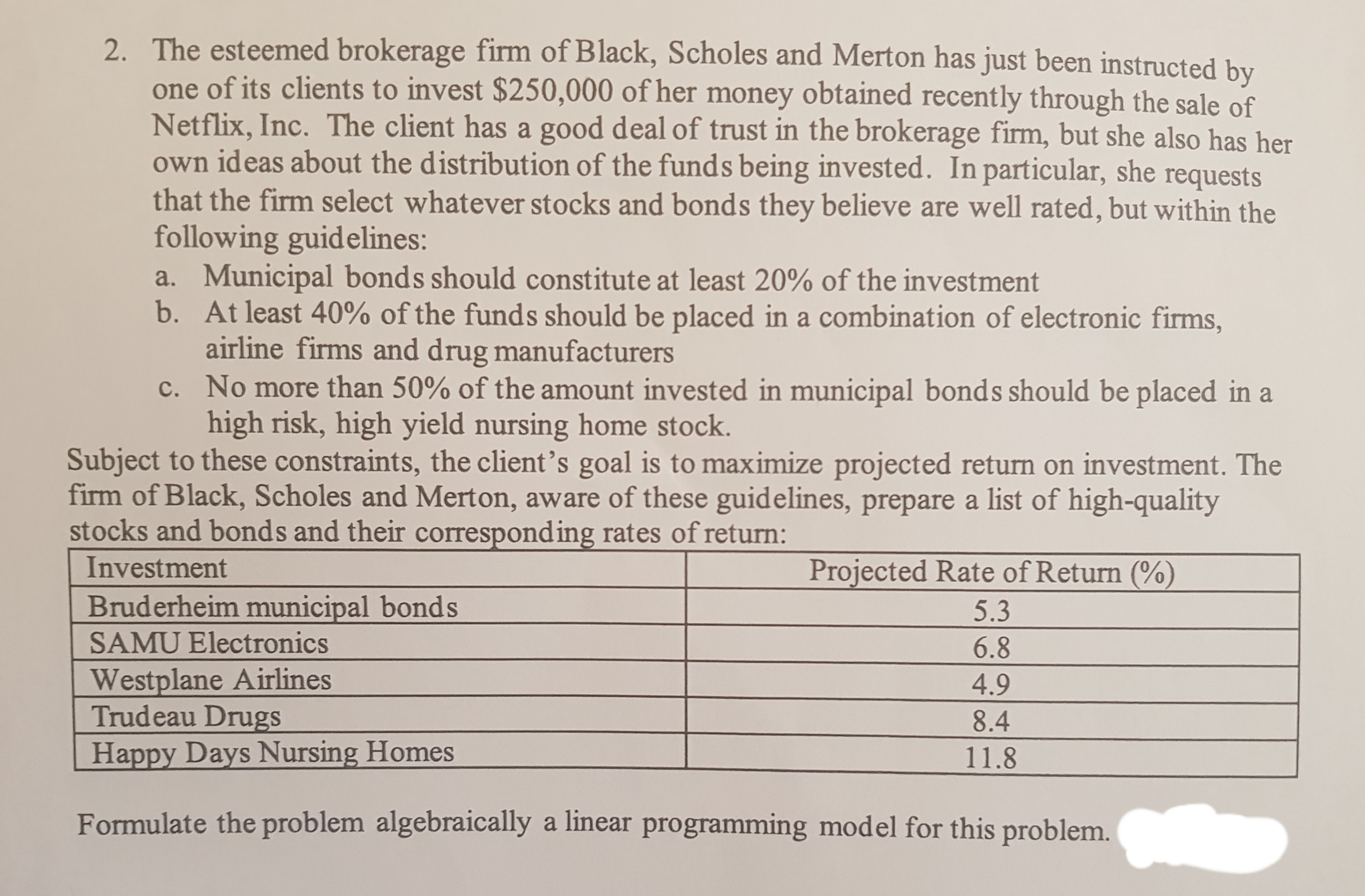

2. The esteemed brokerage firm of Black, Scholes and Merton has just been instructed by one of its clients to invest $250,000 of her money obtained recently through the sale of Netflix, Inc. The client has a good deal of trust in the brokerage firm, but she also has her own ideas about the distribution of the funds being invested. In particular, she requests that the firm select whatever stocks and bonds they believe are well rated, but within the following guidelines: a. Municipal bonds should constitute at least 20% of the investment b. At least 40% of the funds should be placed in a combination of electronic firms, airline firms and drug manufacturers c. No more than 50% of the amount invested in municipal bonds should be placed in a high risk, high yield nursing home stock. Subject to these constraints, the client's goal is to maximize projected return on investment. The firm of Black, Scholes and Merton, aware of these guidelines, prepare a list of high-quality stocks and bonds and their corresponding rates of return: Investment Projected Rate of Return (%) Bruderheim municipal bonds 5.3 SAMU Electronics 6.8 Westplane Airlines Trudeau Drugs Happy Days Nursing Homes 4.9 8.4 11.8 Formulate the problem algebraically a linear programming model for this problem.

2. The esteemed brokerage firm of Black, Scholes and Merton has just been instructed by one of its clients to invest $250,000 of her money obtained recently through the sale of Netflix, Inc. The client has a good deal of trust in the brokerage firm, but she also has her own ideas about the distribution of the funds being invested. In particular, she requests that the firm select whatever stocks and bonds they believe are well rated, but within the following guidelines: a. Municipal bonds should constitute at least 20% of the investment b. At least 40% of the funds should be placed in a combination of electronic firms, airline firms and drug manufacturers c. No more than 50% of the amount invested in municipal bonds should be placed in a high risk, high yield nursing home stock. Subject to these constraints, the client's goal is to maximize projected return on investment. The firm of Black, Scholes and Merton, aware of these guidelines, prepare a list of high-quality stocks and bonds and their corresponding rates of return: Investment Projected Rate of Return (%) Bruderheim municipal bonds 5.3 SAMU Electronics 6.8 Westplane Airlines Trudeau Drugs Happy Days Nursing Homes 4.9 8.4 11.8 Formulate the problem algebraically a linear programming model for this problem.

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:2. The esteemed brokerage firm of Black, Scholes and Merton has just been instructed by

one of its clients to invest $250,000 of her money obtained recently through the sale of

Netflix, Inc. The client has a good deal of trust in the brokerage firm, but she also has her

own ideas about the distribution of the funds being invested. In particular, she requests

that the firm select whatever stocks and bonds they believe are well rated, but within the

following guidelines:

a. Municipal bonds should constitute at least 20% of the investment

b. At least 40% of the funds should be placed in a combination of electronic firms,

airline firms and drug manufacturers

c. No more than 50% of the amount invested in municipal bonds should be placed in a

high risk, high yield nursing home stock.

Subject to these constraints, the client's goal is to maximize projected return on investment. The

firm of Black, Scholes and Merton, aware of these guidelines, prepare a list of high-quality

stocks and bonds and their corresponding rates of return:

Investment

Projected Rate of Return (%)

Bruderheim municipal bonds

5.3

SAMU Electronics

6.8

Westplane Airlines

Trudeau Drugs

Happy Days Nursing Homes

4.9

8.4

11.8

Formulate the problem algebraically a linear programming model for this problem.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education