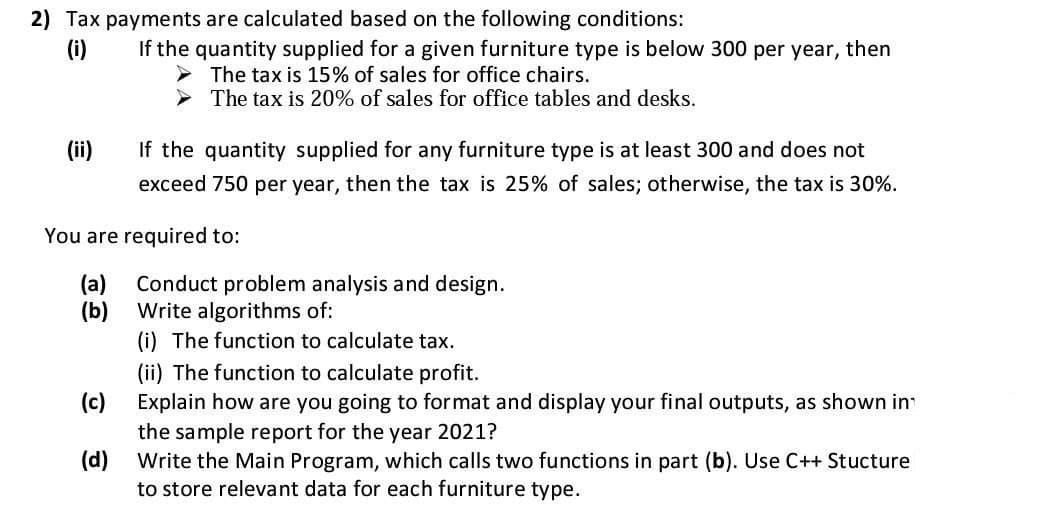

2) Tax payments are calculated based on the following conditions: (i) If the quantity supplied for a given furniture type is below 300 per year, then The tax is 15% of sales for office chairs. The tax is 20% of sales for office tables and desks. (ii) If the quantity supplied for any furniture type is at least 300 and does not exceed 750 per year, then the tax is 25% of sales; otherwise, the tax is 30%. You are required to: (a) Conduct problem analysis and design. (b) Write algorithms of: (i) The function to calculate tax. (ii) The function to calculate profit.

2) Tax payments are calculated based on the following conditions: (i) If the quantity supplied for a given furniture type is below 300 per year, then The tax is 15% of sales for office chairs. The tax is 20% of sales for office tables and desks. (ii) If the quantity supplied for any furniture type is at least 300 and does not exceed 750 per year, then the tax is 25% of sales; otherwise, the tax is 30%. You are required to: (a) Conduct problem analysis and design. (b) Write algorithms of: (i) The function to calculate tax. (ii) The function to calculate profit.

C++ Programming: From Problem Analysis to Program Design

8th Edition

ISBN:9781337102087

Author:D. S. Malik

Publisher:D. S. Malik

Chapter6: User-defined Functions

Section: Chapter Questions

Problem 14PE

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:2) Tax payments are calculated based on the following conditions:

(i)

If the quantity supplied for a given furniture type is below 300 per year, then

The tax is 15% of sales for office chairs.

The tax is 20% of sales for office tables and desks.

(ii)

If the quantity supplied for any furniture type is at least 300 and does not

exceed 750 per year, then the tax is 25% of sales; otherwise, the tax is 30%.

You are required to:

(a)

Conduct problem analysis and design.

(b)

Write algorithms of:

(i) The function to calculate tax.

(ii) The function to calculate profit.

(c)

Explain how are you going to format and display your final outputs, as shown in

the sample report for the year 2021?

(d)

Write the Main Program, which calls two functions in part (b). Use C++ Stucture

to store relevant data for each furniture type.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Recommended textbooks for you

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning

Operations Research : Applications and Algorithms

Computer Science

ISBN:

9780534380588

Author:

Wayne L. Winston

Publisher:

Brooks Cole

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning

Operations Research : Applications and Algorithms

Computer Science

ISBN:

9780534380588

Author:

Wayne L. Winston

Publisher:

Brooks Cole