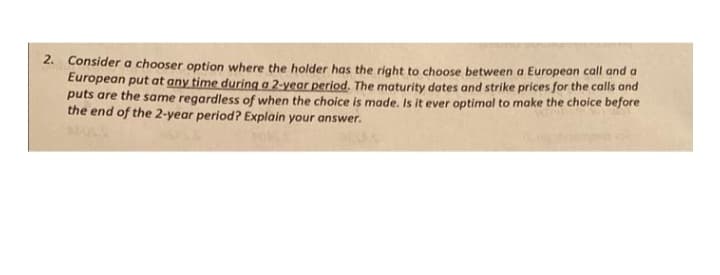

2. Consider a chooser option where the holder has the right to choose between a European call and a European put at any time during a 2-year period. The maturity dates and strike prices for the calls and puts are the same regardless of when the choice is made. Is it ever optimal to make the choice before the end of the 2-year period? Explain your answer.

Q: 1. if a small bank lends to a customer who wants a mortgage that is too large for the small bank to ...

A: A loan is a financial transaction in which one or more individuals, organisations, or other entities...

Q: Big Rock has several investment portfolios with a local mutual fund company. One of the company's di...

A: The formula for the calculation of Sharpe ratio is as follows: Sharpe ratio=Expected return on portf...

Q: Secondary Market can be best described in which of the following statement? a. It is a market for an...

A: Stock market there are buying and selling of securities are done depending on demand and supply of s...

Q: R-Kraine Inc. is considering acquiring an existing project (with financial backing from the governme...

A: Given: Particulars Amount Current market price $584,608.56760 Face value $800,000.00000 Cou...

Q: Round each z-score to the nearest hundredth. A data set has a mean of x = 6.2 and a standard dev...

A: A difference in given value from standard deviation is known as a Z- score. It denotes how far or cl...

Q: Find how much you should invest now at 6% interest, compounded quarterly in order to have $15,750 in...

A: Present Value: It represents the present worth of the future sum of the amount which is discounted ...

Q: Fatimah pays monthly rent of $520 for her townhouse. If she bought the property, the mortgage loan, ...

A: When a series of deposits or payments are made of equal amounts at equal intervals of time, it is ca...

Q: Which of the following is not a cash disbursement item? a. Cash purchases b. Cash dividend payment c...

A: Cash disbursement is also called cash payment made in specific period.

Q: Improvised explosive devices (IEDs) are responsible for many deaths in times of strife and war. Unma...

A: Equivalent cost refers to the annuity value for the discounted worth of all costs which are associat...

Q: Compute the present value of each scenario. Show the complete solution. 1. Your mother is expecting ...

A: The present value is calculated as per the concept of time value of money. Here, the future value is...

Q: The ingredients for your braised greens cost $1.32. You sell it for $4. What is your contribution ma...

A: Contribution Margin is difference of Sales & Variable costs. Contribution Margin = (Sales - V...

Q: the consultant's report, the cash flows that can be generated from the upgrade are as follows and 2)...

A: NPV Net present value (NPV) is the present value of all cash flows resulted in different time period...

Q: Technical analysts believe that investors can use past price changes to predict future price changes...

A: Like Fundamental analysis, Technical analysis is alsoan analysis tool used by various day traders an...

Q: Management of the Toys R4U Company needs to decide whether to introduce a certain new novelty toy fo...

A: Note: This post has several subparts. The first three have been solved below.

Q: What are 'accelerated filers,' and how are they chosen (i.e., based on income, number of employees, ...

A: An issuer qualifies as an accelerated filer if its total global public float is greater than or equa...

Q: Central Staircase is offering preferred stock which is commonly referred to as 10-10 stock. This sto...

A: The stock price is calculated as discounted value of cash flows

Q: n item is 10000, payable in 10 days but if paid in 30 days there will be a P30 discount. Find the ra...

A: Simple interest = Principal * rate* time (n).

Q: 4. Calculating AAR You're trying to determine whether or not to expand vour business by building a n...

A: The accounting rate of return is the rate of return which is expected from the investment made by th...

Q: Assume that you start with a balance of $3900 on your credit card. During the first month you charge...

A: Given, Starting balance is $3900. First month charge is $400. Second month charge is $650 Rate of in...

Q: to determine the regular payment amount, rounded to the nearest dollar. Consider the following pair ...

A: Here, Mortgage Amount (P) is $130,000 Compounding Period (n) is Monthly i.e 12 Details of Mortgage A...

Q: The interest rate for the first five years of a $95,000 mortgage is 7.2% compounded semiannually. Mo...

A: Given, The mortgage loan is $95000 Rate is 7.2% Term of amortization is 25 years Prepayment is $300...

Q: An initial investment amount P, an annual interest rate r, and a time t are given. Find the future v...

A: As per Bartleby Honor Code, when a question with multiple sub-parts has been asked, the expert is re...

Q: now costs $25.25, and the price has increase exponentially, write an equation that will - Barnaby's ...

A: Future value: Because of the basic principle of the time value of money, one dollar now is worth mo...

Q: Previous balance, Finance charge- Purchase- New balance 2 month Previous balance, Finance charge- Pu...

A: A credit card is issued by banks or financial institutions that allows cardholders to make payments ...

Q: On January 1, 2021, STUDY HARDER Company purchased 9% bonds with face amount of P6,0 The bonds matur...

A: Price of bond is the present value of coupon payment and the present value of the par value of the b...

Q: Denise has just set up an investment plan that would fulfill her life-long dream of buying a brand "...

A: Effective annual rate of return Effective annual rate of return is the true rate on an investment w...

Q: The rabbit population at the city park increases by 9% per year. If there are intially 276 rabbits i...

A: Initial rabbit population is 276 rabbits Growth rate in population is 9% per year To Find: Model fo...

Q: How can banks safeguard their information security?

A: Protecting information and information systems from illegal access, usage, disclosure, interruption,...

Q: Big Rock is listed on the local stock exchange and its stock has had mixed performance over the last...

A: Initial value is $1000 Value at end of year 1 is $1268 Value at end of year 2 is $1334 Value at end ...

Q: A corporation issues 100 sinking fund bonds of P1,000 face value, redeemable at par in 15 years, wit...

A: Given: Number of bonds = 100 Face Value = P1000 number of periods "n" = 15*2 = 30 Semiannual coupon ...

Q: An endowment fund is providing an annual scholarship of P50,000 for the first five years, P60,000 fo...

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at t...

Q: Data Provided Date Closing Market Index Value Closing Price for PG Closing Price for F 1/2/2017 227...

A: Monthy return is the method of finding out the returns of assets in a current scenario as it helps f...

Q: Q1. Risk and Return Big Rock is listed on the local stock exchange and its stock has had mixed perfo...

A: Arithmetic mean and geometric mean is used in finance to find out the performance of an investment. ...

Q: How much could BTU Oil & Gas Fracking afford to spend on new equipment every start of the year for ...

A: Equipment and machinery are the most important tools and implements in the operation of a business (...

Q: A stock is currently selling for S0 = $200: Over each of the next 6 months it is expected to grow by...

A: Here; One period is 6 months Time period is 1 year Expected upside movement is 10% Expected downsid...

Q: You have 24 quarts of brown stock. You need .75 cups to make one serving of kidney beans. How many s...

A: The tracking and evaluation of a firm's cost structure are known as cost accounting. Cost accounting...

Q: Calculate the simple interest earned. Round to the nearest cent. P = $3900, r = 5.3%, t = 6 months

A: P = $3900 r = 5.3% t = 6 monnths

Q: what are the key characteristics of active fund management and passive fund management, focusing on ...

A: The key characteristics of active fund management is the frequent buying and selling in an attempt t...

Q: Bond valuation and yield to maturity Personal Finance Problem Mark Goldsmith's broker has shown him ...

A: Bond value: A bond's value is calculated by discounting the bond's predicted cash flows to the prese...

Q: The higher the interest rate, the higher my future value will be. O True False

A: The given statement is correct. The future value is a concept of time value of money which states th...

Q: or the hat would have been made to sete the bils For maks your answer) shoud be rounded to the neore...

A: Companies gives credit to customers to increase the sales and also give discounts to customers to pa...

Q: Your father is 50 years old and will retire in 10 years. He expects to live for 25 years after he re...

A: Given Amount needed $45000. Amount available as savings $220,000 Inflation rate is 3% interest rate ...

Q: ) McGloire Construction is analyzing its capital expenditure proposals for the purchase of equipment...

A: Here, To Find: Payback Period =? NPV =?

Q: Suppose Anastasia has a consol bond (a perpetuity bond) that pays an annual coupon of $200 per year ...

A: Here, Annual Coupon = $200 YTM = 10% Increase in YTM = 12% To Find: Capital gain =?

Q: 5. A certain manufacturing plant is being sold and was submitted for bidding. Two bids were submitte...

A: The Present Value of a cash stream: A series of cash equal or unequal cash flows that occur regularl...

Q: Question 2: (a) You wish to buy a house. The market value of the house is $650,000 and you have save...

A: The present value of the loan is equal to the sum of the present values of all future monthly instal...

Q: If a broker quotes a price of 111.25 for a bond on September 10, what amount will a client pay per $...

A: Solution : Given, Face value = $1,000 Coupon rate = 7% Accrued interest = Face value * coupon ra...

Q: Charmaine has just purchased an apartment at a price of $10 million. She made a down- payment of $4 ...

A: Loan amount (L) = $6 million n = 15 years = 180 months r = 3% per annum = 0.25% per month Let M = Mo...

Q: Magnum plans to retire in 28 years with an amount of $2,500,000. His financial advisor has found a b...

A: Period (t) = 28 Years Interest rate (r) = 5% Future value (FV) = $2,500,000

Q: Determine the exact simple interest on P 5,000.00 for the period from June 10 2015 to November 21, 2...

A: Simple Interest is calculated using the following formula: = Principal * Rate * Time

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Assume that the price of a forward contract is 127.87. The European options on the forward contract has an exercise price $150, expiring in 60 days. 3.75% is the continuously compounded risk-free rate, and volatility is 0.33.A. Using the Black model, calculate the price of a call option on a forward contract.B. Calculate the underlying asset's price. Using the Black-Scholes-Merton model, determine the price of a call option on the underlying asset. Should this pricing be any different from the one calculated in letter A? Explain your answer.C. Using the Black model, calculate the price of a put option on a forward contract.D. Using the Black-Scholes-Merton model, compute the price of a put option on the underlying asset. Should this pricing be any different from the one calculated in letter C? Explain your answer.You are considering a European put option and a European call option on ABC Ltd and have available the following information. The put option with an exercise price of $15 and time to maturity of 60 days is priced at $2.00. The call option with the same exercise price and time to maturity is priced at $3.00. The underlying asset price is $15. The risk-free rate is 2% per 60 days. Could an arbitrage profit be earned? If so, how much the arbitrage profit is? Show your works (Hint: use discrete put-call parity equation and consider two scenarios for stock price at maturity of the options: $10 or $20).Assume that the price of a forward contract is 127.87. The European options on the forward contract has an exercise price $150, expiring in 60 days. 3.75% is the continuously compounded risk-free rate, and volatility is 0.33. Using the Black model, calculate the price of a call option on a forward contract.

- Assume that the price of a forward contract is 127.87. The European options on the forward contract has an exercise price $150, expiring in 60 days. 3.75% is the continuously compounded risk-free rate, and volatility is 0.33. Using the Black model, calculate the price of a put option on a forward contract.A put option with an exercise price of $56 will expire in 180 days. The underlying asset price of today is $160 . The underlying asset price at expiration is $126. The risk-free rate is 2%, What is the lower bounds for an European put?which one is correct please confirm? Q9: An option that gives the owner the right to buy a financial instrument at the exercise price within a specified period of time is a call option put option American option European option

- Assume that the price of a forward contract is 127.87. The European options on the forward contract has an exercise price $150, expiring in 60 days. 3.75% is the continuously compounded risk-free rate, and volatility is 0.33. Calculate the underlying asset's price. Using the Black-Scholes-Merton model, determine the price of a call option on the underlying asset.Assume that the price of a forward contract is 127.87. The European options on the forward contract has an exercise price $150, expiring in 60 days. 3.75% is the continuously compounded risk-free rate, and volatility is 0.33. Using the Black-Scholes-Merton model, compute the price of a put option on the underlying asset.Choose all expressions that accurately complete the statement below: Writing a European call option on £10,000 at a strike price of $1.80/£ and a premium of $0.02/£: Group of answer choices Obligates the optionholder to purchase £10,000 for $18,000 USD. Will be profitable for the seller when the price of the GBP exceeds the put-call parity rate. Obligates the writer to sell £10,000 on the expiration date if the optionholder chooses to exercise. Allows the optionholder to exercise the option at any point up to the expiration date. Earns the seller a premium of $200.

- Assume the spot Swiss franc is $0.7015 and the six-month forward rate is $0.6980. What is the Value of a six-month call and a put option with a strike price of $0.6815 should sell for in a rational market? Assume the annualized six-month Eurodollar rate is 3.50 percent. Assume the annualized volatility of the Swiss franc is 14.20 percent. Use the European option-pricing models to value the call and put option. This problem can be solved using the FXOPM.xls spreadsheet. (Do not round intermediate calculations. Round your answers to 2 decimal places.)A European put option contract with an exercise price of $1.65 per pound and a contract size of £32,000 is currently trading at a premium of $0.18 per pound. Required: a-1. If you buy this contract, what spot exchange rate at maturity will maximize your profit? a-2. If you buy this contract, what is the amount of the maximum possible profit from one contract? b. If you buy this contract, what is your maximum possible loss from one contract? c. If you sell this contract, what is your maximum possible profit on this contract? d-1. If you sell this contract, what is your maximum possible loss from one contract? d-2. At what future spot exchange rate will you maximize your loss? e. At what future spot exchange rate, will either the buyer or seller of this contract break even?Assume that K=61, St =65, t = 0.25 (i.e. time to expiry is 3 months), and the risk-free rate is 0.04. The current price of the put option is p = 4. What would the price of the call option ‘c’ need to be for put-call parity to hold?