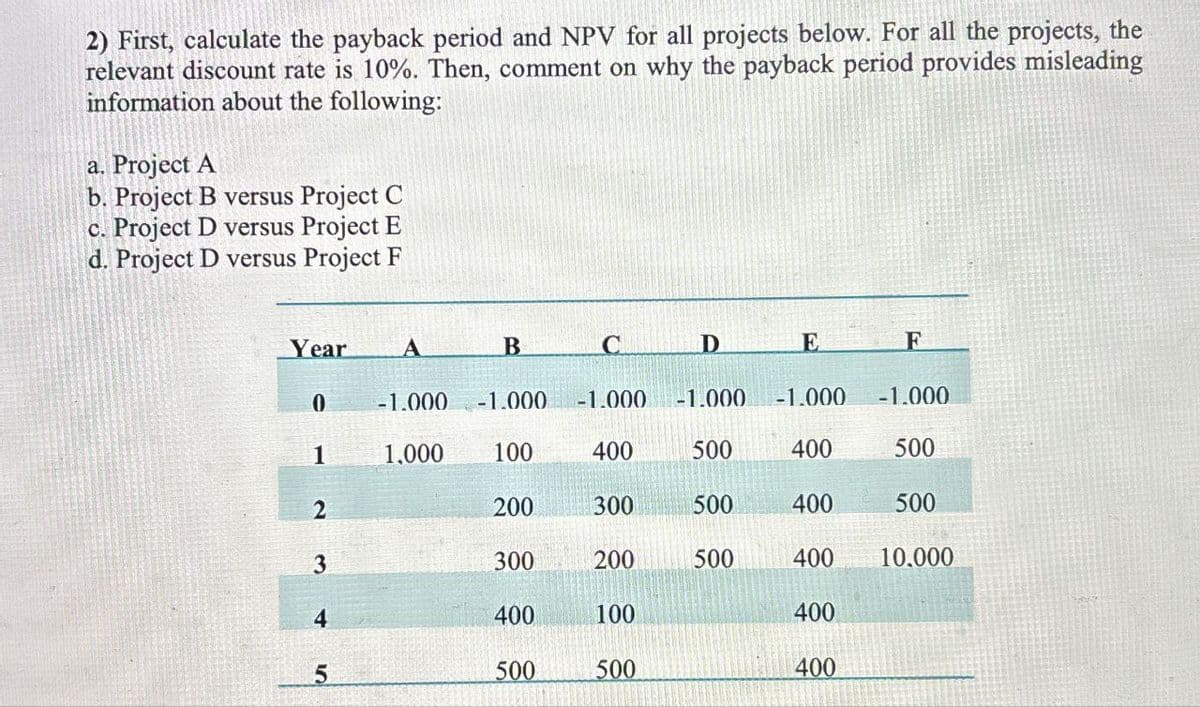

2) First, calculate the payback period and NPV for all projects below. For all the projects, the relevant discount rate is 10%. Then, comment on why the payback period provides misleading information about the following: a. Project A b. Project B versus Project C c. Project D versus Project E d. Project D versus Project F Year A B C D E F 0 -1.000 -1.000 -1.000 -1.000 -1.000 -1.000 1 1,000 100 400 500 400 500 2 200 300 500 400 500 3 300 200 500 400 10.000 4 400 100 400 5 500 500 400

Q: Use the following information for Questions 6 to 10: A promissory note for $12,500 was written on…

A: Promissory note: It is a financial instrument that has been traded in the money market to allow the…

Q: You've observed the following returns on Pine Computer's stock over the past five years: -28.5…

A: Part 2: Explanation:Step 1: Calculate the average nominal risk-free rate:The average T-bill rate…

Q: Consider a project with a 3-year life. The initial cost to set up the project is $100,000. This…

A: The objective of the question is to calculate the annual cash flow from assets and the Net Present…

Q: I need typing clear urjent

A: Step 1:Given data:F=75 KNa=106 mmStep 2:yˉ=2150=75mmxˉ=2b+db2=2∗106+1501062=31.038mm /a=b=106…

Q: During the year just ended, Anna Schultz's portfolio, which has a beta of 0.96, earned a return of…

A: The above answer can be explained as under - Treynor's measure can be calculated as - Treynor's…

Q: What is the weighted average cost of capital for SKYE Corporation given the following information?…

A: Value of Equity =Equity shares outstanding ∗ Stock price per share=1million×$23=$23million Value of…

Q: is my response accurate

A: Reason:The present value (PV) uses a discounting factor and discounting is opposite / reverse of…

Q: None

A: 1. Calculate the NPV: Subtract the initial cost of $96.03 million from the present value of the…

Q: Assume XYZ has a marginal tax rate of 21 percent for the foreseeable future and earns an after-tax…

A: Step 1: Calculate Present Value of Current Salary:Present Value (PV) = Future Value (FV) / (1 +…

Q: Total income

A: Responseshttps://www.investopedia.com/budgeting-4689726https://www.investopedia.com/terms/e/expenser…

Q: The current yield curve for default-free zero-coupon bonds is as follows: Maturity (Years) Spot…

A: A bond provides the issuing company access to debt capital from investors and other non-traditional…

Q: Nikul

A: We will utilize the Capital Asset Pricing Model (CAPM) to determine the necessary rate of return and…

Q: The net present value (NPV) rule is considered one of the most common and preferred criteria that…

A:

Q: The Wildcat Oil Company is trying to decide whether to lease or buy a new computer- assisted…

A: Step 1. Calculate the annual depreciation expense.The drilling system costs $9.8 million and will be…

Q: Whitehaven Group Ltd (WHG) is an industrial machinery manufacturing company based in Sydney. Due to…

A: Net Present Value (NPV) is a financial metric that measures the profitability of an investment or…

Q: Nikul

A: Part 2: Explanation:Step 1: Calculate the Sharpe Ratio:The Sharpe Ratio measures the risk-adjusted…

Q: Nikul

A: 1. Macaulay Duration: This is the weighted average time until a bond's cash flows are received. It's…

Q: Machine A costs $1,520,000 to buy and install and costs $48,000 per year to operate. The machine has…

A: The objective of this question is to calculate the equivalent annual cost of Machine A. This…

Q: The standard process of settlement in ASX is T+2. If tomorrow is the record date for dividend…

A: The dividend is a payment that a corporation pays to its shareholders for owning its stock. The…

Q: Turnbull Co. has a target capital structure of 58% debt, 6% preferred stock, and 36% common equity.…

A: : let's go through the calculations step by step for question one.**Turnbull Co.:**Given data:-…

Q: You find a certain stock that had returns of 13 percent, -21.5 percent, 27.5 percent, and 18.5…

A: Given,Average return of the stock = 11 %Number of years = 5 yearsa.) To find the stock's return for…

Q: Baghiben

A: The objective of the question is to calculate the short-term and long-term capital loss carryovers…

Q: Fink Co. is interested in purchasing a new business vehicle. The vehicle costs $48,000 and will…

A: The objective of the question is to determine whether Fink Co. should purchase the new business…

Q: Quantitative Problem 1: Findley Furniture Company must install $5.9 million of new equipment in one…

A: Answer image:1. Cash Outflows = Financing + Maintenance Costs - Tax Savings2. In 5th Year's cash…

Q: Enabled Exam 4 ch 10 & 12 (Total assets, total liabilities, and total stockholder' equity do not…

A: The question is asking whether the total assets, total liabilities, and total stockholder's equity…

Q: You have the following financial market information. You also have 1.88 million Australian dollar…

A: Here's a detailed explanation for better understanding. Borrow THB: We assume we borrow 3.14 million…

Q: Problem 6-30 Calculating Project NPV Calligraphy Pens is deciding when to replace its old machine.…

A: Old Machine: Salvage Value at Year 5: $125,000Maintenance Costs for 5 years: $680,000 per…

Q: Bhupatbhai

A: Unfortunately, the phrase "25 percent What's the opening?" doesn't provide enough context to…

Q: Interest Rate Parity Assume that interest rate parity holds and that 90-day risk-free securities…

A: 90-day forward rate = Current Spot rate * (1 + United States interest rate) / (1 + Germany interest…

Q: None

A: Approach to solving the question: For better clarity of the solution, I have provided the…

Q: Consider the following table for the total annual returns for a given period of time. Series Average…

A: To find the range of returns for large-company stocks: Requirement 1: To cover 68% of the cases, we…

Q: What is the difference between industrial projects and a film company? The main difference between…

A:

Q: The IRR evaluation method assumes that cash flows from the project are reinvested at the same rate…

A: Approach to Calculating Modified Internal Rate of Return (MIRR)1. Understanding the ConceptIRR…

Q: Money is invested at 11.94% p.a. compounded semi-annually for 43 months. What is the numerical value…

A: Part 2: Explanation:Step 1: Determine the effective interest rate per compounding period.Given that…

Q: Replacement value coverage is less costly than actual cash value. This is reflected in lower…

A: Replacement Cost vs. Actual Cash Value: Understanding the Coverage and CostWhen choosing insurance,…

Q: Under a firm commitment agreement, Zeke, Company, went public and received $30.00 for each of the…

A: Step 1: The calculation of the flotation cost as a percentage of funds raised AB1Per share price $…

Q: account has an interest rate of 4.1%. I also started the account with an initial deposit of $4,000…

A: Given information, Target future value = $500,000Time (t) = 41 yearsAnnual interest rate (r) = 4.1%…

Q: Investment Timing Option: Option Analysis Kim Hotels is interested in developing a new hotel in…

A: First, let's calculate the expected value of the cash flows (C1_expected) at time 1:C1_expected =…

Q: Q2C) Use Incremental benefit cost analysis method to compare between the following three projects.…

A: The objective of the question is to use the Incremental Benefit-Cost Analysis method to compare…

Q: 3) X Corporation wants to calculates its cost of capital for major expansion program which riskier…

A: b) Discount Rate for Expansion Program:The WACC (9.12%) is a good starting point for the discount…

Q: Jeff bought an annuity immediate for $45.24. This annuity immediate is designed such that payments…

A: Annuity refers to a situation where a cash flow sequence occurs, and this could be either in…

Q: Use the Black-Scholes formula for the following stock: Time to expiration Standard deviation…

A: Black-Scholes Option PricingWe'll use the Black-Scholes formula to calculate the value of the call…

Q: Please Write Step by Step Solution Otherwise I give you DISLIKE !!

A: Step-by-Step Solution to Find NPV for Caspian Sea Drinks' Diet Drink:1. Calculate Annual Cash…

Q: You have been asked by the president of your company to evaluate the proposed acquisition of a new…

A: Step 1: Determine the cash flows for year 0 In year 0 the cash flows are the cost of the truck and…

Q: Needs Complete solution don't use chat gpt or ai i definitely upvote you.

A: Let's dissect the issue and go over the computations one by one. 1. Determine the loan's original…

Q: a. The December 31, 2018 accounts receivable amounted to? b. The December 31, 2018 foreign currency…

A: The spot rate shows the cost of exchanging money at present. The strike price is the agreed-upon…

Q: Use the following after-tax cash flows for project A and B to answer the next question: (Numbers in…

A: Step 1: The calculation of the Net present value AB1YearCashflow (A)20 $ -2,900.00 31 $…

Q: Machines A and B are mutually exclusive and are expected to produce the following real cash flows:…

A: Capital Budgeting AnalysisWe will analyze Machines A and B to determine the better investment based…

Q: Suppose the continuously compounding interest rate r is constant. Given S(0), find the price of the…

A: Continuously Compounding Interest Rate (r): This is the interest rate at which an investment grows…

Q: a. What is the relative tax advantage of corporate debt if the corporate tax rate is TC=0.22, the…

A: Step 1: The formula for this is: Relative Tax Advantage = (1 - Tp) / (1 - Tpe) * (1 - Tp) where Tc…

Step by step

Solved in 2 steps

- Cooney Co. is evaluating the following mutually exclusive projects. The manager has determined that the appropriate discount rate is 6.2% for all the recommended projects. Rank order the projects based on the profitability index. Year Project A Project B Project C 0 (35,000) (65,000) (86,000) 1 - 40,000 44,000 2 - 22,000 44,000 3 55,000 22,000 35,000Use these data to compute for each (a) the NPV at discount rates of 10 and 5 percent, (b) the BCR at the same rates, and (c) the internal rate of return for each. Describe the facts about the projects that would dictate which criterion is appropriate, and indicate which project is preferable under each circumstance.Suppose the following two independent investment opportunities are available to Fitz, Inc. The appropriate discount rate is 8 percent. Year Project Alpha Project Beta 0 −$5,500 −$7,100 1 2,800 1,600 2 2,700 5,500 3 1,700 4,500 a. Compute the profitability index for each of the two projects. (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) b. Which project(s), if either, should the company accept based on the profitability index rule? multiple choice Neither project Project Beta Both projects Project Alpha

- Tri Star, Inc., has the following mutually exclusive projects: Year Project A Project B 0 –$ 13100 –$ 8500 1 7300 3200 2 6300 2700 3 2,100 5100 Calculate the payback period for each project. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) If the appropriate discount rate is 9 percent, what is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)(i.)If the projects are mutually exclusive and the required rate of return is 7%, which of the projects is chosen by NPV?a. Project Omicronb. Project Upsilonc. Project Omegad. Project Upsilon and Project Omegae. None of the above (ii.)If you use a cut-off period of two years, which of the projects would you accept using the payback period method?a. Project Omicronb. Project Upsilonc. Project Omegad. Project Upsilon and Project Omegae. None of the aboveWilson is concerned that this project has multiple its year 1, 2 flows -50 100 0 -50 how many discount rates produce a zero NPV for the project? a. two, discount rates of 0% and 62% b.one, discount rate of 0 percent c. two, discount rates of 0% and 32%

- Your division is considering two projects. The discount rate is 10 percent, and the projects’ after- tax cash flows would be:Years 01234 Project A -$30 $5 $10 $15 $20 Project B -$30 $20 $10 $8 $6a. Calculate the projects’ NPVs and IRRs.b. If the two projects are independent, which project(s) should be chosen?c. If the two projects are mutually exclusive, which project should be chosen?d. Calculate the projects’ regular paybacks and discounted paybacks. Which project looksbetter when judged by the paybacks?e. What two pieces of information does the payback convey that are absent from the othercapital budgeting decision methods (NPV and IRR)?The NPV of a project when discounted using a discount rate of 6% is positive $ 40,000. When the same project is discounted using a discount rate of 16% the NPV is negative $ 80,000. What is the IRR using linear interpolation A.5.33% B.11.00% C.9.33% D.0%Estimate the NPV, ROI, and payback period for the XYZ project using the information below, Estimated costs for the XYZ project are $200,000 in year 0 and $50,000 each in years 1, 2, and 3. Estimated benefits are $0 in year 0 and $150,000 each year in years 1, 2 and 3. Calculate the following i) NPV, ii) ROI, iii) and year in which payback occurs for a discount rate of 6.5

- Please show calcualtions: a) Calculate the NPV and IRR for the following project with a discount rate of 10% - ncf yr 0 = -250,000, ncf yr 1 = 200,000, ncf yr 2 = 350,000, ncf yr 3 = 300,000, ncf yr 4 = 300,000, ncf yr 5 = -50,000Monroe, Inc., is evaluating a project. The company uses a 13.8 percent discount rate for this project. Cost and cash flows are shown in the table. What is the NPV of the project? Year Project 0 ($11,368,000) 1 $ 2,127,589 2 $ 3,787,552 3 $ 3,125,650 4 $ 4,115,899 5 $ 4,556,424 Round to two decimal places.Calculating Payback Period and NPV Novell, Inc., has the following mutually exclusive projects. Year Project A Project B 0 -$15,000 -$19,000 1 10,400 12,700 2 5,900 6, 100 3 2,100 5, 300 Suppose the company’s payback period cutoff is two years. Which of these two projects should be chosen? Suppose the company uses the NPV rule to rank these two projects. Which project should be chosen if the appropriate discount rate is 15 percent?