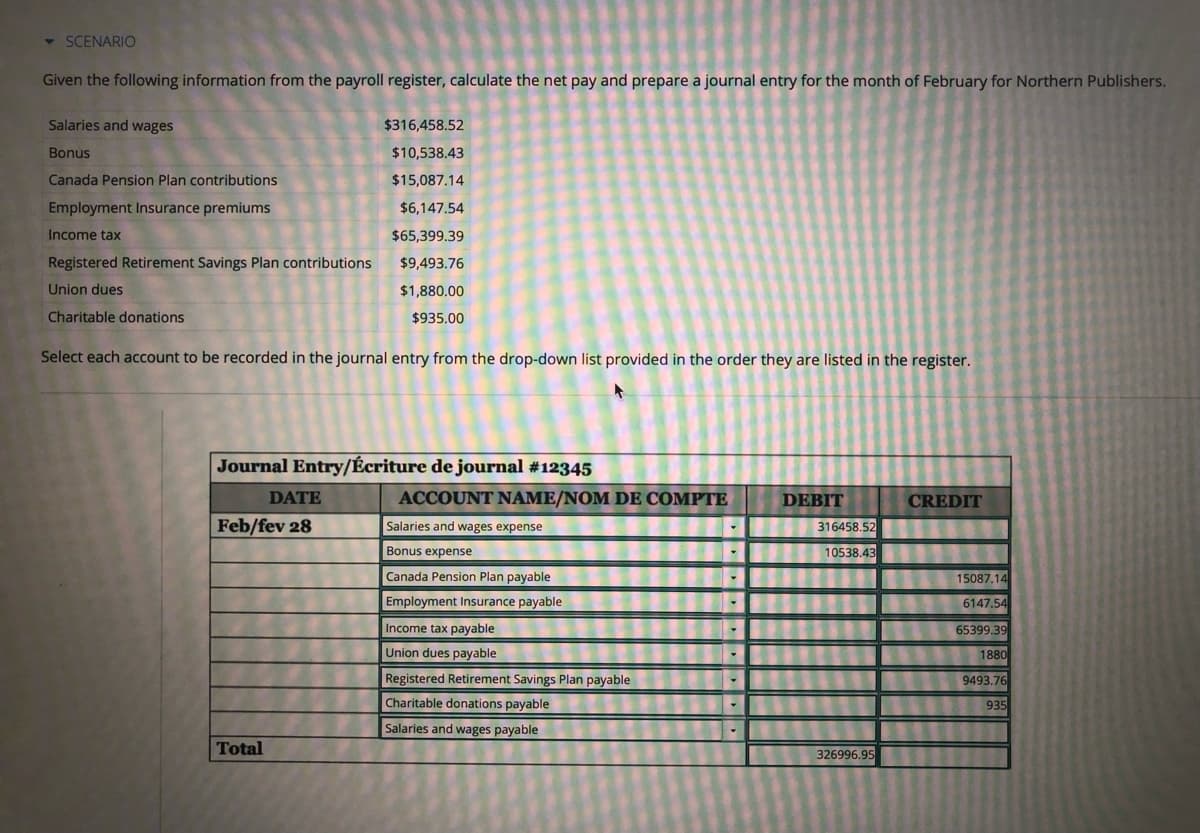

Given the following information from the payroll register, calculate the net pay and prepare a journal entry for the month of February for Northern Publishers. Salaries and wages $316,458.52 $10,538.43 Bonus Canada Pension Plan contributions $15,087.14 Employment Insurance premiums $6,147.54 Income tax $65,399.39 Registered Retirement Savings Plan contributions $9,493.76 Union dues $1,880.00 Charitable donations $935.00 Select each account to be recorded in the journal entry from the drop-down list provided in the order they are listed in the register. Journal Entry/Écriture de journal #12345 DATE DEBIT CREDIT ACCOUNT NAME/NOM DE COMPTE Salaries and wages expense Feb/fev 28 ▾ Bonus expense ▾ Canada Pension Plan payable ▾ Employment Insurance payable Income tax payable Union dues payable Registered Retirement Savings Plan payable Charitable donations payable Salaries and wages payable Total ▾ ▾ ▾ ▾ 316458.52 10538.43 326996.95 15087,14 6147.54 65399.39 1880 9493.76 935

Given the following information from the payroll register, calculate the net pay and prepare a journal entry for the month of February for Northern Publishers. Salaries and wages $316,458.52 $10,538.43 Bonus Canada Pension Plan contributions $15,087.14 Employment Insurance premiums $6,147.54 Income tax $65,399.39 Registered Retirement Savings Plan contributions $9,493.76 Union dues $1,880.00 Charitable donations $935.00 Select each account to be recorded in the journal entry from the drop-down list provided in the order they are listed in the register. Journal Entry/Écriture de journal #12345 DATE DEBIT CREDIT ACCOUNT NAME/NOM DE COMPTE Salaries and wages expense Feb/fev 28 ▾ Bonus expense ▾ Canada Pension Plan payable ▾ Employment Insurance payable Income tax payable Union dues payable Registered Retirement Savings Plan payable Charitable donations payable Salaries and wages payable Total ▾ ▾ ▾ ▾ 316458.52 10538.43 326996.95 15087,14 6147.54 65399.39 1880 9493.76 935

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 3E

Related questions

Question

Payroll

Transcribed Image Text:▾ SCENARIO

Given the following information from the payroll register, calculate the net pay and prepare a journal entry for the month of February for Northern Publishers.

Salaries and wages

$316,458.52

$10,538.43

Bonus

Canada Pension Plan contributions

$15,087.14

Employment Insurance premiums

$6,147.54

Income tax

$65,399.39

Registered Retirement Savings Plan contributions

$9,493.76

Union dues

$1,880.00

Charitable donations

$935.00

Select each account to be recorded in the journal entry from the drop-down list provided in the order they are listed in the register.

Journal Entry/Écriture de journal #12345

DATE

DEBIT

CREDIT

ACCOUNT NAME/NOM DE COMPTE

Salaries and wages expense

Feb/fev 28

Bonus expense

▾

Canada Pension Plan payable

▾

Employment Insurance payable

Income tax payable

▾

Union dues payable

▾

Registered Retirement Savings Plan payable

Charitable donations payable

Salaries and wages payable

Total

316458.52

10538.43

326996.95

15087,14

6147.54

65399.39

1880

9493.76

935

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage