2. The gift tax payable of Mr. Alba on the July 14 donation is Mr. and Mrs. Alba gave the following donations: 05/03/19 Community property valued at P400,000 donated to Barbado, legitimate son who got married January 1, 2018.

2. The gift tax payable of Mr. Alba on the July 14 donation is Mr. and Mrs. Alba gave the following donations: 05/03/19 Community property valued at P400,000 donated to Barbado, legitimate son who got married January 1, 2018.

Chapter19: Family Tax Planning

Section: Chapter Questions

Problem 26P

Related questions

Question

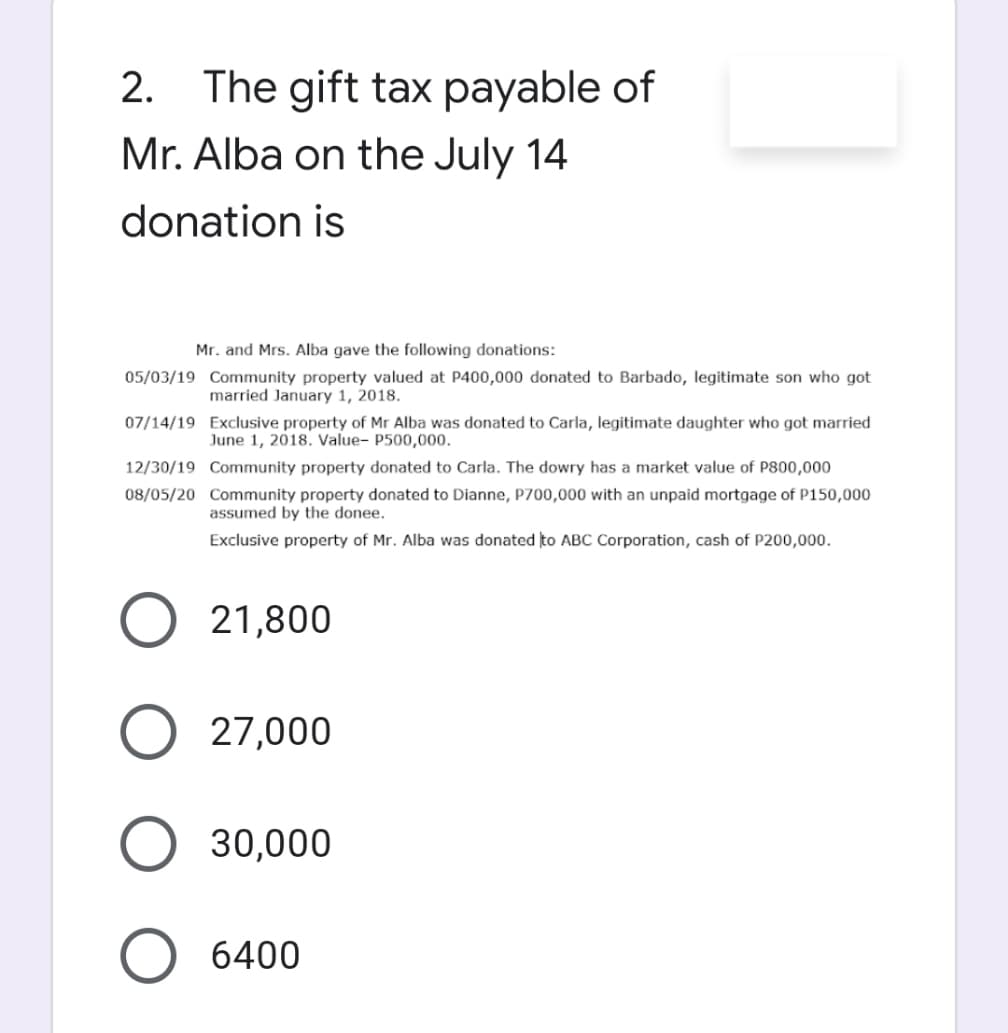

Transcribed Image Text:2. The gift tax payable of

Mr. Alba on the July 14

donation is

Mr. and Mrs. Alba gave the following donations:

05/03/19 Community property valued at P400,000 donated to Barbado, legitimate son who got

married January 1, 2018.

07/14/19 Exclusive property of Mr Alba was donated to Carla, legitimate daughter who got married

June 1, 2018. Value- P500,000.

12/30/19

Community property donated to Carla. The dowry has a market value of P800,000

08/05/20 Community property donated to Dianne, P700,000 with an unpaid mortgage of P150,000

assumed by the donee.

Exclusive property of Mr. Alba was donated to ABC Corporation, cash of P200,000.

O 21,800

O 27,000

O 30,000

O 6400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT