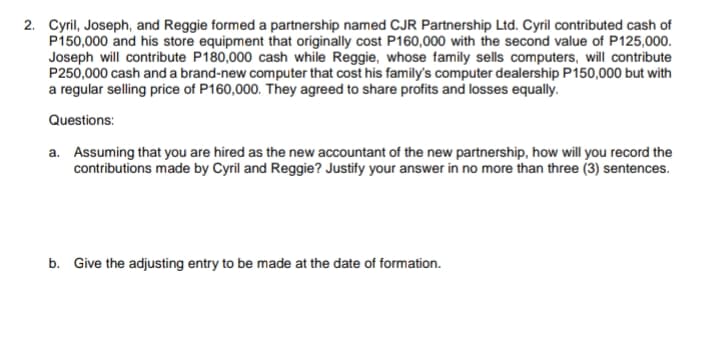

2. Cyril, Joseph, and Reggie formed a partnership named CJR Partnership Ltd. Cyril contributed cash of P150,000 and his store equipment that originally cost P160,000 with the second value of P125,000. Joseph will contribute P180,000 cash while Reggie, whose family sells computers, will contribute P250,000 cash and a brand-new computer that cost his family's computer dealership P150,000 but with a regular selling price of P160,000. They agreed to share profits and losses equally. Questions: a. Assuming that you are hired as the new accountant of the new partnership, how will you record the contributions made by Cyril and Reggie? Justify your answer in no more than three (3) sentences. b. Give the adjusting entry to be made at the date of formation.

2. Cyril, Joseph, and Reggie formed a partnership named CJR Partnership Ltd. Cyril contributed cash of P150,000 and his store equipment that originally cost P160,000 with the second value of P125,000. Joseph will contribute P180,000 cash while Reggie, whose family sells computers, will contribute P250,000 cash and a brand-new computer that cost his family's computer dealership P150,000 but with a regular selling price of P160,000. They agreed to share profits and losses equally. Questions: a. Assuming that you are hired as the new accountant of the new partnership, how will you record the contributions made by Cyril and Reggie? Justify your answer in no more than three (3) sentences. b. Give the adjusting entry to be made at the date of formation.

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 90DC

Related questions

Question

Questions are indicated

Transcribed Image Text:2. Cyril, Joseph, and Reggie formed a partnership named CJR Partnership Ltd. Cyril contributed cash of

P150,000 and his store equipment that originally cost P160,000 with the second value of P125,000.

Joseph will contribute P180,000 cash while Reggie, whose family sells computers, will contribute

P250,000 cash and a brand-new computer that cost his family's computer dealership P150,000 but with

a regular selling price of P160,000. They agreed to share profits and losses equally.

Questions:

a. Assuming that you are hired as the new accountant of the new partnership, how will you record the

contributions made by Cyril and Reggie? Justify your answer in no more than three (3) sentences.

b. Give the adjusting entry to be made at the date of formation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT