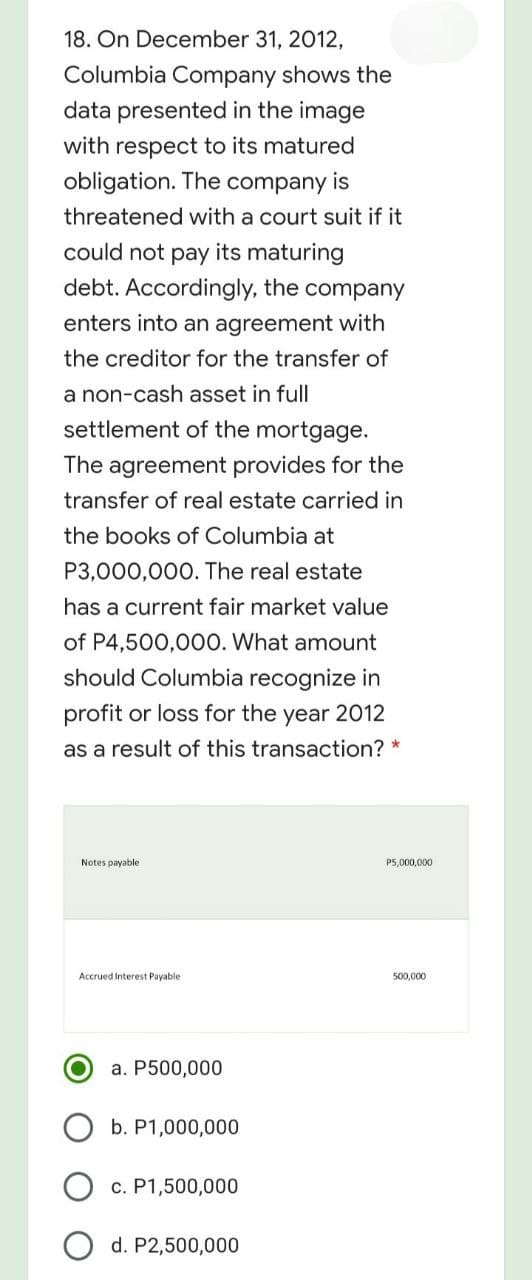

18. On December 31, 2012, Columbia Company shows the data presented in the image with respect to its matured obligation. The company is threatened with a court suit if it could not pay its maturing debt. Accordingly, the company enters into an agreement with the creditor for the transfer of a non-cash asset in full settlement of the mortgage. The agreement provides for the transfer of real estate carried in the books of Columbia at P3,000,000. The real estate has a current fair market value of P4,500,000. What amount should Columbia recognize in profit or loss for the year 2012 as a result of this transaction? * Notes payable P5,000,000 Accrued Interest Payable 500,000 a. P500,000 b. P1,000,000 c. P1,500,000 d. P2,500,000

18. On December 31, 2012, Columbia Company shows the data presented in the image with respect to its matured obligation. The company is threatened with a court suit if it could not pay its maturing debt. Accordingly, the company enters into an agreement with the creditor for the transfer of a non-cash asset in full settlement of the mortgage. The agreement provides for the transfer of real estate carried in the books of Columbia at P3,000,000. The real estate has a current fair market value of P4,500,000. What amount should Columbia recognize in profit or loss for the year 2012 as a result of this transaction? * Notes payable P5,000,000 Accrued Interest Payable 500,000 a. P500,000 b. P1,000,000 c. P1,500,000 d. P2,500,000

Chapter14: Property Transactions: Determination Of Gain Or Loss And Basis Considerations

Section: Chapter Questions

Problem 4DQ

Related questions

Question

Transcribed Image Text:18. On December 31, 2012,

Columbia Company shows the

data presented in the image

with respect to its matured

obligation. The company is

threatened with a court suit if it

could not pay its maturing

debt. Accordingly, the company

enters into an agreement with

the creditor for the transfer of

a non-cash asset in full

settlement of the mortgage.

The agreement provides for the

transfer of real estate carried in

the books of Columbia at

P3,000,000. The real estate

has a current fair market value

of P4,500,000. What amount

should Columbia recognize in

profit or loss for the year 2012

as a result of this transaction? *

Notes payable

P5.000,000

Accrued Interest Payable

500,000

a. P500,000

b. P1,000,000

c. P1,500,000

d. P2,500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage