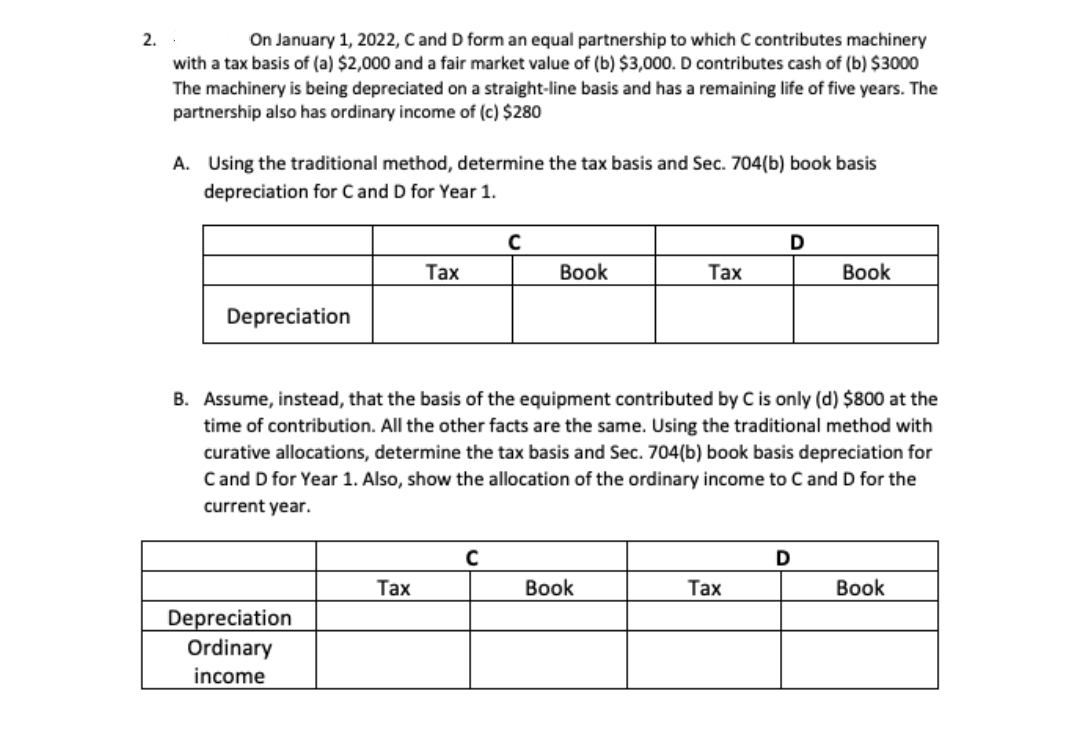

2. On January 1, 2022, C and D form an equal partnership to which C contributes machinery with a tax basis of (a) $2,000 and a fair market value of (b) $3,000. D contributes cash of (b) $3000 The machinery is being depreciated on a straight-line basis and has a remaining life of five years. The partnership also has ordinary income of (c) $280 A. Using the traditional method, determine the tax basis and Sec. 704(b) book basis depreciation for C and D for Year 1. Depreciation Depreciation Ordinary income Tax Tax C с Book B. Assume, instead, that the basis of the equipment contributed by C is only (d) $800 at the time of contribution. All the other facts are the same. Using the traditional method with curative allocations, determine the tax basis and Sec. 704(b) book basis depreciation for C and D for Year 1. Also, show the allocation of the ordinary income to C and D for the current year. Tax Book D Tax Book D Book

2. On January 1, 2022, C and D form an equal partnership to which C contributes machinery with a tax basis of (a) $2,000 and a fair market value of (b) $3,000. D contributes cash of (b) $3000 The machinery is being depreciated on a straight-line basis and has a remaining life of five years. The partnership also has ordinary income of (c) $280 A. Using the traditional method, determine the tax basis and Sec. 704(b) book basis depreciation for C and D for Year 1. Depreciation Depreciation Ordinary income Tax Tax C с Book B. Assume, instead, that the basis of the equipment contributed by C is only (d) $800 at the time of contribution. All the other facts are the same. Using the traditional method with curative allocations, determine the tax basis and Sec. 704(b) book basis depreciation for C and D for Year 1. Also, show the allocation of the ordinary income to C and D for the current year. Tax Book D Tax Book D Book

Chapter21: Partnerships

Section: Chapter Questions

Problem 25CE

Related questions

Question

Transcribed Image Text:2.

On January 1, 2022, C and D form an equal partnership to which C contributes machinery

with a tax basis of (a) $2,000 and a fair market value of (b) $3,000. D contributes cash of (b) $3000

The machinery is being depreciated on a straight-line basis and has a remaining life of five years. The

partnership also has ordinary income of (c) $280

A. Using the traditional method, determine the tax basis and Sec. 704(b) book basis

depreciation for C and D for Year 1.

Depreciation

Depreciation

Ordinary

income

Tax

Tax

C

с

Book

B. Assume, instead, that the basis of the equipment contributed by C is only (d) $800 at the

time of contribution. All the other facts are the same. Using the traditional method with

curative allocations, determine the tax basis and Sec. 704(b) book basis depreciation for

C and D for Year 1. Also, show the allocation of the ordinary income to C and D for the

current year.

Tax

Book

D

Tax

Book

D

Book

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you