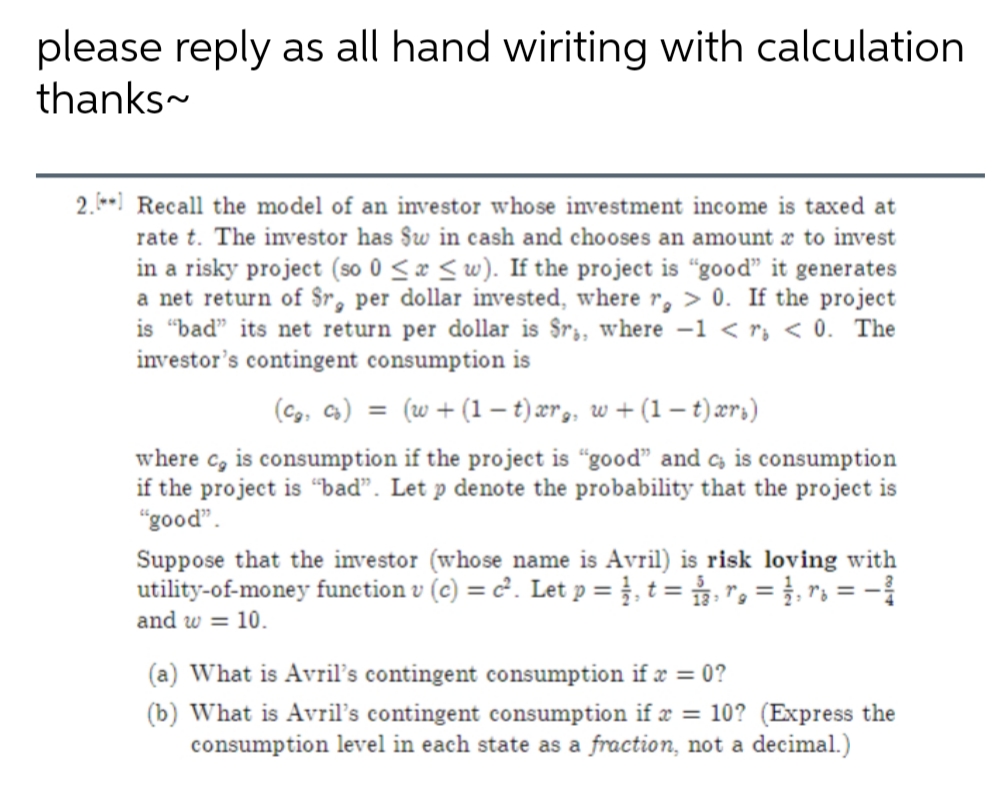

2.- Recall the model of an investor whose investment income is taxed at rate t. The investor has §w in cash and chooses an amount æ to invest in a risky project (so 0 0. If the project is "bad" its net return per dollar is $r;, where –1 < r; << 0. The investor's contingent consumption is (Cg, Ca) = (w+ (1 – t) ær,, w + (1 – t)2ærs) %3D where c, is consumption if the project is "good" and , is consumption if the project is “bad". Let p denote the probability that the project is "good". Suppose that the investor (whose name is Avril) is risk loving with utility-of-money function v (c) = c². Let p =t=r, = }, n = - and w = 10. (a) What is Avril's contingent consumption if x = 0? (b) What is Avril's contingent consumption if x = 10? (Express the consumption level in each state as a fraction, not a decimal.)

2.- Recall the model of an investor whose investment income is taxed at rate t. The investor has §w in cash and chooses an amount æ to invest in a risky project (so 0 0. If the project is "bad" its net return per dollar is $r;, where –1 < r; << 0. The investor's contingent consumption is (Cg, Ca) = (w+ (1 – t) ær,, w + (1 – t)2ærs) %3D where c, is consumption if the project is "good" and , is consumption if the project is “bad". Let p denote the probability that the project is "good". Suppose that the investor (whose name is Avril) is risk loving with utility-of-money function v (c) = c². Let p =t=r, = }, n = - and w = 10. (a) What is Avril's contingent consumption if x = 0? (b) What is Avril's contingent consumption if x = 10? (Express the consumption level in each state as a fraction, not a decimal.)

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.7P

Related questions

Question

E3

Transcribed Image Text:please reply as all hand wiriting with calculation

thanks-

2.- Recall the model of an investor whose investment income is taxed at

rate t. The investor has §w in cash and chooses an amount x to invest

in a risky project (so 0 <æ < w). If the project is “good" it generates

a net return of $r, per dollar invested, where r, > 0. If the project

is "bad" its net return per dollar is $r;, where -1 < r, < 0. The

investor's contingent consumption is

(Cg. Cs) = (w+ (1 – t) ær,, w + (1 – t)ærs)

where c, is consumption if the project is “good" and c is consumption

if the project is “bad". Let p denote the probability that the project is

"good".

Suppose that the investor (whose name is Avril) is risk loving with

utility-of-money function v (c) = c². Let p = },t = r, = }, r = -

and w = 10.

(a) What is Avril's contingent consumption if æ = 0?

(b) What is Avril's contingent consumption if æ = 10? (Express the

consumption level in each state as a fraction, not a decimal.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning