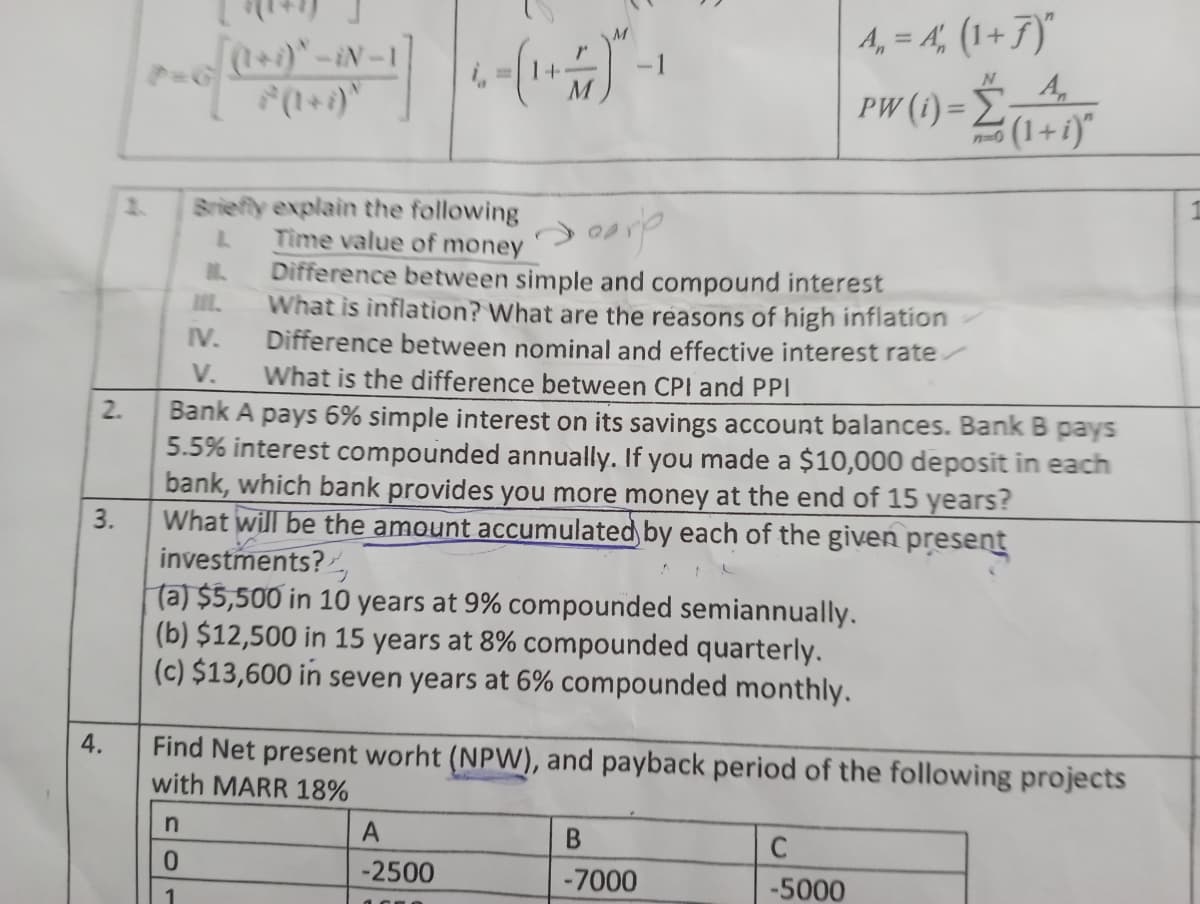

2. 4. Briefly explain the following Time value of money L IL n 0 1 Doarp Difference between simple and compound interest What is inflation? What are the reasons of high inflation Difference between nominal and effective interest rate What is the difference between CPI and PPI IV. V. Bank A pays 6% simple interest on its savings account balances. Bank B pays 5.5% interest compounded annually. If you made a $10,000 deposit in each bank, which bank provides you more money at the end of 15 years? What will be the amount accumulated by each of the given present investments? (a) $5,500 in 10 years at 9% compounded semiannually. (b) $12,500 in 15 years at 8% compounded quarterly. (c) $13,600 in seven years at 6% compounded monthly. Find Net present worht (NPW), and payback period of the following projects with MARR 18% A -2500 B -7000 C -5000

2. 4. Briefly explain the following Time value of money L IL n 0 1 Doarp Difference between simple and compound interest What is inflation? What are the reasons of high inflation Difference between nominal and effective interest rate What is the difference between CPI and PPI IV. V. Bank A pays 6% simple interest on its savings account balances. Bank B pays 5.5% interest compounded annually. If you made a $10,000 deposit in each bank, which bank provides you more money at the end of 15 years? What will be the amount accumulated by each of the given present investments? (a) $5,500 in 10 years at 9% compounded semiannually. (b) $12,500 in 15 years at 8% compounded quarterly. (c) $13,600 in seven years at 6% compounded monthly. Find Net present worht (NPW), and payback period of the following projects with MARR 18% A -2500 B -7000 C -5000

Chapter4: Time Value Of Money

Section4.12: Uneven, Or Irregular, Cash Flows

Problem 3ST

Related questions

Question

Plz provide answer for question 2

Transcribed Image Text:2.

3.

4.

[(1+i)* -iN-1

n

0

1

Briefly explain the following

L

Time value of money

1₂

LL

carp

Difference between simple and compound interest

What is inflation? What are the reasons of high inflation

Difference between nominal and effective interest rate

What is the difference between CPI and PPI

IV.

V.

Bank A pays 6% simple interest on its savings account balances. Bank B pays

5.5% interest compounded annually. If you made a $10,000 deposit in each

bank, which bank provides you more money at the end of 15 years?

What will be the amount accumulated by each of the given present

investments?

(a) $5,500 in 10 years at 9% compounded semiannually.

(b) $12,500 in 15 years at 8% compounded quarterly.

(c) $13,600 in seven years at 6% compounded monthly.

Find Net present worht (NPW), and payback period of the following projects

with MARR 18%

A

-2500

A₁ = A₁, (1 + 7)"

pw (1) = (1+1)

PW

B

-7000

C

-5000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you