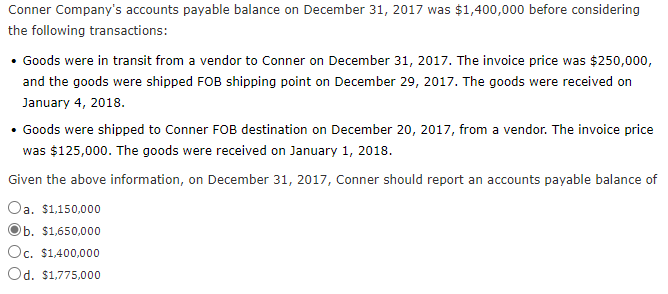

Conner Company's accounts payable balance on December 31, 2017 was $1,400,000 before considering the following transactions: • Goods were in transit from a vendor to Conner on December 31, 2017. The invoice price was $250,000, and the goods were shipped FOB shipping point on December 29, 2017. The goods were received on January 4, 2018. • Goods were shipped to Conner FOB destination on December 20, 2017, from a vendor. The invoice price was $125,000. The goods were received on January 1, 2018. Given the above information, on December 31, 2017, Conner should report an accounts payable balance of Oa. $1,150,000 b. $1,650,000 Oc. $1,400,0000 Od. $1,775,000

Conner Company's accounts payable balance on December 31, 2017 was $1,400,000 before considering the following transactions: • Goods were in transit from a vendor to Conner on December 31, 2017. The invoice price was $250,000, and the goods were shipped FOB shipping point on December 29, 2017. The goods were received on January 4, 2018. • Goods were shipped to Conner FOB destination on December 20, 2017, from a vendor. The invoice price was $125,000. The goods were received on January 1, 2018. Given the above information, on December 31, 2017, Conner should report an accounts payable balance of Oa. $1,150,000 b. $1,650,000 Oc. $1,400,0000 Od. $1,775,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 71APSA: Effects of an Inventory Error The income statements for Graul Corporation for the 3 years ending in...

Related questions

Question

100%

I'm not sure about my answer. Thank you for helping me!

Transcribed Image Text:Conner Company's accounts payable balance on December 31, 2017 was $1,400,000 before considering

the following transactions:

• Goods were in transit from a vendor to Conner on December 31, 2017. The invoice price was $250,000,

and the goods were shipped FOB shipping point on December 29, 2017. The goods were received on

January 4, 2018.

• Goods were shipped to Conner FOB destination on December 20, 2017, from a vendor. The invoice price

was $125,000. The goods were received on January 1, 2018.

Given the above information, on December 31, 2017, Conner should report an accounts payable balance of

Oa. $1,150,000

$1,650,000

Oc. $1,400,000

Od. $1,775,000

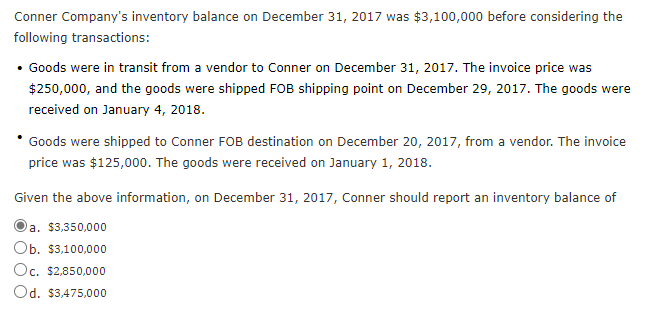

Transcribed Image Text:Conner Company's inventory balance on December 31, 2017 was $3,100,000 before considering the

following transactions:

• Goods were in transit from a vendor to Conner on December 31, 2017. The invoice price was

$250,000, and the goods were shipped FOB shipping point on December 29, 2017. The goods were

received on January 4, 2018.

Goods were shipped to Conner FOB destination on December 20, 2017, from a vendor. The invoice

price was $125,000. The goods were received on January 1, 2018.

Given the above information, on December 31, 2017, Conner should report an inventory balance of

a. $3,350,000

а.

Ob. $3,100,000

Oc. $2,850,000

Od. $3,475,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning