18. An example of systematic risk is: a. changes in the Federal budget deficit that could affect interest rates or federal taxation. b. a fire at a Dow Chemical Corporation factory. c. the bankruptcy of Pea Pod Corporation. e. the accidental death of the President and CEO of United Amalgam Corporation. f. all of the above. g. none of the above.

18. An example of systematic risk is: a. changes in the Federal budget deficit that could affect interest rates or federal taxation. b. a fire at a Dow Chemical Corporation factory. c. the bankruptcy of Pea Pod Corporation. e. the accidental death of the President and CEO of United Amalgam Corporation. f. all of the above. g. none of the above.

Chapter8: Risk And Rates Of Return

Section: Chapter Questions

Problem 9PROB

Related questions

Question

please help me check my work and help solve any unsolved questions, thanks!

Transcribed Image Text:18. An example of systematic risk is:

a. changes in the Federal budget deficit that could affect interest rates or federal taxation.

b. a fire at a Dow Chemical Corporation factory.

c. the bankruptcy of Pea Pod Corporation.

e. the accidental death of the President and CEO of United Amalgam Corporation.

f. all of the above.

g. none of the above.

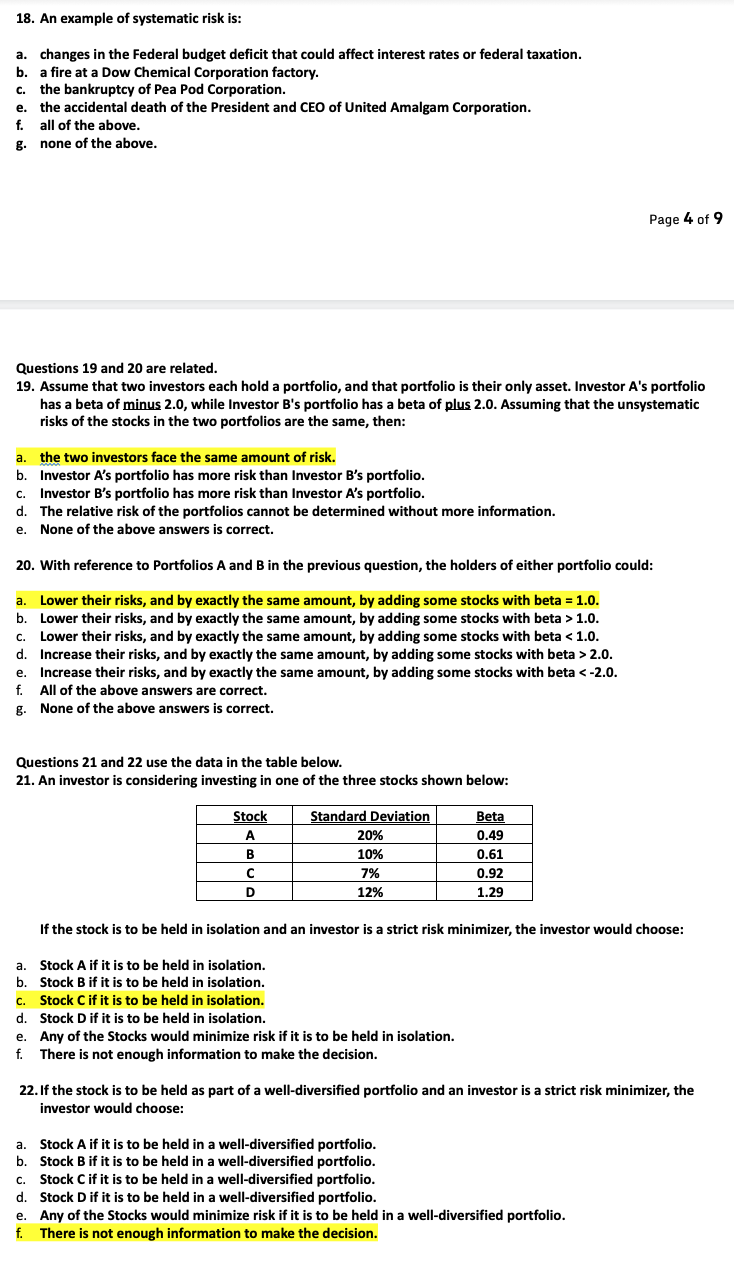

Questions 19 and 20 are related.

19. Assume that two investors each hold a portfolio, and that portfolio is their only asset. Investor A's portfolio

has a beta of minus 2.0, while Investor B's portfolio has a beta of plus 2.0. Assuming that the unsystematic

risks of the stocks in the two portfolios are the same, then:

a.

the two investors face the same amount of risk.

b. Investor A's portfolio has more risk than Investor B's portfolio.

C. Investor B's portfolio has more risk than Investor A's portfolio.

d. The relative risk of the portfolios cannot be determined without more information.

e. None of the above answers is correct.

20. With reference to Portfolios A and B in the previous question, the holders of either portfolio could:

a. Lower their risks, and by exactly the same amount, by adding some stocks with beta = 1.0.

b. Lower their risks, and by exactly the same amount, by adding some stocks with beta > 1.0.

C. Lower their risks, and by exactly the same amount, by adding some stocks with beta < 1.0.

d. Increase their risks, and by exactly the same amount, by adding some stocks with beta > 2.0.

e. Increase their risks, and by exactly the same amount, by adding some stocks with beta < -2.0.

f. All of the above answers are correct.

g.

