George buys a car on April 3 for $25,000. George estimates it has a life expectancy of 10 years with a residual value of $5,000. Using straight line depreciation, what will be the depreciation after the First year? O $5,000 O$2,000 O $2,500 O $1,500 QUESTION 3 A pair of twins were given $20,000 on their birthday in 2020. One twin purchased a car for $20,000 with a expected life of 7 years and residual value of $3,000. The other twin bought one Bitcoin. Assume straight line depreciation. If Bitcoin is now worth $60,000, how much is the difference between the book value of twin 1's car and the twin 2's bitcoin? Hint: $60,000-book value. Assume this is the end of year two for the car. O $57,571 O$44,857 O $24,857 O $17,571 QUESTION 4 Using the MACRS three-year table, how much will a $1,000 cell phone be worth after 2 years (the book value not the depreciation for year 2)?

George buys a car on April 3 for $25,000. George estimates it has a life expectancy of 10 years with a residual value of $5,000. Using straight line depreciation, what will be the depreciation after the First year? O $5,000 O$2,000 O $2,500 O $1,500 QUESTION 3 A pair of twins were given $20,000 on their birthday in 2020. One twin purchased a car for $20,000 with a expected life of 7 years and residual value of $3,000. The other twin bought one Bitcoin. Assume straight line depreciation. If Bitcoin is now worth $60,000, how much is the difference between the book value of twin 1's car and the twin 2's bitcoin? Hint: $60,000-book value. Assume this is the end of year two for the car. O $57,571 O$44,857 O $24,857 O $17,571 QUESTION 4 Using the MACRS three-year table, how much will a $1,000 cell phone be worth after 2 years (the book value not the depreciation for year 2)?

Chapter14: Property Transactions: Determination Of Gain Or Loss And Basis Considerations

Section: Chapter Questions

Problem 29P

Related questions

Question

100%

Transcribed Image Text:Question Completion Status:

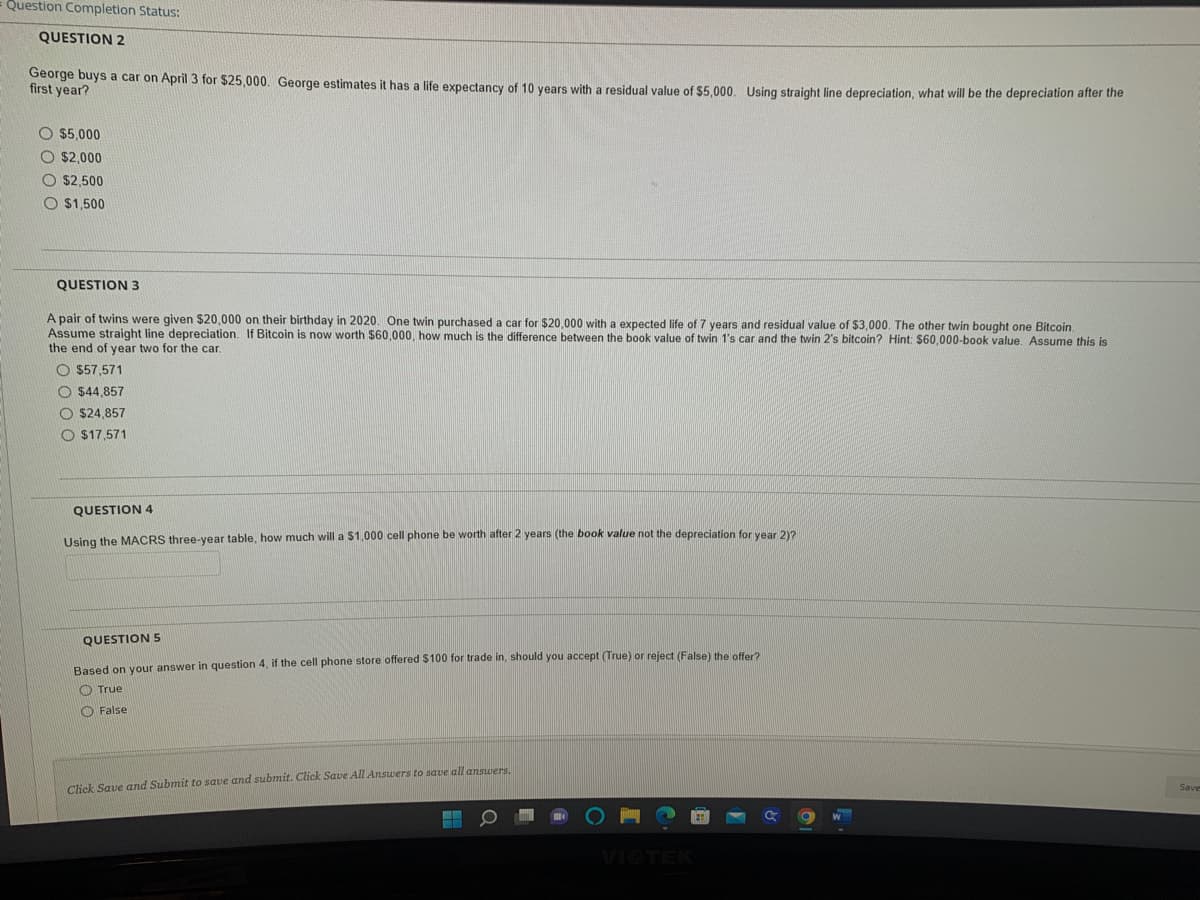

QUESTION 2

George buys a car on April 3 for $25,000. George estimates it has a life expectancy of 10 years with a residual value of $5,000. Using straight line depreciation, what will be the depreciation after the

first year?

O $5,000

O $2,000

O $2,500

$1,500

QUESTION 3

A pair of twins were given $20,000 on their birthday in 2020. One twin purchased a car for $20,000 with a expected life of 7 years and residual value of $3,000. The other twin bought one Bitcoin.

Assume straight line depreciation. If Bitcoin is now worth $60,000, how much is the difference between the book value of twin 1's car and the twin 2's bitcoin? Hint: $60,000-book value. Assume this is

the end of year two for the car.

O $57,571

O $44,857

$24,857

$17,571

QUESTION 4

Using the MACRS three-year table, how much will a $1,000 cell phone be worth after 2 years (the book value not the depreciation for year 2)?

QUESTION 5

Based on your answer in question 4, if the cell phone store offered $100 for trade in, should you accept (True) or reject (False) the offer?

True

False

Click Save and Submit to save and submit. Click Save All Answers to save all answers.

O

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT