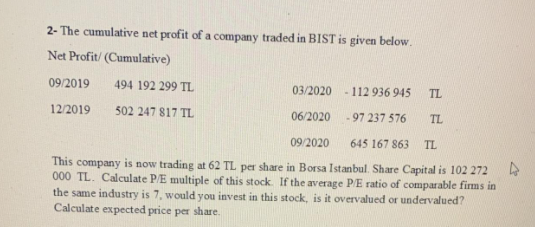

2- The cumulative net profit of a company traded in BIST is given below. Net Profit/ (Cumulative) 09/2019 494 192 299 TL 03/2020 - 112 936 945 TL 12/2019 502 247 817 TIL 06/2020 - 97 237 576 TL 09/2020 645 167 863 TL This company is now trading at 62 TL per share in Borsa Istanbul. Share Capital is 102 272 000 TL. Calculate PE multiple of this stock. If the average PE ratio of comparable firms in the same industry is 7, would you invest in this stock, is it overvalued or undervalued? Calculate expected price per share.

2- The cumulative net profit of a company traded in BIST is given below. Net Profit/ (Cumulative) 09/2019 494 192 299 TL 03/2020 - 112 936 945 TL 12/2019 502 247 817 TIL 06/2020 - 97 237 576 TL 09/2020 645 167 863 TL This company is now trading at 62 TL per share in Borsa Istanbul. Share Capital is 102 272 000 TL. Calculate PE multiple of this stock. If the average PE ratio of comparable firms in the same industry is 7, would you invest in this stock, is it overvalued or undervalued? Calculate expected price per share.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.12P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Do not copy from another source especially when it has a negative rating.

Transcribed Image Text:2- The cumulative net profit of a company traded in BIST is given below.

Net Profit/ (Cumulative)

09/2019

494 192 299 TL

03/2020

- 112 936 945

TL

12/2019

502 247 817 TL

06/2020

- 97 237 576

TL

09/2020

645 167 863

TL

This company is now trading at 62 TL per share in Borsa Istanbul. Share Capital is 102 272

000 TL. Calculate P/E multiple of this stock. If the average PE ratio of comparable firms in

the same industry is 7, would you invest in this stock, is it overvalued or undervalued?

Calculate expected price per share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning