19,000, would have a useful life o at the investment has been in ope 11 years (including the year just c raluate the success of the project. e number eg -45 or parentheses eg aces as displayed in the factor table

19,000, would have a useful life o at the investment has been in ope 11 years (including the year just c raluate the success of the project. e number eg -45 or parentheses eg aces as displayed in the factor table

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 51P: Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new...

Related questions

Question

Please Solve In 20mins

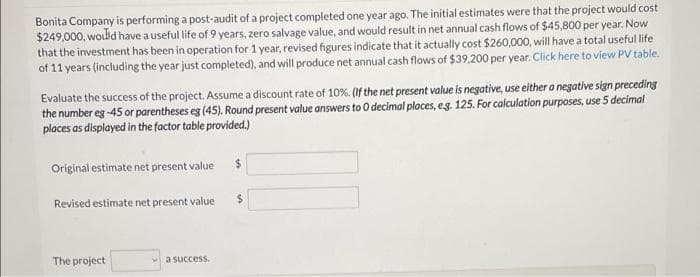

Transcribed Image Text:Bonita Company is performing a post-audit of a project completed one year ago. The initial estimates were that the project would cost

$249,000, would have a useful life of 9 years, zero salvage value, and would result in net annual cash flows of $45,800 per year. Now

that the investment has been in operation for 1 year, revised figures indicate that it actually cost $260,000, will have a total useful life

of 11 years (including the year just completed), and will produce net annual cash flows of $39.200 per year. Click here to view PV table.

Evaluate the success of the project. Assume a discount rate of 10%. (If the net present value is negative, use either a negative sign preceding

the number eg -45 or parentheses eg (45). Round present value answers to O decimal places, eg. 125. For calculation purposes, use 5 decimal

places as displayed in the factor table provided.)

Original estimate net present value

24

Revised estimate net present value

%24

The project

a success.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,