19. A financial analyst in Bookman's Book Company just analyzed a capital budgeting project and realized that the IRR of 12% on the project was identical to the company's discount rate of 12%. Which of the following is true regarding the net present value of the project? A. The NPV of the project is positive B. The NPV of the project is zero C. The NPV of the project is negative D. More information is needed to answer the question 20. When a company's discount rate increases, which of the following is true for a project that currently has a net present value of $105,325.69 and an IRR of 15.66%? A. The company's IRR will increase B. The company's IRR will decrease C. The company's net present value will increase D. The company's net present value will decrease 21. Which of the following is a period cost for a computer manufacturer: A. Wages for assembly line workers B. Glue for computers C. Rent for factory building D. None of the above 22. If the LHK Company had a per unit cost that was $5 when 400 units were produced and a per unit cost of $4 when 500 units were produced, the cost is a A. Variable cost of $5 per unit B. Fixed cost of $2,000 C. Mixed cost of $5 per unit variable cost and $400 fixed cost D. Mixed cost of $4 per unit variable cost and $400 fixed cost 23. Which of the following would be included as a cash disbursement on a cash budget? A. Fixed asset purchases B. Depreciation C. Borrowings from a bank D. Both A & C 12 24. Which of the following is a possible reason for a sales volume variance? A. Direct material prices per unit were different than expected B. The quantity of labor hours used per unit were different than expected C. The actual number of units sold were different than expected D. Both A & B 25. You have won the lottery and you have been given the following options. Which one should you choose if the current interest rate is 5% annually? A. $3,000,000 today B. $290,000 per year at the end of each of the next 15 years C. $6,000,000 at the end of 15 years. D. $350,000 per year at the end of each of the next 10 years 26. You have received a settlement from an insurance company which will pay you $100,000 per year for 12 years at the end of each year and J.G. Wentworth wants to buy your annuity. What is JG Wentworth's annual rate of return (interest rate) if they are willing to pay you $500,000 today? A. 7.56% B. 18.21% C. 16.94% D. Interest rate cannot be calculated. 27. The Merrymount Company has budgeted sales of $400,000 and budgeted cash receipts of $380,000 for the month of July. The company sells beach bags for $40 each. The Company has also budgeted inventory purchases of 10,500 units at a cost of $20 each. If the company incurred $125,000 of selling and administrative expenses during July, what is the company's budgeted operating income for the month of July? A. $75,000 B. $65,000 C. $45,000 D. None of the above 12

19. A financial analyst in Bookman's Book Company just analyzed a capital budgeting project and realized that the IRR of 12% on the project was identical to the company's discount rate of 12%. Which of the following is true regarding the net present value of the project? A. The NPV of the project is positive B. The NPV of the project is zero C. The NPV of the project is negative D. More information is needed to answer the question 20. When a company's discount rate increases, which of the following is true for a project that currently has a net present value of $105,325.69 and an IRR of 15.66%? A. The company's IRR will increase B. The company's IRR will decrease C. The company's net present value will increase D. The company's net present value will decrease 21. Which of the following is a period cost for a computer manufacturer: A. Wages for assembly line workers B. Glue for computers C. Rent for factory building D. None of the above 22. If the LHK Company had a per unit cost that was $5 when 400 units were produced and a per unit cost of $4 when 500 units were produced, the cost is a A. Variable cost of $5 per unit B. Fixed cost of $2,000 C. Mixed cost of $5 per unit variable cost and $400 fixed cost D. Mixed cost of $4 per unit variable cost and $400 fixed cost 23. Which of the following would be included as a cash disbursement on a cash budget? A. Fixed asset purchases B. Depreciation C. Borrowings from a bank D. Both A & C 12 24. Which of the following is a possible reason for a sales volume variance? A. Direct material prices per unit were different than expected B. The quantity of labor hours used per unit were different than expected C. The actual number of units sold were different than expected D. Both A & B 25. You have won the lottery and you have been given the following options. Which one should you choose if the current interest rate is 5% annually? A. $3,000,000 today B. $290,000 per year at the end of each of the next 15 years C. $6,000,000 at the end of 15 years. D. $350,000 per year at the end of each of the next 10 years 26. You have received a settlement from an insurance company which will pay you $100,000 per year for 12 years at the end of each year and J.G. Wentworth wants to buy your annuity. What is JG Wentworth's annual rate of return (interest rate) if they are willing to pay you $500,000 today? A. 7.56% B. 18.21% C. 16.94% D. Interest rate cannot be calculated. 27. The Merrymount Company has budgeted sales of $400,000 and budgeted cash receipts of $380,000 for the month of July. The company sells beach bags for $40 each. The Company has also budgeted inventory purchases of 10,500 units at a cost of $20 each. If the company incurred $125,000 of selling and administrative expenses during July, what is the company's budgeted operating income for the month of July? A. $75,000 B. $65,000 C. $45,000 D. None of the above 12

Chapter11: Capital Budgeting And Risk

Section: Chapter Questions

Problem 16P

Related questions

Question

Please do 22, 23, 26

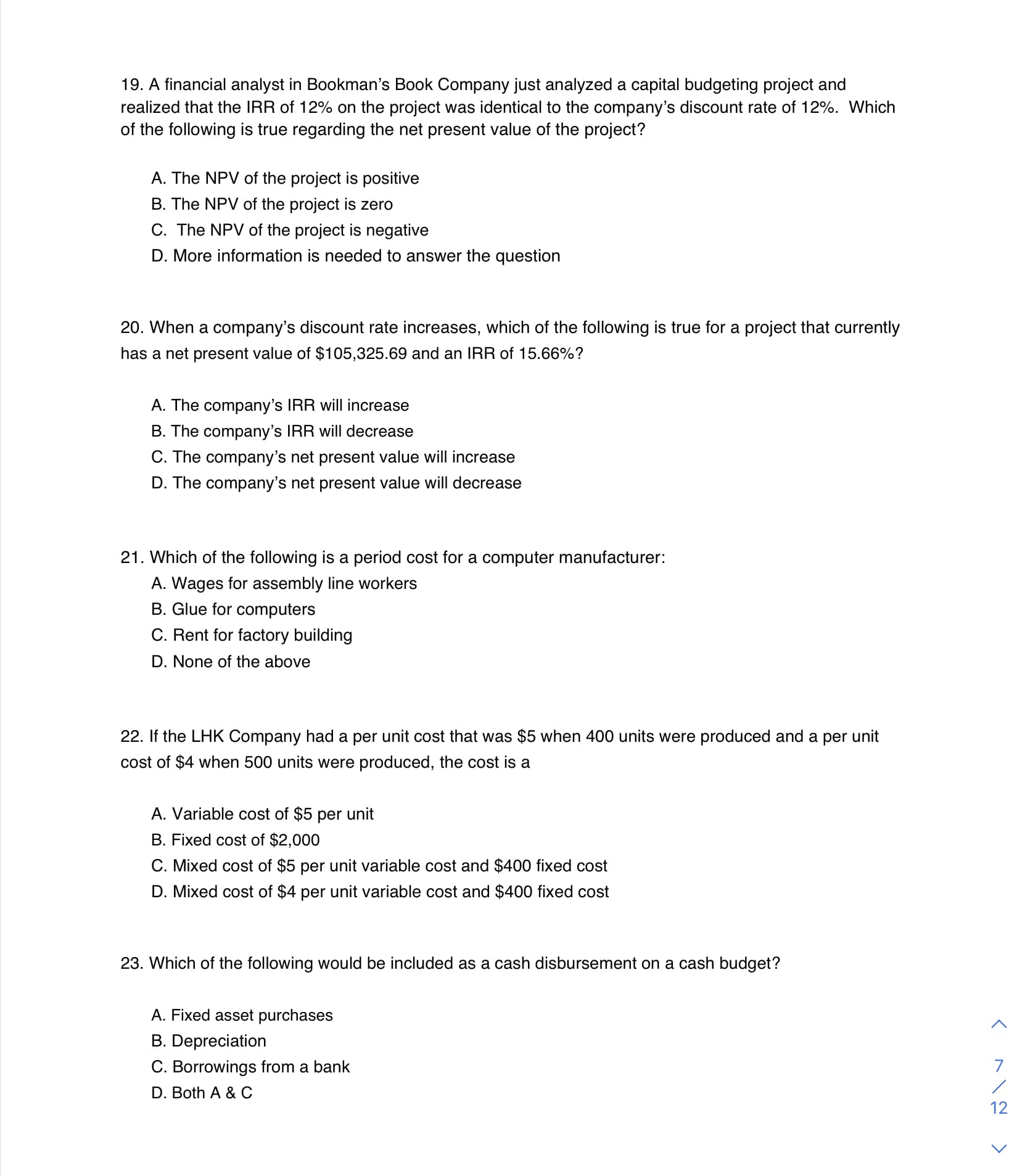

Transcribed Image Text:19. A financial analyst in Bookman's Book Company just analyzed a capital budgeting project and

realized that the IRR of 12% on the project was identical to the company's discount rate of 12%. Which

of the following is true regarding the net present value of the project?

A. The NPV of the project is positive

B. The NPV of the project is zero

C. The NPV of the project is negative

D. More information is needed to answer the question

20. When a company's discount rate increases, which of the following is true for a project that currently

has a net present value of $105,325.69 and an IRR of 15.66%?

A. The company's IRR will increase

B. The company's IRR will decrease

C. The company's net present value will increase

D. The company's net present value will decrease

21. Which of the following is a period cost for a computer manufacturer:

A. Wages for assembly line workers

B. Glue for computers

C. Rent for factory building

D. None of the above

22. If the LHK Company had a per unit cost that was $5 when 400 units were produced and a per unit

cost of $4 when 500 units were produced, the cost is a

A. Variable cost of $5 per unit

B. Fixed cost of $2,000

C. Mixed cost of $5 per unit variable cost and $400 fixed cost

D. Mixed cost of $4 per unit variable cost and $400 fixed cost

23. Which of the following would be included as a cash disbursement on a cash budget?

A. Fixed asset purchases

B. Depreciation

C. Borrowings from a bank

D. Both A & C

12

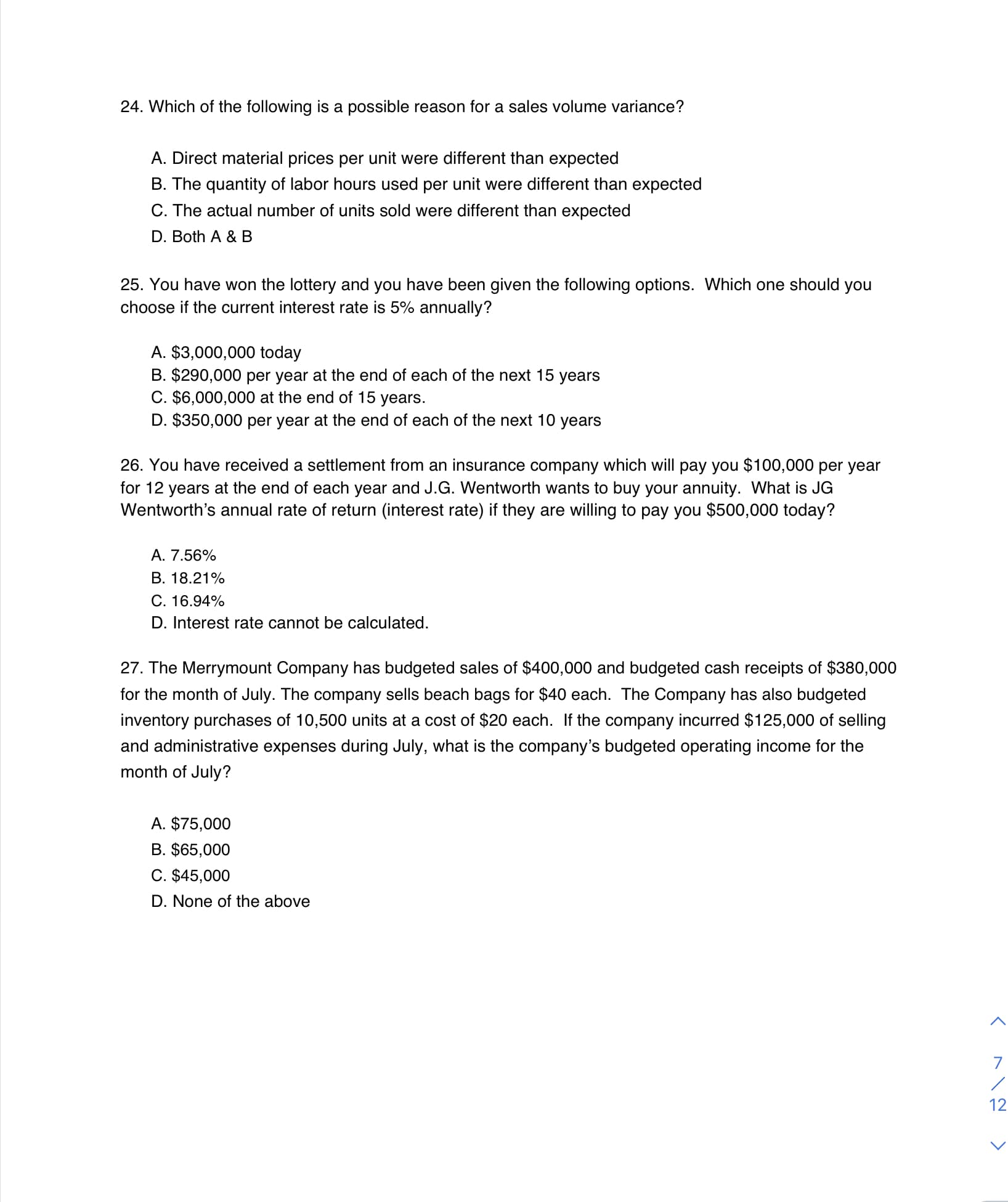

Transcribed Image Text:24. Which of the following is a possible reason for a sales volume variance?

A. Direct material prices per unit were different than expected

B. The quantity of labor hours used per unit were different than expected

C. The actual number of units sold were different than expected

D. Both A & B

25. You have won the lottery and you have been given the following options. Which one should you

choose if the current interest rate is 5% annually?

A. $3,000,000 today

B. $290,000 per year at the end of each of the next 15 years

C. $6,000,000 at the end of 15 years.

D. $350,000 per year at the end of each of the next 10 years

26. You have received a settlement from an insurance company which will pay you $100,000 per year

for 12 years at the end of each year and J.G. Wentworth wants to buy your annuity. What is JG

Wentworth's annual rate of return (interest rate) if they are willing to pay you $500,000 today?

A. 7.56%

B. 18.21%

C. 16.94%

D. Interest rate cannot be calculated.

27. The Merrymount Company has budgeted sales of $400,000 and budgeted cash receipts of $380,000

for the month of July. The company sells beach bags for $40 each. The Company has also budgeted

inventory purchases of 10,500 units at a cost of $20 each. If the company incurred $125,000 of selling

and administrative expenses during July, what is the company's budgeted operating income for the

month of July?

A. $75,000

B. $65,000

C. $45,000

D. None of the above

12

Expert Solution

Step 1

22) correct option is B i.e. Fixed cost of $2000

Explanation:

400 units @ $ 5 = $2000

500 units @ $ 4 = $ 2000

Total cost is same at both the level hence it is fixed cost

Fixed cost is $ 2000

Step 2

Correct option is D i.e. both A $ C

Explanation :

Fixed assets purchases involves cash

Depreciation is a non cash expense

Borrowing from a bank involves cash

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning