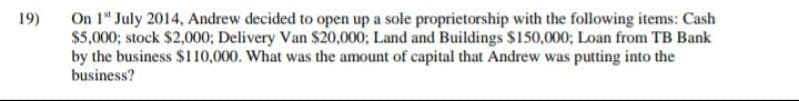

19) On 1 July 2014, Andrew decided to open up a sole proprietorship with the following items: Cash $5,000; stock $2,000; Delivery Van $20,000; Land and Buildings $150,000; Loan from TB Bank by the business $110,000. What was the amount of capital that Andrew was putting into the business?

Q: What is the difference between liabilities and assets?

A: The balance sheet represents the financial position of the business with assets and liabilities at…

Q: • Price per unit: $10 . Variable cost per unit: $7 . Fixed costs: $1,500 Given these data, compute…

A: Under Marginal costing (variable costing) contribution percentage or contribution per unit of…

Q: 1) Explain Historical cost concept and provide example.

A: Hi student Since there are multiple questions, we will answer only first question.

Q: EITHER TRUE OR FALSE. Explain why the assertion is incorrect if it is in fact incorrect. 1.…

A: Purchase Order is issued to seller for approval. Approved PO is not sent to seller but is sent for…

Q: In the month of June, Jose Hebert's Beauty Salon gave 3,800 haircuts, shampoos, and permanents at an…

A: The contribution margin is calculated by deducting the variable cost from the sales revenues of the…

Q: 5. If a unit of inventory has declined in value below original cost, but the market value exceeds…

A: The procedure of determining the actual value of inventories at the end of the year is known as…

Q: 2. For each of the following transactions, place an X in the table to indicate whether direct or…

A: *As per Bartleby policy, if multiple questions are asked then answer first three only. Direct…

Q: On December 22, Travis Company purchased merchandise on account from a supplier for $7,500, terms…

A: Introduction: Journal: All the business transactions are to be recorded in journals. Journals are…

Q: If Kim buys a car for $30,000 with an estimated life of 5 years, with a residual value of $5,000,…

A: Formula: Straight line method depreciation = ( Asset cost - Salvage value ) / Useful life years

Q: State the standard method of determining the cost of goods sold by a retailing or a wholesaling…

A: The cost of goods sold includes the total cost of goods sold include the cost of goods that are sold…

Q: Question 39 If the selling price per unit is $10, the unit contribution margin is $5, and total…

A: Lets understand the basics. Break even point is a point at which no profit/no loss condition arise.…

Q: A financial statement user can not gain a complete understanding of the financial statements…

A: A Financial Statement is the Statement which company prepares to show their business activities and…

Q: Net corporate cash flow is a metric created by cash-basis accounting. Explain the metric in detail

A: Cash basis accounting: According to cash basis of accounting, revenue should be recognized at the…

Q: Journalize the following business transactions in general journal form. Identify each transaction by…

A: The journal entries are prepared to record the transactions of business on regular basis.

Q: In 2021, Sonny earns $47,900 and is unemployed for $10,000. What is Sonny's taxable income if he…

A: As per Income tax act 1961 (endian no any other detail given for other country tax that why)

Q: TCL Company had the following transactions during 2021 1. Sales of P4,500 on account 2. Collected…

A: Accrual Basis of Accounting - a. Under the Accrual basis of accounting, revenue is recognized when…

Q: Richmond Chocolates Limited, a manufacturing Company, produces a single product. The following…

A: 3. Schedule of goods manufactured in the year…

Q: SCENARIO Given the following information from the payroll register, calculate the net pay and…

A: Introduction: Payroll is the recompense that a company is required to pay to its employees for a…

Q: Equipment with a cost of $95,550, an estimated residual value of $4,550, and an estimated life of 13…

A: Depreciation as per straight line method is given as under: = (Original cost - Salvage value) ÷…

Q: Catena's Marketing Company has the following adjusted trial balance at the end of the current year.…

A: Total assets are the all type of resources being held by the business. Asset turnover is one of the…

Q: The accounting records of Wall's China Shop reflected the following balances as of January 1, Year…

A: The inventory can be valued using various methods as FIFO, LIFO and weighted average method. FIFO…

Q: Thompson Company gathered the following reconciling information in preparing its October bank…

A: Cash: The term "cash and cash equivalents" refers to the line item on the balance sheet that…

Q: Can you help me do this quickly, thanks a. The constraint at Shanghai Company is an expensive…

A: Contribution margin per unit=Selling price per unit-Variable cost per unit

Q: The accounting records of Bass SARL contain the following information: Raw Materials Used: $68,479…

A: The cost of goods manufactured is the total value incurred for manufacturing the products. It is a…

Q: Bare Unimart Manufacturing Beginning inventory Merchandise $ 225,000 Finished goods $ 450,000 Cost…

A: Cost of goods sold = Beginning inventory + Cost of goods manufactured - Ending inventory

Q: Balance Sheet Data Accounts receivable Allowance for doubtful accounts Net accounts receivable…

A: The inventory turnover ratio indicates the number of times inventory turns to sales. It can be…

Q: A partnership had the following condensed financial position: Assets Liabilities and Capital…

A: Admission of new partner by purchase of interest in firm. Journal entry will be debit the capital…

Q: A corporate charter specifies that the company may sell up to 40 million shares of stock. The…

A: Issue of shares by the company by the company is one of important source of capital for the company.…

Q: Accounting and business management are two distinct disciplines

A: MEANING OF BUSINESS ADMINISTRATION AND ACCOUNTANCY - ACCOUNTANCY IS A FIELD OF STUDY AND A…

Q: Ernst Company's balance sheet shows total liabilities of $32,500,000, total stockholders' equity of…

A: Debt ratio= total debt/Total asset*100 =32500000/40625000 *100 = 80%

Q: If the selling price per unit is $80, the variable expense per unit is $40, and total fixed expenses…

A: Formula: Break even sales dollars = Break even units x Sales price per unit

Q: What are the ethical and legal implications of using accounting practices such as the book-and-hold…

A: Accounting practices refers to the processes as well as activity of reporting the daily financial…

Q: A plant bought a calciner for P220,000.00 and uses it for 10years, the life span of the equipment.…

A: Depreciation Methods: a) Straight Line Method: Calculation of Book Value of Calciner (Asset) after 5…

Q: please explain in steps thanks.

A: Manufacturing cost per unit = Direct material + Direct labor + Variable manufacturing overhead =…

Q: ew merchandising business, Dazzle Corporation started its operations last January 1, 2020. Presented…

A: Income Statement: This statement is also known as Statement of Profit and Loss or Profit and Loss…

Q: Which of the following is not a taxable corporation?

A: Under the Philippine's National Internal Revenue Code of 1997, the term "corporation" includes…

Q: 14. Which of the following can be used to calculate the value of X in the following CFD: a. X= 10…

A: Value of X can be calculated by calculating the future value of the cashflow from year 1 to 8. Cash…

Q: Aside from the regular corporate income tax, what other tax(es) may be imposed on corporations under…

A: Corporation have to pay tax on the income or profits which has been earned by the corporation during…

Q: E8.20 (LO 1) Information for Bob's Company is provided in E8.19. Instructions a. Assuming the…

A: Absorption costing also referred to as "full costing," is an accounting management technique that…

Q: On September 21, the firm received a 6% 90-day note for money lent to Ling Ying Wei amounting to…

A: Lets understand the basics. Adjustment entry is need to pass to record correct amount of revenue and…

Q: Phil Cousteau is an accountant. Phil is 47 years old and is married to Claire who is 45 years old.…

A: Tax refers to the compulsory charge levied by the government over the money gained by an entity.

Q: new merchandising business, Dazzle Corporation started its operations last January 1, 2020.…

A: Balance Sheet: It is the statement or sheet where Assets, Liabilities and Owner's Equity are shown…

Q: Entries for cash dividend

A: When the Board of Directors approve and announce a cash dividend, then the company must record a…

Q: purchased for $20,000. The firm expects the loader to salvage value of $5,000 after 7 years. The…

A: Explanation of Concept Annual Worth method is been used for decision making where two assets is…

Q: Huron Corporation generated total sales of $10,000,000 during the year with 80% representing credit…

A: The allowance for doubtful accounts is the contra assets account which is maintained to record…

Q: . How much is the net income for distribution to partners? A. P 2,750,000 B. P 2,900,000 C. P…

A: 7. Net Income for Distribution to partners D. P 5,750,000 is correct option. Explanation: Gross…

Q: Each certified instructor puts in 480 hours per quarter regular time and can work an additional 120…

A: Introduction: Chase strategy: The chase strategy is based on the notion that you will be following…

Q: If a retailer has revenues of $700,000, cost of goods sold that total $270,000, and operating…

A: The net income or loss is calculated as difference between revenues and expenses for the period.

Q: The joint process from which Ple'egrea, Inc. obtains both Nuts and Bolts has a total cost of $74,000…

A: Allocation of Joint Cost: To calculate the cost per unit of output using this approach, just divide…

Q: Could the accountant be sure that all dividends due on the client's marketable securities have been…

A: Dividends: This is the amount of cash distributed to stockholders by a company from its earnings in…

Step by step

Solved in 2 steps

- On 1 August 2020, Jojo decided to start a sole proprietorship business with i point the following items: building RM400,000; motor vehicles RM160,000; fixtures and fittings RM 120,000; loan from bank RM100,000; cash at bank RM30,000. What was the amount of capital that Jojo contributed to the business.Faith D. Nakpil started her accounting practice on November 3, 2021 by investing P138,000 cash and her old laptop with an original cost of P64,000 but with a fair value of P31,000 at the time of investment. How much was the initial capital of Faith?X had started business with $2,00,000 in the beginning of the year. During the year, he borrowed $1,00,000 from Y. He further introduced $2,00,000 in the business. He also gave $50,000 as loan to his son. Goods given away as charity by him were $20,000. Profits earned by him were $2,50,000. He also withdraw $30,000 from the business. His capital at the end of the year would be__________.

- On first August, Izah decided to start a sole proprietorship business with the following items; building RM400, 000; motor vehicles RM160, 000; fixtures & fittings RM120, 000; loan from bank RM100, 000; Cash at bank RM30, 000. What was the amount of capital that Izah contributed to the business?Fae and Carley had a tech business. After two unprofitable years, the business closed. At that point, the liabilities of the business were $100,000 larger than its assets. Under each separate situation, how much money (if any) can creditors take from Carley’s personal assets to pay the unpaid business debts? a. The business is set up as a limited liability company (LLC). b. The business is set up as an S corporation.4.Owner Juana invested P100,000 to start her laundry business .During the first year of operations (2019), the company had a net income of P15,000. Juana invested additional P100,000 to grow the business.In 2020,the business earned P50,000.As of December31,2020,Juana’s capital balance is P200,000.How much isJuana’s withdrawal?

- Carl and Stefanie each invest $15,000 in a business and are given shares of stock in ThibeauIndustries as evidence of their ownership interests. For this transaction, identify the effect on theaccounting equation.a. Assets increase and liabilities increase.b. Assets increase and stockholders’ equity increases.c. Liabilities increase and stockholders’ equity decreases.d. Liabilities decrease and assets decrease.Ms. Muchomoney is incredibly wealthy and has a net worth of $1,000,000,000. She starts a business by giving $100,000 to the company and receiving stock in return. That is the only transaction to date this year. The new business's balance sheet would have: Group of answer choices Total owners' equity of $1,000,100,000. Total owners' equity of $100,000. No owners' equity Total owners' equity of $1,000,000,000.After researching the different forms of business organization, Natalie Koebel decides to operate “Cookie Creations” as a corporation. She then starts the process of getting the business running. In November 2022, the following activities take place. Nov. 8 Natalie cashes her U.S. Savings Bonds and receives $520, which she deposits in her personal bank account. 8 She opens a bank account under the name “Cookie Creations” and transfers $500 from her personal account to the new account in exchange for common stock. 11 Natalie pays $65 to have advertising brochures and posters printed. She plans to distribute these as opportunities arise. (Hint: Use Advertising Expense.) 13 She buys baking supplies, such as flour, sugar, butter, and chocolate chips, for $125 cash. 14 Natalie starts to gather some baking equipment to take with her when teaching the cookie classes. She has an excellent top-of-the-line food processor and mixer…

- After researching the different forms of business organization, Natalie Koebel decides to operate “Cookie Creations” as a corporation. She then starts the process of getting the business running. In November 2022, the following activities take place. Nov. 8 Natalie cashes her U.S. Savings Bonds and receives $520, which she deposits in her personal bank account. 8 She opens a bank account under the name “Cookie Creations” and transfers $500 from her personal account to the new account in exchange for common stock. 11 Natalie pays $65 to have advertising brochures and posters printed. She plans to distribute these as opportunities arise. (Hint: Use Advertising Expense.) 13 She buys baking supplies, such as flour, sugar, butter, and chocolate chips, for $125 cash. 14 Natalie starts to gather some baking equipment to take with her when teaching the cookie classes. She has an excellent top-of-the-line food processor and mixer…Let us assume that Mr. Amir starts a business called Amir Enterprises on 1st January, 2021 and invests cash of RO. 20,000 as his capital. Amir Enterprise’s purchases machinery worth RO. 1,000 paid 35% in cash and remaining on credit. The company purchased goods worth RO. 5,000. Paid RO. 2,000 cash and balance on credit The company made a sale of RO. 2800 (cost being RO 3000) on credit basis The company took loan of RO. 10,000 from Bank Muscat . Mr. Amir withdrew RO. 1,000 from the business for his personal use You need to record the above transactions in an equation form. Q2Select any five financial transactions of your choice and make journal entries for the same. Q3 There are three types of organizations namely manufacturing, services and trading sectors, choose any one organization from each sector of your choice and name 5 Assets, Liabilities, Expenses and revenue from them.Ms. QWE began a business on April 1, 2021, contributing to the business the following assets: Cash, P 3,000,000, Office Supplies, P 275,000, Office Equipment, P 700,000, Furniture and Fixtures, P 2,100,000. A. What is the total value of the assets that Ms. QWE contributed to the business? B. Determine the value of Ms. QWE's ownership in the business.