None of the above answers is correct.

Questions 21 and 22 use the data in the table below.

21. An investor is considering investing in one of the three stocks shown below:

Stock

A

B

с

D

Standard Deviation

20%

10%

7%

12%

Page 4 of 9

Beta

0.49

0.61

0.92

1.29

e. Any of the Stocks would minimize risk if it is to be held in isolation.

f. There is not enough information to make the decision.

If the stock is to be held in isolation and an investor is a strict risk minimizer, the investor would choose:

a. Stock A if it is to be held in isolation.

b. Stock B if it is to be held in isolation.

c. Stock C if it is to be held in isolation.

d. Stock D if it is to be held in isolation.

22. If the stock is to be held as part of a well-diversified portfolio and an investor is a strict risk minimizer, the

investor would choose:

a. Stock A if it is to be held in a well-diversified portfolio.

b. Stock B if it is to be held in a well-diversified portfolio.

C. Stock C if it is to be held in a well-diversified portfolio.

d. Stock D if it is to be held in a well-diversified portfolio.

e. Any of the Stocks would minimize risk if it is to be held in a well-diversified portfolio.

f. There is not enough information to make the decision.

![Questions 12 and 13 use the Data in the table below.

E[R]

Std Dev

Weight

Correlation Coefficient of Stratton & Stowe

Correlation Coefficient of Stratton & Ice

Correlation Coefficient of Stowe & Ice

Answer: 10.14%

Answer: 5.94%

Stratton

Corp.

7.80%

5.20%

30.00%

12. Given the Portfolio data in the table above, what is the Expected Return of the Portfolio? Answer as a

percentage and round to 1 basis point or 2 decimal places.

0.7500

0.4000

0.1000

a. Remains constant

b.

Stowe Inc.

13. Given the Portfolio data in the table above, what is the Standard Deviation of the Expected Return of the

Portfolio? Answer as a percentage and round to 1 basis point or 2 decimal places.

Decreases

c. Increases

d.

Changes but in an unknown way

e. None of the above answers is correct.

a. -1.00

b. +1.00

9.20%

7.30%

40.00%

a. What is the best proxy for the "market" portfolio?

b. What happens when investors cannot borrow and lend at the risk-free rate?

c. How good the Capital Asset Pricing Model is at forecasting?

d. What the Beta of the market portfolio of risky assets is?

e. What the stability of individual stock betas is?

Ice Ltd.

14. When applying the Capital Asset Pricing Model to the real world, all of the following questions remain to be

answered EXCEPT:

C. 0.00

d. Between 0 and -1.00

e. Between 0 and +1.00

10.30%

8.40%

40.00%

15. According to the CAPM, as the number of assets in a portfolio increases, the amount of unsystematic risk in

the portfolio:

Page 3 of 9

16. According to the CAPM, the correlation coefficient between a perfectly diversified portfolio and the market

portfolio of all risky assets should be:

17. According to the Single Index Model, the only systematic influence(s) on common stock prices is:

a. growth of the gross national product.

b. company-specific or stock-specific risk.

c. changes in the relative strength of sectors, or industries, of the economy.

d. the return on an index representing the overall stock market.

e. all of the above.

f. none of the above.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F3daea104-4b11-414e-ab05-caf231aaf22d%2F3484b232-86da-4547-aff9-3737c803ff83%2F7jxv5kv_processed.png&w=3840&q=75)

Transcribed Image Text:Questions 12 and 13 use the Data in the table below.

E[R]

Std Dev

Weight

Correlation Coefficient of Stratton & Stowe

Correlation Coefficient of Stratton & Ice

Correlation Coefficient of Stowe & Ice

Answer: 10.14%

Answer: 5.94%

Stratton

Corp.

7.80%

5.20%

30.00%

12. Given the Portfolio data in the table above, what is the Expected Return of the Portfolio? Answer as a

percentage and round to 1 basis point or 2 decimal places.

0.7500

0.4000

0.1000

a. Remains constant

b.

Stowe Inc.

13. Given the Portfolio data in the table above, what is the Standard Deviation of the Expected Return of the

Portfolio? Answer as a percentage and round to 1 basis point or 2 decimal places.

Decreases

c. Increases

d.

Changes but in an unknown way

e. None of the above answers is correct.

a. -1.00

b. +1.00

9.20%

7.30%

40.00%

a. What is the best proxy for the "market" portfolio?

b. What happens when investors cannot borrow and lend at the risk-free rate?

c. How good the Capital Asset Pricing Model is at forecasting?

d. What the Beta of the market portfolio of risky assets is?

e. What the stability of individual stock betas is?

Ice Ltd.

14. When applying the Capital Asset Pricing Model to the real world, all of the following questions remain to be

answered EXCEPT:

C. 0.00

d. Between 0 and -1.00

e. Between 0 and +1.00

10.30%

8.40%

40.00%

15. According to the CAPM, as the number of assets in a portfolio increases, the amount of unsystematic risk in

the portfolio:

Page 3 of 9

16. According to the CAPM, the correlation coefficient between a perfectly diversified portfolio and the market

portfolio of all risky assets should be:

17. According to the Single Index Model, the only systematic influence(s) on common stock prices is:

a. growth of the gross national product.

b. company-specific or stock-specific risk.

c. changes in the relative strength of sectors, or industries, of the economy.

d. the return on an index representing the overall stock market.

e. all of the above.

f. none of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning