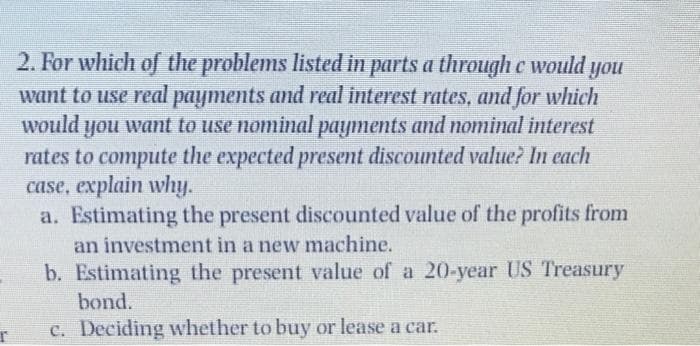

2. For which of the problems listed in parts a through c would you want to use real payments and real interest rates, and for which would you want to use nominal payments and nominal interest rates to compute the expected present discounted value? In each case, explain why. a. Estimating the present discounted value of the profits from an investment in a new machine. b. Estimating the present value of a 20-year US Treasury bond. c. Deciding whether to buy or lease a car.

Q: You observe the following quotes for the USD/AUD in the spot market from two banks: Bank of Sydney…

A: Locational arbitrage is a trading strategy in which a person earns a profit by buying and selling…

Q: A bank has two investment options to chose from for short term investment: Option A: A money market…

A: Option A:- Face Value = $2,000 Current price = $1,850 Time Period = 120 Days Option B:- Face Value…

Q: Which of the following provides the best estimate of the risk-free interest rate for the CAPM…

A: CAPM is a tool or model which is used to find the possible return form the stock by considering risk…

Q: b) At what yield (or rate) will the loan be trading at par? Explain whether it is trading above or…

A: The bond price is the sum of the present discounted value of the future cash stream generated by a…

Q: The following questions are about TIPS. a. What is meant by the “real rate”? b. What is meant by the…

A: Note: Since you have posted a question with multiple subparts, we will solve the first three…

Q: 9. The treasurer of XYZ Corp. knows that the company will need to lend $100 million in one year for…

A: The spot market is also referred to as the cash market in the financial markets. In this market…

Q: 1. Briefly explain the following: a. You want to sell your bond that has a par value of ₱100,000…

A: Bond valuation helps in determining the fair bond of the bond. of bond's fair bond. As with the…

Q: An investor is faced with the problem of choosing among 2 investment opportunities that have the…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: n order to make CDs look more attractive as an investment than they really are, some banks advertise…

A: Deposits = $10,000 Simple Interest = 10% Time period = 3 years

Q: If an ARM is priced with an initial interest rate of 8 percent and a margin of 2 percent (when the…

A: Introduction: The term ARM is used to refer the adjustable rate mortgages. As the name indicates…

Q: Given a choice between 5-year and 1-year instruments most people would choose 5-year instruments…

A: liquidity prefereance theory: investor should demand high interest rate for long term maturites…

Q: An analyst is evaluating securities in a developing nation where the inflation rate is very high. As…

A: Given information: Real risk-free rate is 5% Inflation is expected to be 18% for next 4 years

Q: How is the market interest rate in the short-term and long-term financial market affected under the…

A: Introduction : In simple words, the pure expectation theory refers to the market finance theory…

Q: Problem 1: What are the effective annualized rates for each of the following annual stated rates and…

A: Introduction: The rate that is actually earned on an investment is called the effective annual rate.…

Q: You have surplus funds to lend for a 3-year period. Current coupon rates are as follows: 10.0% for…

A: An investor should modify his investment decision according to change in market factor. Interest…

Q: If the return on U.S. Treasury bills is 7.02%, the risk premium is 2.32%, and the inflation rate is…

A: U.S. Treasury bills return is 7.02%. This is nominal rate of return on U.S. Treasury bills. Hence,…

Q: If the loan interest rate is 4 % mark-up on the 6 month treasury bill and the deposit interest rate…

A: Risks and returns are two sides of same coin and thus cannot be separated from each other. Risks can…

Q: Suppose the U.S. Treasury issues a large quantity of long-term 10-year Treasury bonds, under the…

A: The US treasury bonds are the long-term debt securities that are issued by the US government for the…

Q: This is part a) question and it's answer in order to answer part b) question Question: You hold a…

A: Coupon received in perpetuity=CCurrent interest rate= iSo, price of bond=Coupon Interest ratein next…

Q: This question will compare two different arbitrage situations. Recall that arbitrage should equalize…

A: Arbitrage- It occurs when an investor can make a riskless profit from simultaneously buying and…

Q: Consider the following balance sheet positions for a financial institution: • Rate-sensitive assets…

A: The repricing gap is a measure of the difference between the dollar value of assets and the dollar…

Q: Suppose that -7% (n=1), and that future short term (1 year) interest rates are expected to be 5% and…

A: The liquidity premium theory of interest rates: The liquidity premium theory of interest rates…

Q: Suppose two firms want to borrow money from a bank for a period of 10 years. Firm A has excellent…

A: The appropriate loan rate is the loan rate at which the organization has borrowed the funds from the…

Q: The financial manager of Town Ltd is concerned about the volatility of interest rates. His company…

A: Hedging techniques are very common to prevent risk of increase in interest rate. So hedging can be…

Q: What is meant by the real risk-free rate of interest? Seleccione una: a. The nominal risk-free…

A: Nominal Rate of return is the actual return provided by a security. When the nominal rate of return…

Q: As a newly hired analyst, you are presented the following yields: 1-year 4.6%; 2-year 4.8%; 3-year…

A: Pure Expectation Theory: This theory assumes that various maturities are having substitutes and…

Q: The time value of money is used in calculating bond prices because: Group of answer choices A - The…

A: The time value of money is helpful in calculating the present value of future payments. So the…

Q: B. 20 BP = 0.2% C. Basel I is increasing the amount of capital that banks are required to…

A: The basel norms are a fought to co-ordinate the banking regulation around the world as it is…

Q: If the loan interest rate is 4 % mark-up on the 6 month treasury bill and the deposit interest rate…

A: There are different types of risk faced by the investor such as Repricing risk,yield -curve risk ,…

Q: You are an investor in the world where short-selling assets is prohibited. Suppose that the price of…

A: a. a. The calculation is: The formula image is: Investors will opt for dividend options in order…

Q: uestion Consider the following balance sheet positions for a financial institution: •…

A: The repricing gap is a difference between the assets value and the liability value.

Q: Consider a three-year bond with annual coupons, a face value of 10,000$, and a 2% coupon rate. If…

A: Note: As per our guidelines, we can only answer one question at once. Since, the first question is…

Q: Real and nominal interest rates: Suppose the real return on investing in amachine is 5% and the…

A: A real interest rate is an interest rate that has been adjusted to remove the effects of inflation…

Q: AB Borda shall establish a risk-adjusted required rate of return as part of their investment…

A: We need to use the following equation to calculate nationally adjusted required return Nationally…

Q: a) You observe the following quotes for the USD/AUD in the spot market from two banks: Bank of…

A: There are 3 different questions, solution of first answer will provided. If you want answer for…

Q: Given a choice between 5-year and 1-year instruments most people would choose 5-year instruments…

A: The term structure of interest rates deals with the relationship among the yields of default-free…

Q: What is the difference in the interest rates on commercial paper for financial firms versus…

A: Hello. Since your question has multiple parts, we will solve first question for you. If you want…

4

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- What would be the interest rate that would allow you to convert an investment from B/.5,000 to B/.20,227.79 in 10 years? (NOTE: Do this problem ONLY with Conversion Factor and the corresponding Excel Financial Function and remember to confirm your answer with the corresponding Cash Flow Table)You plan to analyze the value of a potential investment by calculating the sum of the present values of its expected cash flows. Which of the following would lower the calculated value of the investment? The discount rate decreases. The cash flows are in the form of a deferred annuity, and they total to $100,000. You learn that the annuity lasts for only 5 rather than 10 years, hence that each payment is for $20,000 rather than for $10,000. The discount rate increases. The riskiness of the investment's cash flows decreases. The total amount of cash flows remains the same, but more of the cash flows are received in the earlier years and less are received in the later years.Christie, Incorporated, has identified an investment project with the following cash flows. Year Cash Flow 1 $1,020 2 1,250 3 1,470 4 2,210 a. If the discount rate is 6 percent, what is the future value of these cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the discount rate is 14 percent, what is the future value of these cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. If the discount rate is 21 percent, what is the future value of these cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2…

- Fuente, Inc., has identified an investment project with the following cash flows. Year Cash Flow 1 $ 1,075 2 1,210 3 1,340 4 1,420 a. If the discount rate is 8 percent, what is the future value of the cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the discount rate is 11 percent, what is the future value of the cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. If the discount rate is 24 percent, what is the future value of the cash flows in Year 4? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)You plan to analyze the value of a potential investment by calculating the sum of the present values of its expected cash flows. Which of the following would increase the calculated value of the investment? Group of answer choices The cash flows are in the form of a deferred annuity, and they total to $100,000. You learn that the annuity lasts for 10 years rather than 5 years, hence that each payment is for $10,000 rather than for $20,000. The discount rate decreases. The riskiness of the investment's cash flows increases. The total amount of cash flows remains the same, but more of the cash flows are received in the later years and less are received in the earlier years. The discount rate increases.You are considering the purchase of an investment that would pay you $5,000 per year for Years 1-5, $3,000 per year for Years 6-8, and $2,000 per year for Years 9 and 10. If you require a 14%, and the cash flows occur at the end of each year, what is the modified internal rate of return if the initial outlay is $10,000 and the cash flows are reinvested at the required rate of return? 14% 23% 28% 46%

- Wells Inc., has identified an investment project with the following cash flows. Year Cash flow 1 $970 2 $1200 3 $1420 4 $2160 a.) If the discount rate is 7 percent, what is the future value of these cash flows in year 4? a.) Future value at 7 percent_____ b.) What is the future value at an interest rate of 13 percent? b.) Future value at 13 percent_____ c.) What is the future value at an interst rate of 22 percent? c.) Future value at 22 percent_____This question will compare two different arbitrage situations. Recall that arbitrage should equalize rates of return. We want to explore what this implies about equalizing prices. In the first situation, two assets, A and B, will each make a single guaranteed payment of $100 in 1 year. But asset A has a current price of $80 while asset B has a current price of $90.a. Which asset has the higher expected rate of return at current prices? Given their rates of return, which asset should investors be buying and which asset should they be selling?b. Assume that arbitrage continues until A and B have the same expected rate of return. When arbitrage ceases, will A and B have the same price?Next, consider another pair of assets, C and D. Asset C will make a single payment of $150 in one year while D will make a single payment of $200 in one year. Assume that the current price of C is $120 and that the current price of D is $180.c. Which asset has the higher expected rate of return at current…You are considering an investment project with the cash flows of -300 (the initial cash flow), 800 (cash flow at year 1), -200 (cash flow at year 2). Given the discount rate of 10%, compute the Modified Internal Rate of Return (MIRR) using the discountingapproach. 19.72% 71.94% 37.52% 50.55%

- Mendez Company has identified an investment project with the following cash flows. Year Cash Flow 1 $770 2 1,030 3 1,290 4 1,400 a. If the discount rate is 10 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the present value at 17 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the present value at 25 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)Fox Co. has identified an investment project with the following cash flows. Year Cash Flow 1 S 1,090 2 940 3 1, 490 4 1,850 a. If the discount rate is 12 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the present value at 15 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) c. What is the present value at 21 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)Havana, Inc. has identified an investment project with the following uneven cash flows: $0 at Year 0, $950 at Year 1, $1,180 at Year 2, $1,400 at Year 3, and $2,140 at Year 4. Assume the discount rate is 8 percent, what is the future value of these cash flows in Year 4? a) $4,167.62 b) $6,123.60 c) $5,670.00 d) $6,225.08