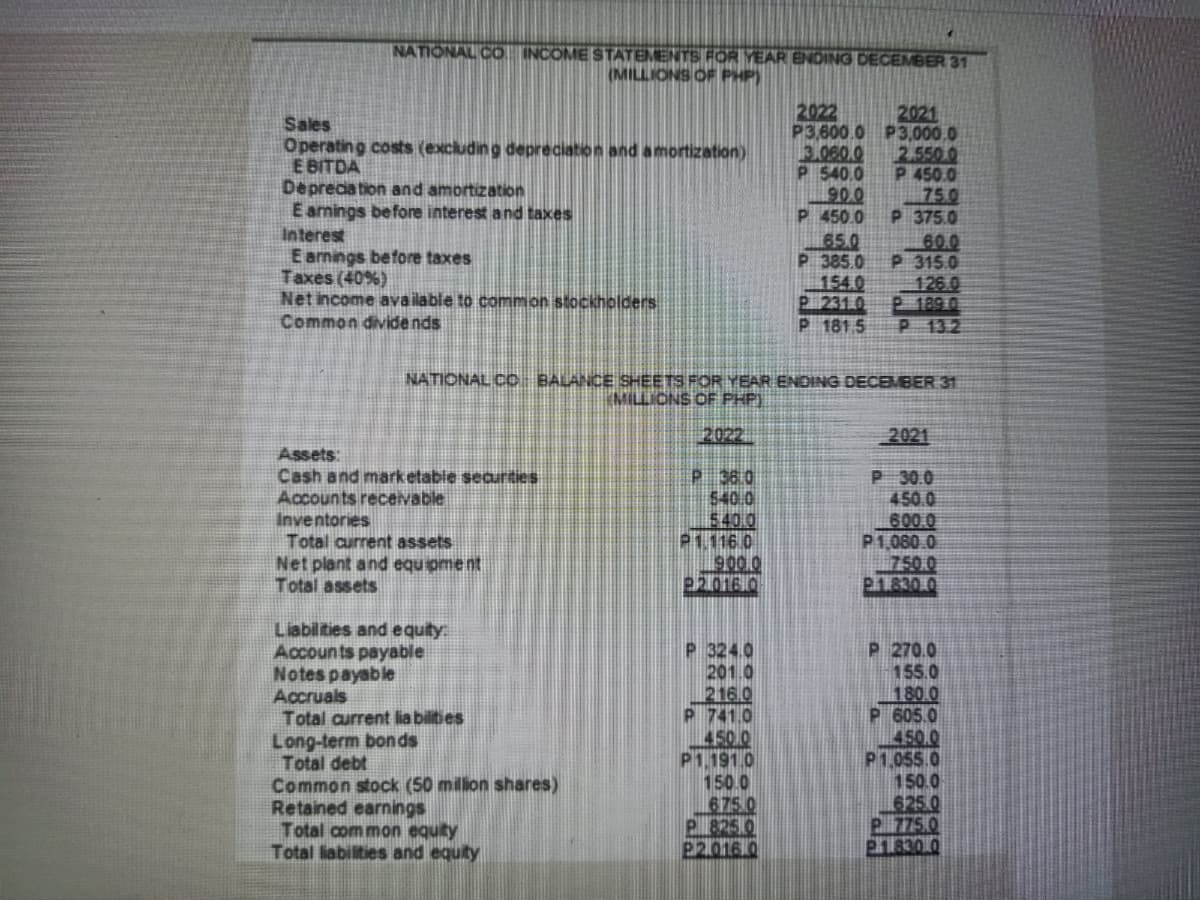

NATIONALCO INCOME STATEMENTS FOR YEAR ENDING DECEMBER 31 (MILLIONS OF PHP) 2022 P3,600.0 P3,000.0 3.060.0 P 540.0 90.0 P 450.0 65.0 P 385.0 154.0 P 231 0 P 1815 2021 Sales Operatin g costs (excluding depreciation and amortization) E BITDA Deprecation and amortization E amings before interest and taxes Interest E armings before taxes Taxes (40%) Net income available to common stockhiolders Common divide nds 2.5500 P 450.0 750 P 375.0 600 P 315.0 126.0 P 189 0 P 132 NATIONAL CO BALANCE SHEETS FOR YEAR ENDING DECEMBER 31 MILLIONS OF PHP) 2022 2021 Assets: Cash and marketable securities Accounts recelvable Inventories P 36.0 540.0 540.0 P1.116.0 900.0 22016 0. P 30.0 450.0 600.0 P1,080.0 750.0 P1.830 0 Total current assets Net plant and equ pme nt Total assets Liabilities and equity Accounts payable Notes payable Accruals Total current lia bilities Long-term bonds Total debt Common stock (50 million shares) Retained earnings Total com mon equity Total labilities and equity P 324.0 201.0 216.0 P 741.0 4500 P1.191.0 150.0 675 0 P 825.0 22.016 0 P 270.0 155.0 180.0 P 605.0 K.50.0 P1,055.0 150.0 625 0 P 775.0 P1830 0

NATIONALCO INCOME STATEMENTS FOR YEAR ENDING DECEMBER 31 (MILLIONS OF PHP) 2022 P3,600.0 P3,000.0 3.060.0 P 540.0 90.0 P 450.0 65.0 P 385.0 154.0 P 231 0 P 1815 2021 Sales Operatin g costs (excluding depreciation and amortization) E BITDA Deprecation and amortization E amings before interest and taxes Interest E armings before taxes Taxes (40%) Net income available to common stockhiolders Common divide nds 2.5500 P 450.0 750 P 375.0 600 P 315.0 126.0 P 189 0 P 132 NATIONAL CO BALANCE SHEETS FOR YEAR ENDING DECEMBER 31 MILLIONS OF PHP) 2022 2021 Assets: Cash and marketable securities Accounts recelvable Inventories P 36.0 540.0 540.0 P1.116.0 900.0 22016 0. P 30.0 450.0 600.0 P1,080.0 750.0 P1.830 0 Total current assets Net plant and equ pme nt Total assets Liabilities and equity Accounts payable Notes payable Accruals Total current lia bilities Long-term bonds Total debt Common stock (50 million shares) Retained earnings Total com mon equity Total labilities and equity P 324.0 201.0 216.0 P 741.0 4500 P1.191.0 150.0 675 0 P 825.0 22.016 0 P 270.0 155.0 180.0 P 605.0 K.50.0 P1,055.0 150.0 625 0 P 775.0 P1830 0

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 19SP

Related questions

Question

1. Net Operating Capital for 2022

2. Amount of Total Investor-Supplied (Net Current Investment and Net Fixed Asset Investment) operating capital for 2022

3. Free Cash Flow for 2022

Net Operating Working Capital for 2022

4. Net Operating Profit After Taxes for 2022

Transcribed Image Text:NATIONAL CO INCOME STATEMENTS FOR YEAR ENDING DECEMBER 31

(MILLIONS OF PHP)

2022

2021

Sales

Operatin g costs (excluding depreciation and amortization)

E BITDA

Deprecation and amortization

E amings before interest and taxes

Interest

E armings before taxes

Taxes (40%)

Net income available to common stockholders

Common divide nds

P3,600.0 P3,000.0

3.060.0

P 540.0

90.0

P 450.0

65.0

P 385.0

154.0

P 231 0

P 1815

2.550 0

P 450.0

750

P 375.0

600

P 315.0

126.0

P 1890

P 132

NATIONAL CO BALANCE SHEETS FOR YEAR ENDING DECEMBER 31

MILLIONS OF PHP)

2022

2021

Assets:

Cash and marketable seaurities

Accounts receivable

Inventories

Total current assets

Net plant and equ pme nt

Total assets

P 36.0

540.0

540 0

P1.116 0

900.0

22016 0

P 300

450.0

600.0

P1,080.0

750.0

P1.830 0

Liabilities and equity:

Accounts payable

Notes payable

Accruals

Total current lia bilities

Long-term bonds

Total debt

Common stock (50 million shares)

Retained earnings

Total com mon equity

Total liabilities and equity

P 324.0

201.0

216.0

P 741.0

4500

P1.191.0

150.0

675 0

P 825 0

22.016 0

270.0

155.0

180.0

605.0

K150.0

P1,055.0

150.0

625 0

P 775.0

21830 0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning