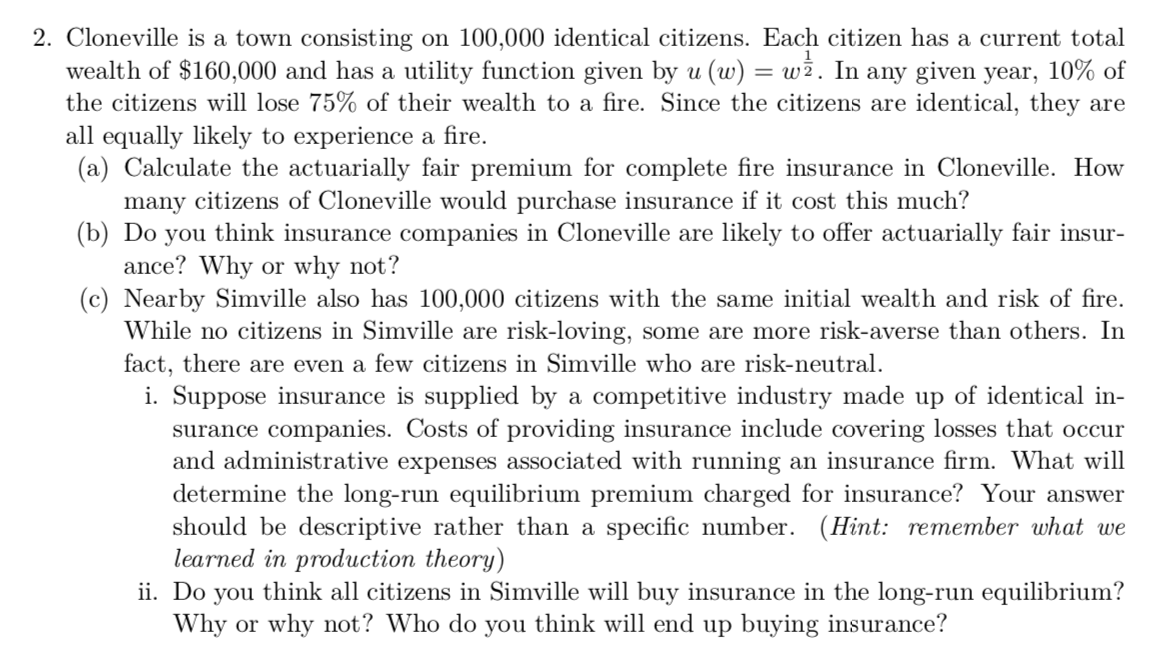

2. Cloneville is a town consisting on 100,000 identical citizens. Each citizen has a current total wealth of $160,000 and has a utility function given by u (w) = w². In any given year, 10% of the citizens will lose 75% of their wealth to a fire. Since the citizens are identical, they are all equally likely to experience a fire. (a) Calculate the actuarially fair premium for complete fire insurance in Cloneville. How many citizens of Cloneville would purchase insurance if it cost this much? (b) Do you think insurance companies in Cloneville are likely to offer actuarially fair insur- ance? Why or why not? (c) Nearby Simville also has 100,000 citizens with the same initial wealth and risk of fire. While no citizens in Simville are risk-loving, some are more risk-averse than others. In fact, there are even a few citizens in Simville who are risk-neutral. i. Suppose insurance is supplied by a competitive industry made up of identical in- surance companies. Costs of providing insurance include covering losses that occur ith

2. Cloneville is a town consisting on 100,000 identical citizens. Each citizen has a current total wealth of $160,000 and has a utility function given by u (w) = w². In any given year, 10% of the citizens will lose 75% of their wealth to a fire. Since the citizens are identical, they are all equally likely to experience a fire. (a) Calculate the actuarially fair premium for complete fire insurance in Cloneville. How many citizens of Cloneville would purchase insurance if it cost this much? (b) Do you think insurance companies in Cloneville are likely to offer actuarially fair insur- ance? Why or why not? (c) Nearby Simville also has 100,000 citizens with the same initial wealth and risk of fire. While no citizens in Simville are risk-loving, some are more risk-averse than others. In fact, there are even a few citizens in Simville who are risk-neutral. i. Suppose insurance is supplied by a competitive industry made up of identical in- surance companies. Costs of providing insurance include covering losses that occur ith

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.4P

Related questions

Question

Transcribed Image Text:2. Cloneville is a town consisting on 100,000 identical citizens. Each citizen has a current total

wealth of $160,000 and has a utility function given by u (w) = wż. In any given year, 10% of

the citizens will lose 75% of their wealth to a fire. Since the citizens are identical, they are

all equally likely to experience a fire.

(a) Calculate the actuarially fair premium for complete fire insurance in Cloneville. How

many citizens of Cloneville would purchase insurance if it cost this much?

(b) Do you think insurance companies in Cloneville are likely to offer actuarially fair insur-

ance? Why or why not?

(c) Nearby Simville also has 100,000 citizens with the same initial wealth and risk of fire.

While no citizens in Simville are risk-loving, some are more risk-averse than others. In

fact, there are even a few citizens in Simville who are risk-neutral.

i. Suppose insurance is supplied by a competitive industry made up of identical in-

surance companies. Costs of providing insurance include covering losses that occur

and administrative expenses associated with

determine the long-run equilibrium premium charged for insurance? Your answer

should be descriptive rather than a specific number. (Hint: remember what we

learned in production theory)

ii. Do you think all citizens in Simville will buy insurance in the long-run equilibrium?

Why or why not? Who do you think will end up buying insurance?

ing an insurance firm. What will

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning