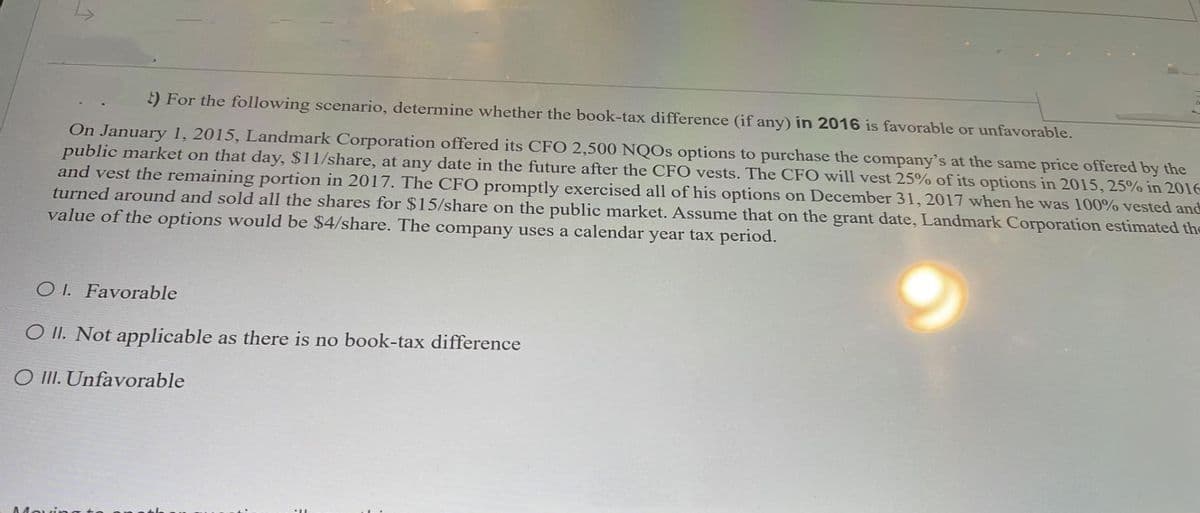

2) For the following scenario, determine whether the book-tax difference (if any) in 2016 is favorable or unfavorable. On January 1, 2015, Landmark Corporation offered its CFO 2,500 NQOS options to purchase the company's at the same price offered by the public market on that day, $11/share, at any date in the future after the CFO vests. The CFO will vest 25% of its options in 2015, 25% in 2016 and vest the remaining portion in 2017. The CFO promptly exercised all of his options on December 31, 2017 when he was 100% vested and turned around and sold all the shares for $15/share on the public market. Assume that on the grant date, Landmark Corporation estimated the value of the options would be $4/share. The company uses a calendar year tax period. OI. Favorable O II. Not applicable as there is no book-tax difference III. Unfavorable

2) For the following scenario, determine whether the book-tax difference (if any) in 2016 is favorable or unfavorable. On January 1, 2015, Landmark Corporation offered its CFO 2,500 NQOS options to purchase the company's at the same price offered by the public market on that day, $11/share, at any date in the future after the CFO vests. The CFO will vest 25% of its options in 2015, 25% in 2016 and vest the remaining portion in 2017. The CFO promptly exercised all of his options on December 31, 2017 when he was 100% vested and turned around and sold all the shares for $15/share on the public market. Assume that on the grant date, Landmark Corporation estimated the value of the options would be $4/share. The company uses a calendar year tax period. OI. Favorable O II. Not applicable as there is no book-tax difference III. Unfavorable

Chapter12: Alternative Minimum Tax

Section: Chapter Questions

Problem 37P

Related questions

Question

V5

Transcribed Image Text:2) For the following scenario, determine whether the book-tax difference (if any) in 2016 is favorable or unfavorable.

On January 1, 2015, Landmark Corporation offered its CFO 2,500 NQOs options to purchase the company's at the same price offered by the

public market on that day, $11/share, at any date in the future after the CFO vests. The CFO will vest 25% of its options in 2015, 25% in 2016

and vest the remaining portion in 2017. The CFO promptly exercised all of his options on December 31, 2017 when he was 100% vested and

turned around and sold all the shares for $15/share on the public market. Assume that on the grant date, Landmark Corporation estimated the

value of the options would be $4/share. The company uses a calendar year tax period.

OI. Favorable

OII. Not applicable as there is no book-tax difference

O III. Unfavorable

Movin

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT