In its first year of operations, Sandhill Corporation purchased available-for-sale debt securıties costing $70,0 investment. At December 31, 2022, the fair value of the securities is $65,000. Prepare the adjusting entry to record the securities at fair value. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31

In its first year of operations, Sandhill Corporation purchased available-for-sale debt securıties costing $70,0 investment. At December 31, 2022, the fair value of the securities is $65,000. Prepare the adjusting entry to record the securities at fair value. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 3MC: On July 1, 2019, Aldrich Company purchased as an available-for-sale security 200,000 face value, 9%...

Related questions

Question

100%

Please answer both questions completely. Fill out every single box

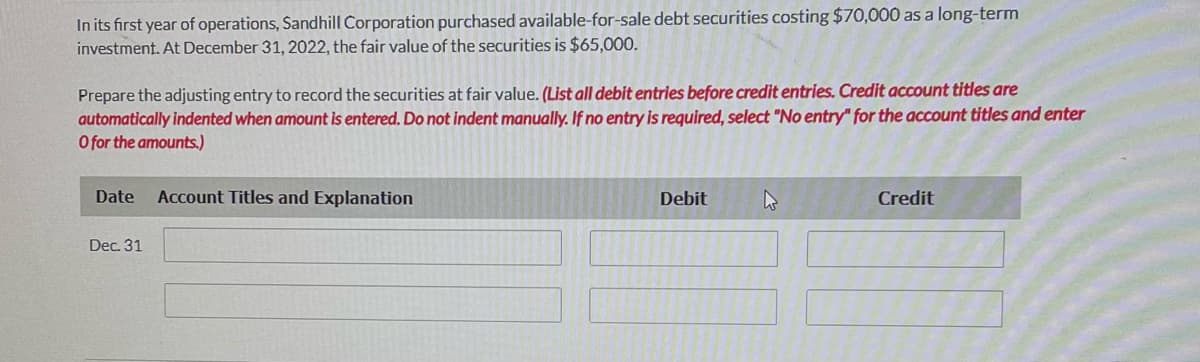

Transcribed Image Text:In its first year of operations, Sandhill Corporation purchased available-for-sale debt securities costing $70,000 as a long-term

investment. At December 31, 2022, the fair value of the securities is $65,000.

Prepare the adjusting entry to record the securities at fair value. (List all debit entries before credit entries. Credit account titles are

automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter

O for the amounts.)

Date

Account Titles and Explanation

Debit

Credit

Dec. 31

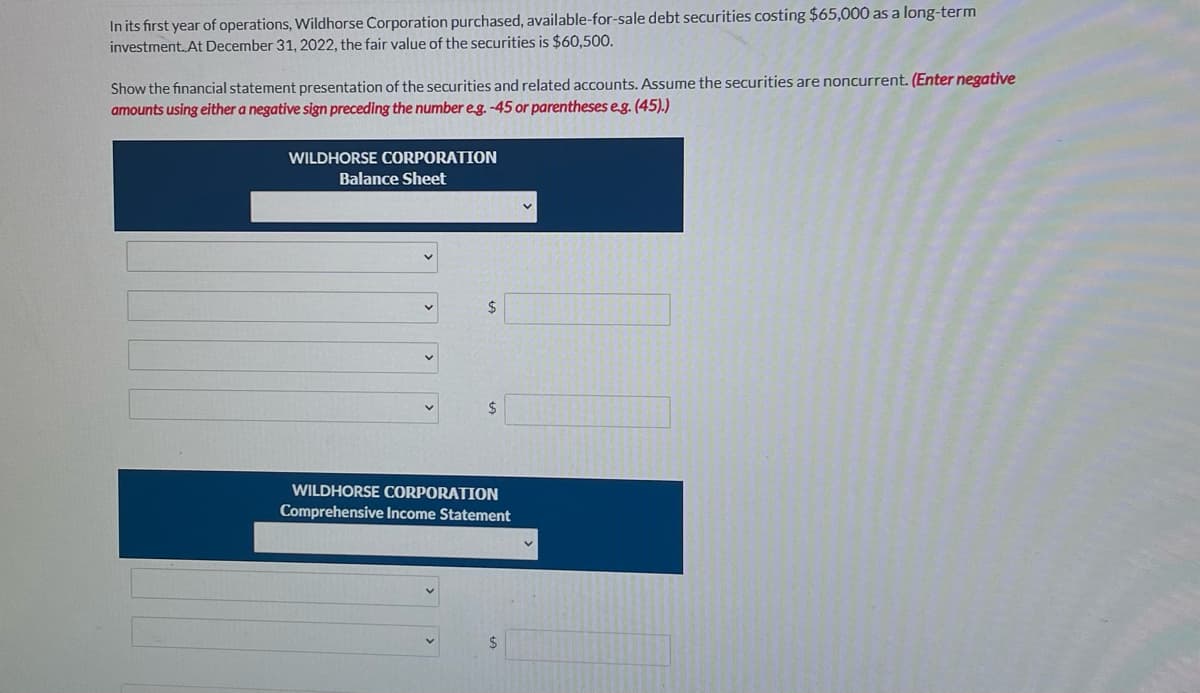

Transcribed Image Text:In its first year of operations, Wildhorse Corporation purchased, available-for-sale debt securities costing $65,000 as a long-term

investment. At December 31, 2022, the fair value of the securities is $60,500.

Show the financial statement presentation of the securities and related accounts. Assume the securities are noncurrent. (Enter negative

amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45).)

WILDHORSE CORPORATION

Balance Sheet

WILDHORSE CORPORATION

Comprehensive Income Statement

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning