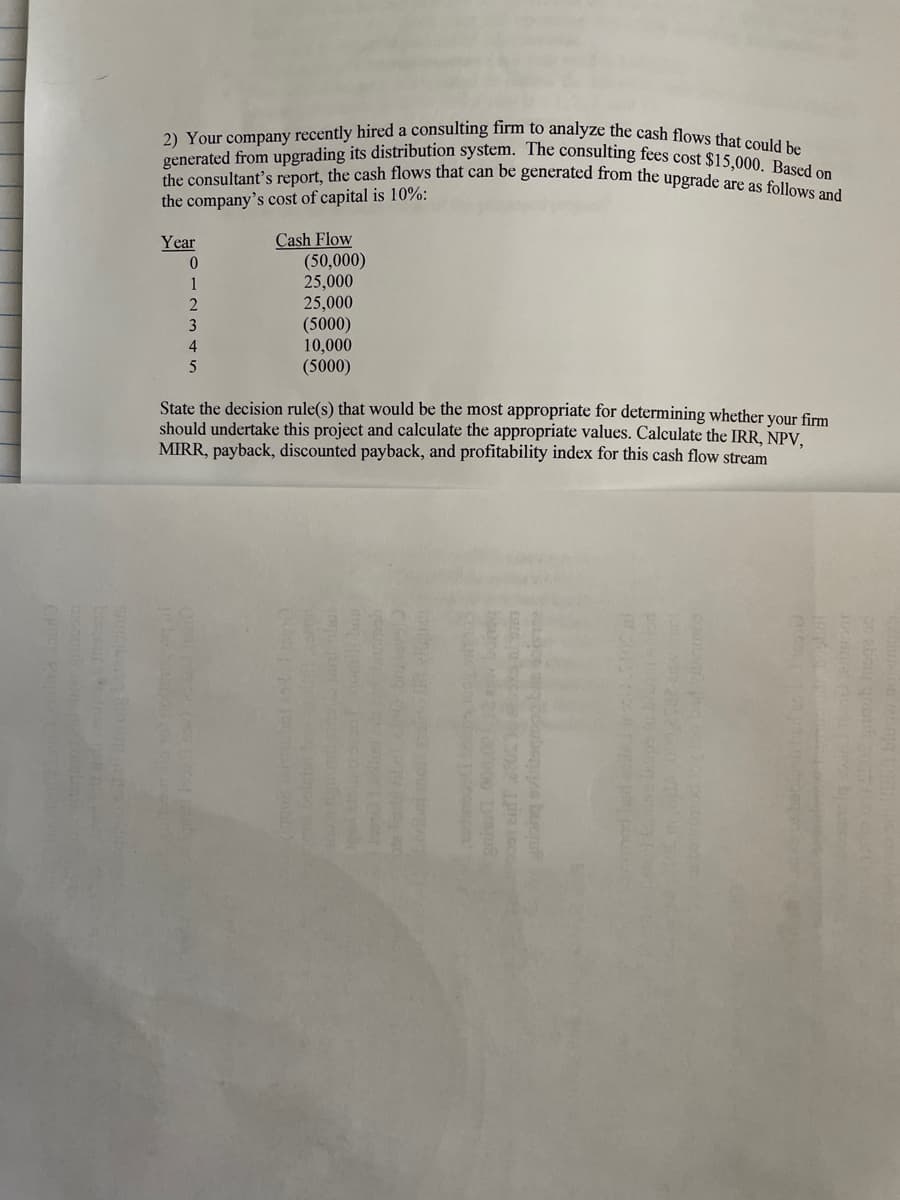

the consultant's report, the cash flows that can be generated from the upgrade are as follows and 2) Your company recently hired a consulting firm to analyze the cash flows that could be generated from upgrading its distribution system. The consulting fees cost $15,000. Based on the company's cost of capital is 10%: Cash Flow (50,000) 25,000 25,000 (5000) 10,000 (5000) Year 1 3 4 State the decision rule(s) that would be the most appropriate for determining whether your firm should undertake this project and calculate the appropriate values. Calculate the IRR, NPV. MIRR, payback, discounted payback, and profitability index for this cash flow stream

the consultant's report, the cash flows that can be generated from the upgrade are as follows and 2) Your company recently hired a consulting firm to analyze the cash flows that could be generated from upgrading its distribution system. The consulting fees cost $15,000. Based on the company's cost of capital is 10%: Cash Flow (50,000) 25,000 25,000 (5000) 10,000 (5000) Year 1 3 4 State the decision rule(s) that would be the most appropriate for determining whether your firm should undertake this project and calculate the appropriate values. Calculate the IRR, NPV. MIRR, payback, discounted payback, and profitability index for this cash flow stream

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 1PA: Your company is planning to purchase a new log splitter for is lawn and garden business. The new...

Related questions

Question

Transcribed Image Text:2) Your company recently hired a consulting firm to analyze the cash flows that could be

the consultantť's report, the cash flows that can be generated from the upgrade are as follows and

generated from upgrading its distribution system. The consulting fees cost $15,000. Based on

the company's cost of capital is 10%:

Cash Flow

(50,000)

25,000

25,000

(5000)

10,000

(5000)

Year

1

3

4

State the decision rule(s) that would be the most appropriate for determining whether your firm

should undertake this project and calculate the appropriate values. Calculate the IRR, NPV.

MIRR, payback, discounted payback, and profitability index for this cash flow stream

hg evitsc

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 10 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub