Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 4CE: Manzer Enterprises is considering two independent investments: A new automated materials handling...

Related questions

Question

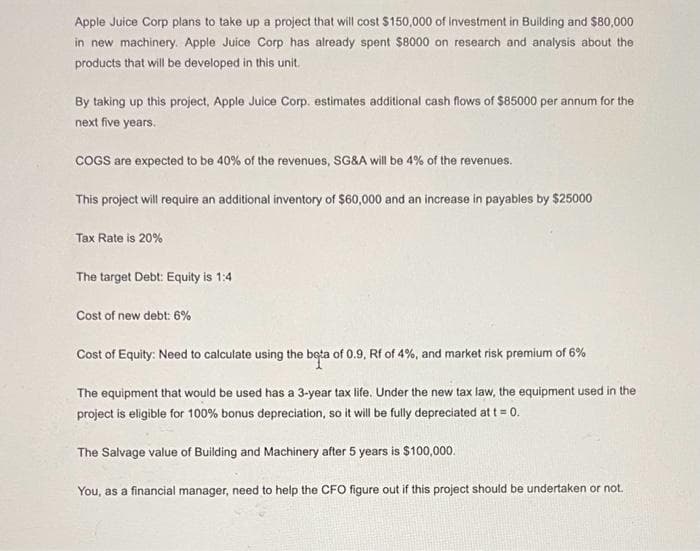

Transcribed Image Text:Apple Juice Corp plans to take up a project that will cost $150,000 of investment in Building and $80,000

in new machinery. Apple Juice Corp has already spent $8000 on research and analysis about the

products that will be developed in this unit.

By taking up this project, Apple Juice Corp. estimates additional cash flows of $85000 per annum for the

next five years.

COGS are expected to be 40% of the revenues, SG&A will be 4% of the revenues.

This project will require an additional inventory of $60,000 and an increase in payables by $25000

Tax Rate is 20%

The target Debt: Equity is 1:4

Cost of new debt: 6%

Cost of Equity: Need to calculate using the beta of 0.9, Rf of 4%, and market risk premium of 6%

The equipment that would be used has a 3-year tax life. Under the new tax law, the equipment used in the

project is eligible for 100% bonus depreciation, so it will be fully depreciated at t = 0.

The Salvage value of Building and Machinery after 5 years is $100,000.

You, as a financial manager, need to help the CFO figure out if this project should be undertaken or not.

Transcribed Image Text:3 Calculate WACC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College