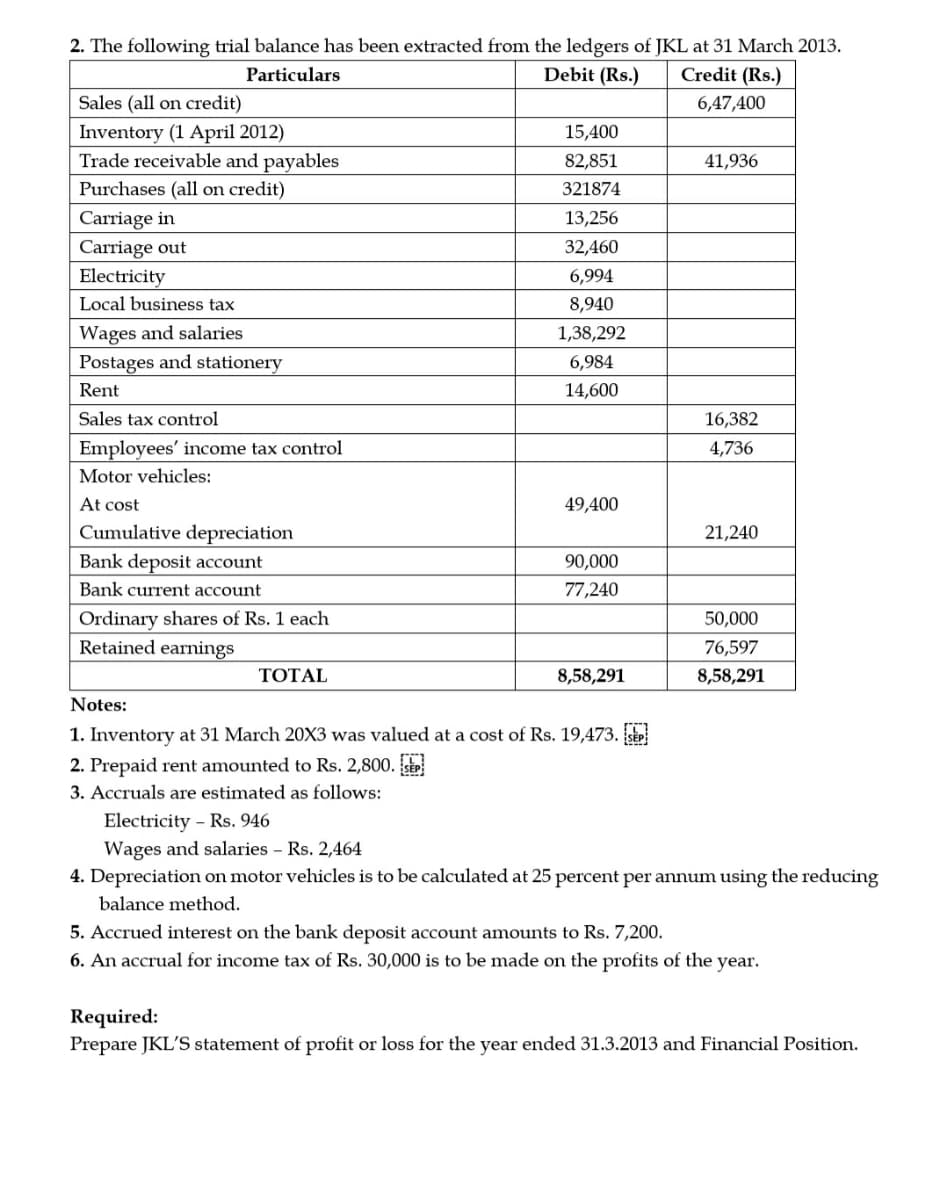

2. The following trial balance has been extracted from the ledgers of JKL at 31 March 2013. Particulars Debit (Rs.) Credit (Rs.) Sales (all on credit) 6,47,400 Inventory (1 April 2012) Trade receivable and payables 15,400 82,851 41,936 Purchases (all on credit) 321874 Carriage in Carriage out Electricity 13,256 32,460 6,994 Local business tax 8,940 Wages and salaries 1,38,292 Postages and stationery 6,984 Rent 14,600 Sales tax control 16,382 Employees' income tax control 4,736 Motor vehicles: At cost 49,400 Cumulative depreciation 21,240 Bank deposit account 90,000 Bank current account 77,240 Ordinary shares of Rs. 1 each 50,000 Retained earnings 76,597 TOTAL 8,58,291 8,58,291 Notes: 1. Inventory at 31 March 20X3 was valued at a cost of Rs. 19,473. 2. Prepaid rent amounted to Rs. 2,800. 3. Accruals are estimated as follows: Electricity - Rs. 946 Wages and salaries – Rs. 2,464 4. Depreciation on motor vehicles is to be calculated at 25 percent per annum using the reducing balance method. 5. Accrued interest on the bank deposit account amounts to Rs. 7,200. 6. An accrual for income tax of Rs. 30,000 is to be made on the profits of the year. Required: Prepare JKL'S statement of profit or loss for the year ended 31.3.2013 and Financial Position.

2. The following trial balance has been extracted from the ledgers of JKL at 31 March 2013. Particulars Debit (Rs.) Credit (Rs.) Sales (all on credit) 6,47,400 Inventory (1 April 2012) Trade receivable and payables 15,400 82,851 41,936 Purchases (all on credit) 321874 Carriage in Carriage out Electricity 13,256 32,460 6,994 Local business tax 8,940 Wages and salaries 1,38,292 Postages and stationery 6,984 Rent 14,600 Sales tax control 16,382 Employees' income tax control 4,736 Motor vehicles: At cost 49,400 Cumulative depreciation 21,240 Bank deposit account 90,000 Bank current account 77,240 Ordinary shares of Rs. 1 each 50,000 Retained earnings 76,597 TOTAL 8,58,291 8,58,291 Notes: 1. Inventory at 31 March 20X3 was valued at a cost of Rs. 19,473. 2. Prepaid rent amounted to Rs. 2,800. 3. Accruals are estimated as follows: Electricity - Rs. 946 Wages and salaries – Rs. 2,464 4. Depreciation on motor vehicles is to be calculated at 25 percent per annum using the reducing balance method. 5. Accrued interest on the bank deposit account amounts to Rs. 7,200. 6. An accrual for income tax of Rs. 30,000 is to be made on the profits of the year. Required: Prepare JKL'S statement of profit or loss for the year ended 31.3.2013 and Financial Position.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 2SEQ: On January 24, 20Y8, Niche Consulting collected $5,700 it had hilled its clients for services...

Related questions

Question

Corporate accounting, As per Ind As Schedule 3 of companies act, 2013

Transcribed Image Text:2. The following trial balance has been extracted from the ledgers of JKL at 31 March 2013.

Particulars

Debit (Rs.)

Credit (Rs.)

Sales (all on credit)

6,47,400

Inventory (1 April 2012)

Trade receivable and payables

15,400

82,851

41,936

Purchases (all on credit)

321874

Carriage in

13,256

Carriage out

32,460

Electricity

6,994

Local business tax

8,940

Wages and salaries

1,38,292

Postages and stationery

6,984

Rent

14,600

Sales tax control

16,382

Employees' income tax control

4,736

Motor vehicles:

At cost

49,400

Cumulative depreciation

21,240

Bank deposit account

90,000

Bank current account

77,240

Ordinary shares of Rs. 1 each

Retained earnings

50,000

76,597

ТОTAL

8,58,291

8,58,291

Notes:

1. Inventory at 31 March 20X3 was valued at a cost of Rs. 19,473. St

2. Prepaid rent amounted to Rs. 2,800. St

3. Accruals are estimated as follows:

Electricity - Rs. 946

Wages and salaries - Rs. 2,464

4. Depreciation on motor vehicles is to be calculated at 25 percent per annum using the reducing

balance method.

5. Accrued interest on the bank deposit account amounts to Rs. 7,200.

6. An accrual for income tax of Rs. 30,000 is to be made on the profits of the year.

Required:

Prepare JKL'S statement of profit or loss for the year ended 31.3.2013 and Financial Position.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning