19. In balance-of-payments accounting, the sale of a foreign production facility by a SA firm is a item in the SA balance of payments; the deposit of funds in a foreign bank account by a SA citizen item in the SA balance of payments. A Debit; also is a debit B Debit; is a credit C Credit; is a debit D Credit; also is a credit

19. In balance-of-payments accounting, the sale of a foreign production facility by a SA firm is a item in the SA balance of payments; the deposit of funds in a foreign bank account by a SA citizen item in the SA balance of payments. A Debit; also is a debit B Debit; is a credit C Credit; is a debit D Credit; also is a credit

Chapter20: International Finance

Section: Chapter Questions

Problem 1.2P

Related questions

Question

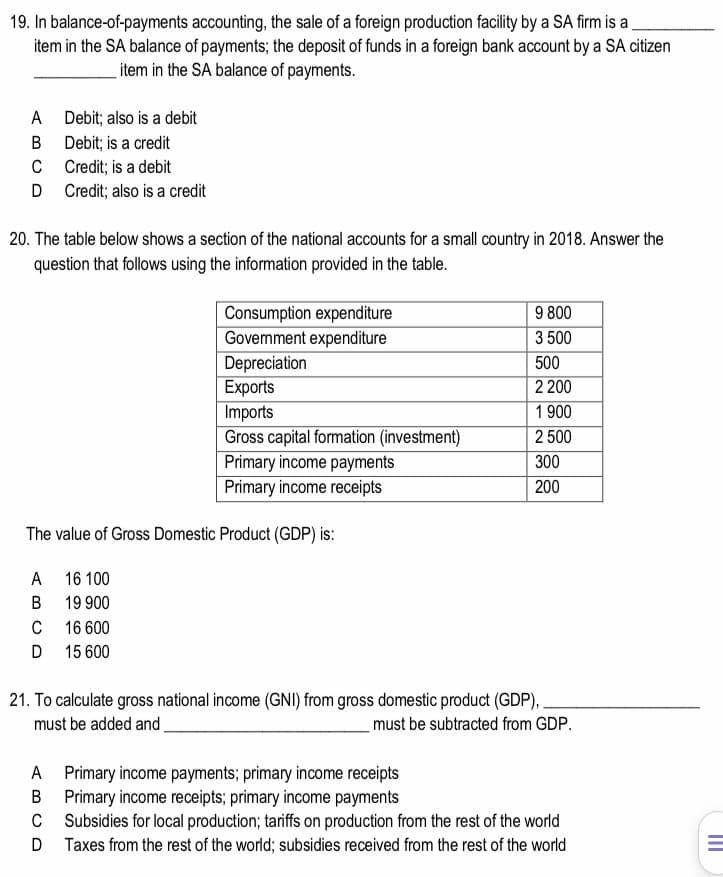

Transcribed Image Text:19. In balance-of-payments accounting, the sale of a foreign production facility by a SA firm is a

item in the SA balance of payments; the deposit of funds in a foreign bank account by a SA citizen

item in the SA balance of payments.

A Debit; also is a debit

B Debit; is a credit

C Credit; is a debit

D Credit; also is a credit

20. The table below shows a section of the national accounts for a small country in 2018. Answer the

question that follows using the information provided in the table.

9 800

Consumption expenditure

Government expenditure

3 500

Depreciation

Exports

Imports

Gross capital formation (investment)

500

2 200

1 900

2 500

Primary income payments

Primary income receipts

300

200

The value of Gross Domestic Product (GDP) is:

A

16 100

В

19 900

16 600

D

15 600

21. To calculate gross national income (GNI) from gross domestic product (GDP),

must be added and

must be subtracted from GDP.

A Primary income payments; primary income receipts

B Primary income receipts; primary income payments

C Subsidies for local production; tariffs on production from the rest of the world

Taxes from the rest of the world; subsidies received from the rest of the world

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning