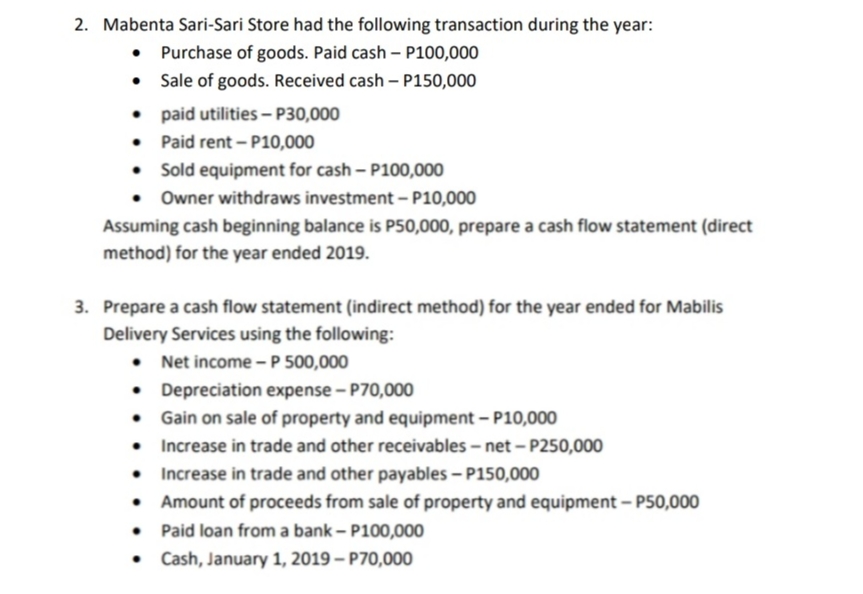

2. Mabenta Sari-Sari Store had the following transaction during the year: • Purchase of goods. Paid cash – P100,000 • Sale of goods. Received cash – P150,000 • paid utilities – P30,000 • Paid rent - P10,000 • Sold equipment for cash - P100,000 • Owner withdraws investment - P10,000 Assuming cash beginning balance is P50,000, prepare a cash flow statement (direct method) for the year ended 2019. 3. Prepare a cash flow statement (indirect method) for the year ended for Mabilis Delivery Services using the following: • Net income - P 500,000 • Depreciation expense - P70,000 • Gain on sale of property and equipment – P10,000 • Increase in trade and other receivables - net- P250,000 • Increase in trade and other payables – P150,000 Amount of proceeds from sale of property and equipment – P50,000 Paid loan from a bank - P100,000 • Cash, January 1, 2019 – P70,000

2. Mabenta Sari-Sari Store had the following transaction during the year: • Purchase of goods. Paid cash – P100,000 • Sale of goods. Received cash – P150,000 • paid utilities – P30,000 • Paid rent - P10,000 • Sold equipment for cash - P100,000 • Owner withdraws investment - P10,000 Assuming cash beginning balance is P50,000, prepare a cash flow statement (direct method) for the year ended 2019. 3. Prepare a cash flow statement (indirect method) for the year ended for Mabilis Delivery Services using the following: • Net income - P 500,000 • Depreciation expense - P70,000 • Gain on sale of property and equipment – P10,000 • Increase in trade and other receivables - net- P250,000 • Increase in trade and other payables – P150,000 Amount of proceeds from sale of property and equipment – P50,000 Paid loan from a bank - P100,000 • Cash, January 1, 2019 – P70,000

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 1PB: Provide journal entries to record each of the following transactions. For each, also identify: *the...

Related questions

Question

Transcribed Image Text:2. Mabenta Sari-Sari Store had the following transaction during the year:

• Purchase of goods. Paid cash – P100,000

Sale of goods. Received cash – P150,000

• paid utilities – P30,000

• Paid rent - P10,000

• Sold equipment for cash – P100,000

• Owner withdraws investment – P10,000

Assuming cash beginning balance is P50,000, prepare a cash flow statement (direct

method) for the year ended 2019.

3. Prepare a cash flow statement (indirect method) for the year ended for Mabilis

Delivery Services using the following:

• Net income - P 500,000

• Depreciation expense – P70,000

• Gain on sale of property and equipment – P10,000

• Increase in trade and other receivables – net – P250,000

• Increase in trade and other payables – P150,000

• Amount of proceeds from sale of property and equipment – P50,000

• Paid loan from a bank – P100,000

Cash, January 1, 2019 – P70,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning