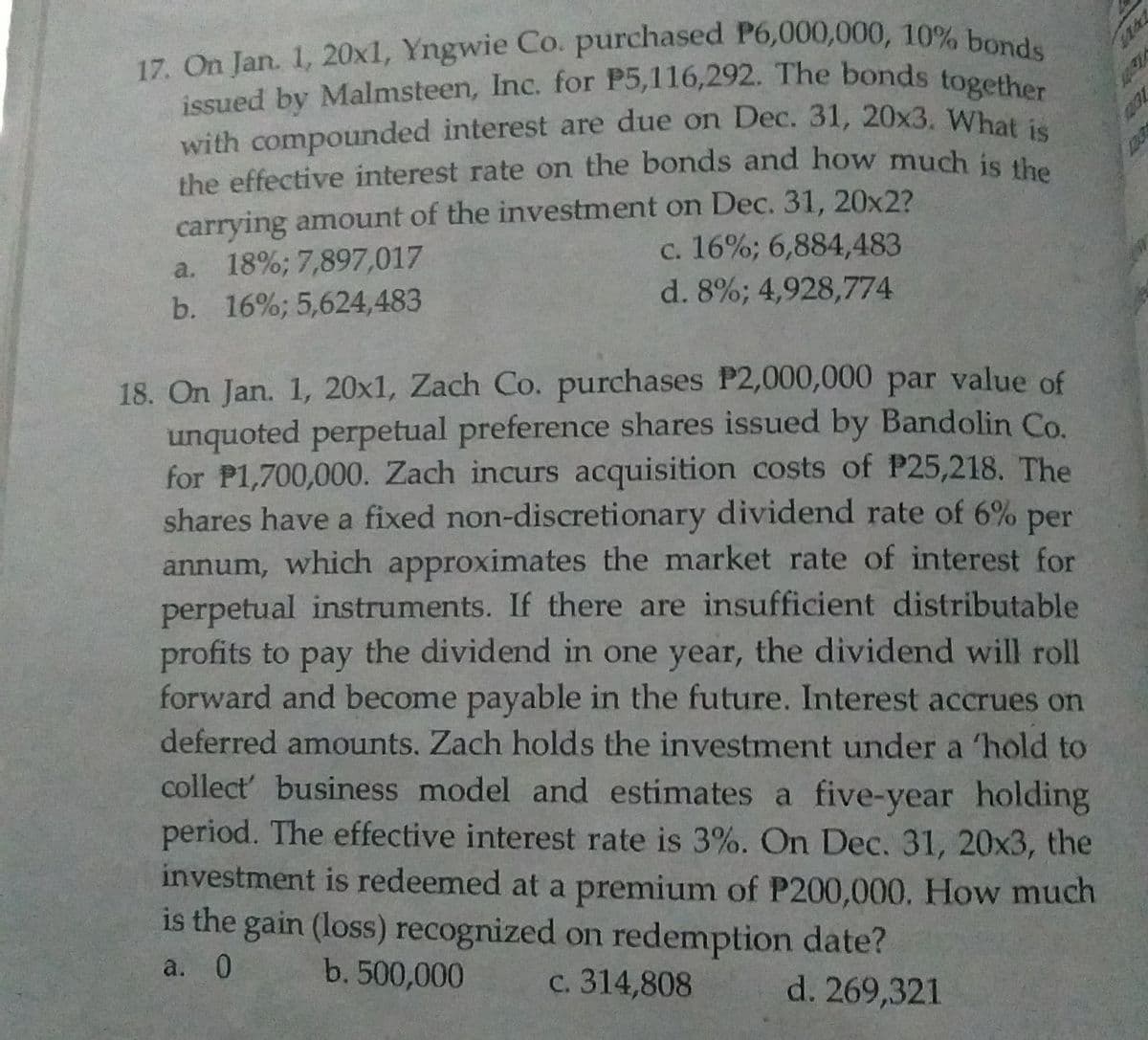

17. On Jan. 1, 20x1, Yngwie Co. purchased P6,000,000, 10% bonds issued by Malmsteen, Inc. for P5,116,292. The bonds together with compounded interest are due on Dec. 31, 20x3. What i the effective interest rate on the bonds and how much is the carrying amount of the investment on Dec. 31, 20x2? a. 18%; 7,897,017 b. 16%; 5,624,483 c. 16%; 6,884,483 d. 8%; 4,928,774 18. On Jan. 1, 20x1, Zach Co. purchases P2,000,000 par value of unquoted perpetual preference shares issued by Bandolin Co. for P1,700,000. Zach incurs acquisition costs of P25,218. The shares have a fixed non-discretionary dividend rate of 6% per annum, which approximates the market rate of interest for perpetual instruments. If there are insufficient distributable profits to pay the dividend in one year, the dividend will roll forward and become payable in the future. Interest accrues on deferred amounts. Zach holds the investment under a 'hold to collect business model and estimates a five-year holding period. The effective interest rate is 3%. On Dec. 31, 20x3, the investment is redeemed at a premium of P200,000. How much is the gain (loss) recognized on redemption date? a. 0 b. 500,000 c. 314,808 d. 269,321

17. On Jan. 1, 20x1, Yngwie Co. purchased P6,000,000, 10% bonds issued by Malmsteen, Inc. for P5,116,292. The bonds together with compounded interest are due on Dec. 31, 20x3. What i the effective interest rate on the bonds and how much is the carrying amount of the investment on Dec. 31, 20x2? a. 18%; 7,897,017 b. 16%; 5,624,483 c. 16%; 6,884,483 d. 8%; 4,928,774 18. On Jan. 1, 20x1, Zach Co. purchases P2,000,000 par value of unquoted perpetual preference shares issued by Bandolin Co. for P1,700,000. Zach incurs acquisition costs of P25,218. The shares have a fixed non-discretionary dividend rate of 6% per annum, which approximates the market rate of interest for perpetual instruments. If there are insufficient distributable profits to pay the dividend in one year, the dividend will roll forward and become payable in the future. Interest accrues on deferred amounts. Zach holds the investment under a 'hold to collect business model and estimates a five-year holding period. The effective interest rate is 3%. On Dec. 31, 20x3, the investment is redeemed at a premium of P200,000. How much is the gain (loss) recognized on redemption date? a. 0 b. 500,000 c. 314,808 d. 269,321

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 5E

Related questions

Question

Transcribed Image Text:17. On Jan. 1, 20x1, Yngwie Co. purchased P6,000,000, 10% bonds

17. On Jan. 1, 20x1, Yngwie Co. purchased P6,000,000, 10% bond

issued by Malmsteen, Inc. for P5,116,292. The bonds together

with compounded interest are due on Dec. 31, 20x3. What is

the effective interest rate on the bonds and how much is

carrying amount of the investment on Dec. 31, 20x2?

a. 18%; 7,897,017

b. 16%; 5,624,483

c. 16%; 6,884,483

d. 8%; 4,928,774

18. On Jan. 1, 20x1, Zach Co. purchases P2,000,000 par value of

unquoted perpetual preference shares issued by Bandolin Co.

for P1,700,000. Zach incurs acquisition costs of P25,218. The

shares have a fixed non-discretionary dividend rate of 6% per

annum, which approximates the market rate of interest for

perpetual instruments. If there are insufficient distributable

profits to pay the dividend in one year, the dividend will roll

forward and become payable in the future. Interest accrues on

deferred amounts. Zach holds the investment under a 'hold to

collect business model and estimates a five-year holding

period. The effective interest rate is 3%. On Dec. 31, 20x3, the

investment is redeemed at a premium of P200,000. How much

is the gain (loss) recognized on redemption date?

a. 0

b. 500,000

c. 314,808

d. 269,321

1231

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College