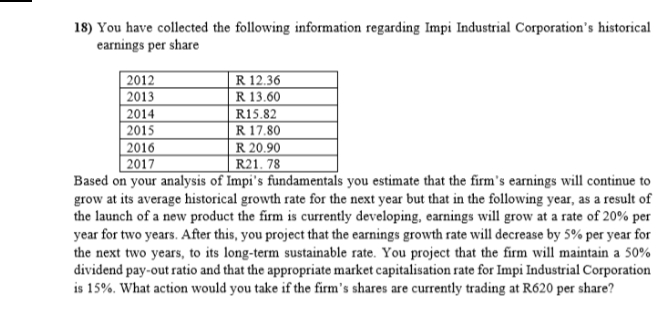

18) You have collected the following information regarding Impi Industrial Corporation's historical earnings per share R 12.36 R 13.60 2012 2013 2014 2015 2016 2017 Based on your analysis of Impi's fundamentals you estimate that the firm's earnings will continue to grow at its average historical growth rate for the next year but that in the following year, as a result of the launch of a new product the firm is currently developing, earnings will grow at a rate of 20% per year for two years. After this, you project that the earnings growth rate will decrease by 5% per year for the next two years, to its long-term sustainable rate. You project that the firm will maintain a 50% dividend pay-out ratio and that the appropriate market capitalisation rate for Impi Industrial Corporation is 15%. What action would you take if the firm's shares are currently trading at R620 per share? R15.82 R 17.80 R 20.90 R21. 78

18) You have collected the following information regarding Impi Industrial Corporation's historical earnings per share R 12.36 R 13.60 2012 2013 2014 2015 2016 2017 Based on your analysis of Impi's fundamentals you estimate that the firm's earnings will continue to grow at its average historical growth rate for the next year but that in the following year, as a result of the launch of a new product the firm is currently developing, earnings will grow at a rate of 20% per year for two years. After this, you project that the earnings growth rate will decrease by 5% per year for the next two years, to its long-term sustainable rate. You project that the firm will maintain a 50% dividend pay-out ratio and that the appropriate market capitalisation rate for Impi Industrial Corporation is 15%. What action would you take if the firm's shares are currently trading at R620 per share? R15.82 R 17.80 R 20.90 R21. 78

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter14: Valuation: Market-based Approach

Section: Chapter Questions

Problem 19PC

Related questions

Question

Transcribed Image Text:18) You have collected the following information regarding Impi Industrial Corporation's historical

earnings per share

R 12.36

R 13.60

2012

2013

2014

2015

2016

2017

Based on your analysis of Impi's fundamentals you estimate that the firm's earnings will continue to

grow at its average historical growth rate for the next year but that in the following year, as a result of

the launch of a new product the firm is currently developing, earnings will grow at a rate of 20% per

year for two years. After this, you project that the earnings growth rate will decrease by 5% per year for

the next two years, to its long-term sustainable rate. You project that the firm will maintain a 50%

dividend pay-out ratio and that the appropriate market capitalisation rate for Impi Industrial Corporation

is 15%. What action would you take if the firm's shares are currently trading at R620 per share?

R15.82

R 17.80

R 20.90

R21. 78

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT