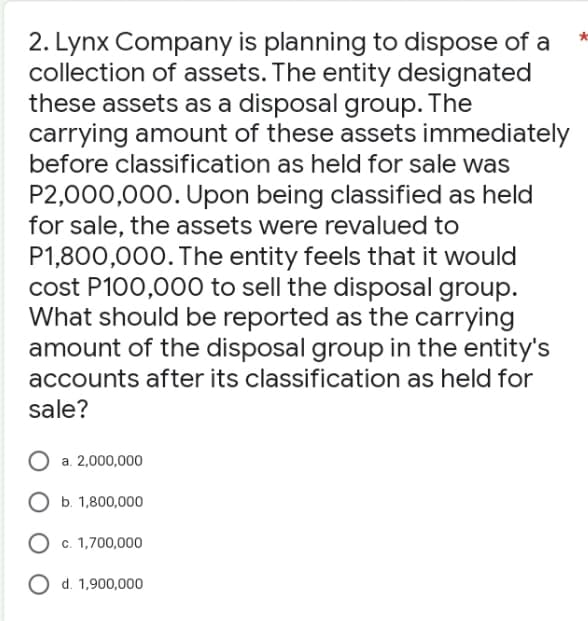

2. Lynx Company is planning to dispose of a collection of assets. The entity designated these assets as a disposal group. The carrying amount of these assets immediately before classification as held for sale was P2,000,000. Upon being classified as held for sale, the assets were revalued to P1,800,000. The entity feels that it would cost P100,000 to sell the disposal group. What should be reported as the carrying amount of the disposal group in the entity's accounts after its classification as held for sale? O a. 2,000,000 O b. 1,800,000 O c. 1,700,000 O d. 1,900,000

2. Lynx Company is planning to dispose of a collection of assets. The entity designated these assets as a disposal group. The carrying amount of these assets immediately before classification as held for sale was P2,000,000. Upon being classified as held for sale, the assets were revalued to P1,800,000. The entity feels that it would cost P100,000 to sell the disposal group. What should be reported as the carrying amount of the disposal group in the entity's accounts after its classification as held for sale? O a. 2,000,000 O b. 1,800,000 O c. 1,700,000 O d. 1,900,000

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 53P

Related questions

Question

Transcribed Image Text:2. Lynx Company is planning to dispose of a

collection of assets. The entity designated

these assets as a disposal group. The

carrying amount of these assets immediately

before classification as held for sale was

P2,000,000. Upon being classified as held

for sale, the assets were revalued to

P1,800,000. The entity feels that it would

cost P100,000 to sell the disposal group.

What should be reported as the carrying

amount of the disposal group in the entity's

accounts after its classification as held for

sale?

a. 2,000,000

b. 1,800,000

O c. 1,700,000

O d. 1,900,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT