2) Assume now that Sell-it-Again is a public company. Prepare all journal entries related to this sale. 3) Assume that the customer's borrowing rate is unknown and that the merchandise cash price is $110,000 (everything else holds true). Calculate the imputed interest rate and the

2) Assume now that Sell-it-Again is a public company. Prepare all journal entries related to this sale. 3) Assume that the customer's borrowing rate is unknown and that the merchandise cash price is $110,000 (everything else holds true). Calculate the imputed interest rate and the

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 61P

Related questions

Question

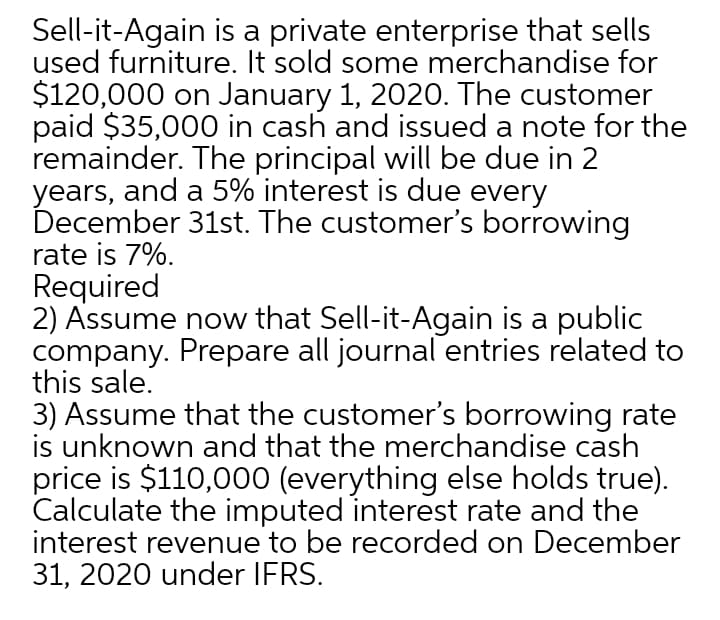

Transcribed Image Text:Sell-it-Again is a private enterprise that sells

used furniture. It sold some merchandise for

$120,000 on January 1, 2020. The customer

paid $35,000 in cash and issued a note for the

remainder. The principal will be due in 2

years, and a 5% interest is due every

December 31st. The customer's borrowing

rate is 7%.

Required

2) Assume now that Sell-it-Again is a public

company. Prepare all journal entries related to

this sale.

3) Assume that the customer's borrowing rate

is unknown and that the merchandise cash

price is $110,000 (everything else holds true).

Calculate the imputed interest rate and the

interest revenue to be recorded on December

31, 2020 under IFRS.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning