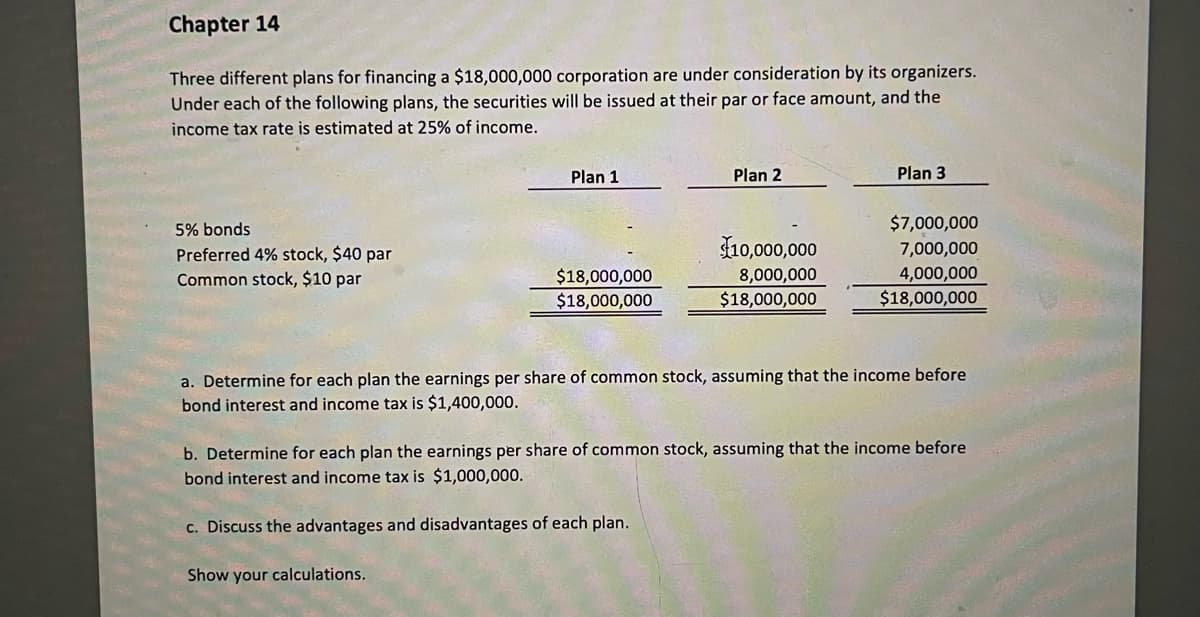

Under each of the following plans, the securities will be issued at their par or face amount, and the income tax rate is estimated at 25% of income. Plan 1 Plan 2 Plan 3 5% bonds $7,000,000 Preferred 4% stock, $40 par $10,000,000 7,000,000 Common stock, $10 par $18,000,000 8,000,000 4,000,000 $18,000,000 $18,000,000 $18,000,000 a. Determine for each plan the earnings per share of common stock, assuming that the income before bond interest and income tax is $1,400,000. b. Determine for each plan the earnings per share of common stock, assuming that the income before bond interest and income tax is $1,000,000. c. Discuss the advantages and disadvantages of each plan. Show your calculations.

Under each of the following plans, the securities will be issued at their par or face amount, and the income tax rate is estimated at 25% of income. Plan 1 Plan 2 Plan 3 5% bonds $7,000,000 Preferred 4% stock, $40 par $10,000,000 7,000,000 Common stock, $10 par $18,000,000 8,000,000 4,000,000 $18,000,000 $18,000,000 $18,000,000 a. Determine for each plan the earnings per share of common stock, assuming that the income before bond interest and income tax is $1,400,000. b. Determine for each plan the earnings per share of common stock, assuming that the income before bond interest and income tax is $1,000,000. c. Discuss the advantages and disadvantages of each plan. Show your calculations.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter8: Liabilities And Stockholders' Equity

Section: Chapter Questions

Problem 8.1.3P

Related questions

Question

Transcribed Image Text:Chapter 14

Three different plans for financing a $18,000,000 corporation are under consideration by its organizers.

Under each of the following plans, the securities will be issued at their par or face amount, and the

income tax rate is estimated at 25% of income.

Plan 1

Plan 2

Plan 3

5% bonds

$7,000,000

Preferred 4% stock, $40 par

$10,000,000

7,000,000

Common stock, $10 par

$18,000,000

8,000,000

4,000,000

$18,000,000

$18,000,000

$18,000,000

a. Determine for each plan the earnings per share of common stock, assuming that the income before.

bond interest and income tax is $1,400,000.

b. Determine for each plan the earnings per share of common stock, assuming that the income before

bond interest and income tax is $1,000,000.

c. Discuss the advantages and disadvantages of each plan.

Show your calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning