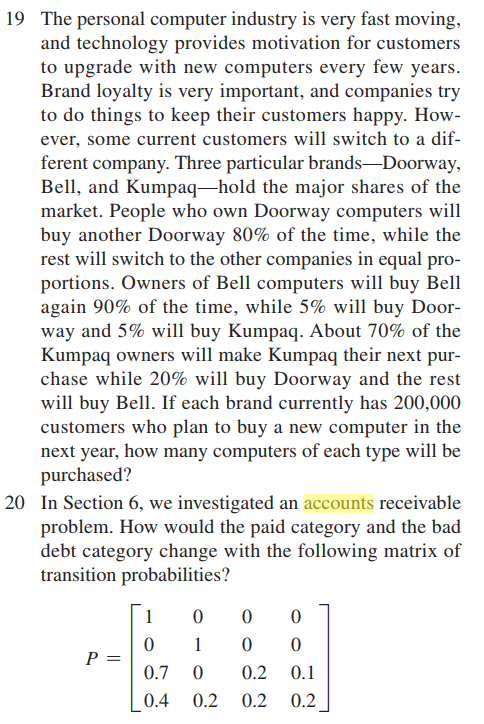

19 The personal computer industry is very fast moving, and technology provides motivation for customers to upgrade with new computers every few years. Brand loyalty is very important, and companies try to do things to keep their customers happy. How- ever, some current customers will switch to a dif- ferent company. Three particular brands–Doorway, Bell, and Kumpaq-hold the major shares of the market. People who own Doorway computers will buy another Doorway 80% of the time, while the rest will switch to the other companies in equal pro- portions. Owners of Bell computers will buy Bell again 90% of the time, while 5% will buy Door- way and 5% will buy Kumpaq. About 70% of the Kumpaq owners will make Kumpaq their next pur- chase while 20% will buy Doorway and the rest will buy Bell. If each brand currently has 200,000 customers who plan to buy a new computer in the next year, how many computers of each type will be purchased?

19 The personal computer industry is very fast moving, and technology provides motivation for customers to upgrade with new computers every few years. Brand loyalty is very important, and companies try to do things to keep their customers happy. How- ever, some current customers will switch to a dif- ferent company. Three particular brands–Doorway, Bell, and Kumpaq-hold the major shares of the market. People who own Doorway computers will buy another Doorway 80% of the time, while the rest will switch to the other companies in equal pro- portions. Owners of Bell computers will buy Bell again 90% of the time, while 5% will buy Door- way and 5% will buy Kumpaq. About 70% of the Kumpaq owners will make Kumpaq their next pur- chase while 20% will buy Doorway and the rest will buy Bell. If each brand currently has 200,000 customers who plan to buy a new computer in the next year, how many computers of each type will be purchased?

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 28PPS

Related questions

Topic Video

Question

see image for question

Transcribed Image Text:19 The personal computer industry is very fast moving,

and technology provides motivation for customers

to upgrade with new computers every few years.

Brand loyalty is very important, and companies try

to do things to keep their customers happy. How-

ever, some current customers will switch to a dif-

ferent company. Three particular brands-Doorway,

Bell, and Kumpaq-hold the major shares of the

market. People who own Doorway computers will

buy another Doorway 80% of the time, while the

rest will switch to the other companies in equal pro-

portions. Owners of Bell computers will buy Bell

again 90% of the time, while 5% will buy Door-

way and 5% will buy Kumpaq. About 70% of the

Kumpaq owners will make Kumpaq their next pur-

chase while 20% will buy Doorway and the rest

will buy Bell. If each brand currently has 200,000

customers who plan to buy a new computer in the

next year, how many computers of each type will be

purchased?

20 In Section 6, we investigated an accounts receivable

problem. How would the paid category and the bad

debt category change with the following matrix of

transition probabilities?

1

1

0 0

P =

0.7

0.2

0.1

0.4

0.2

0.2

0.2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, probability and related others by exploring similar questions and additional content below.Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill