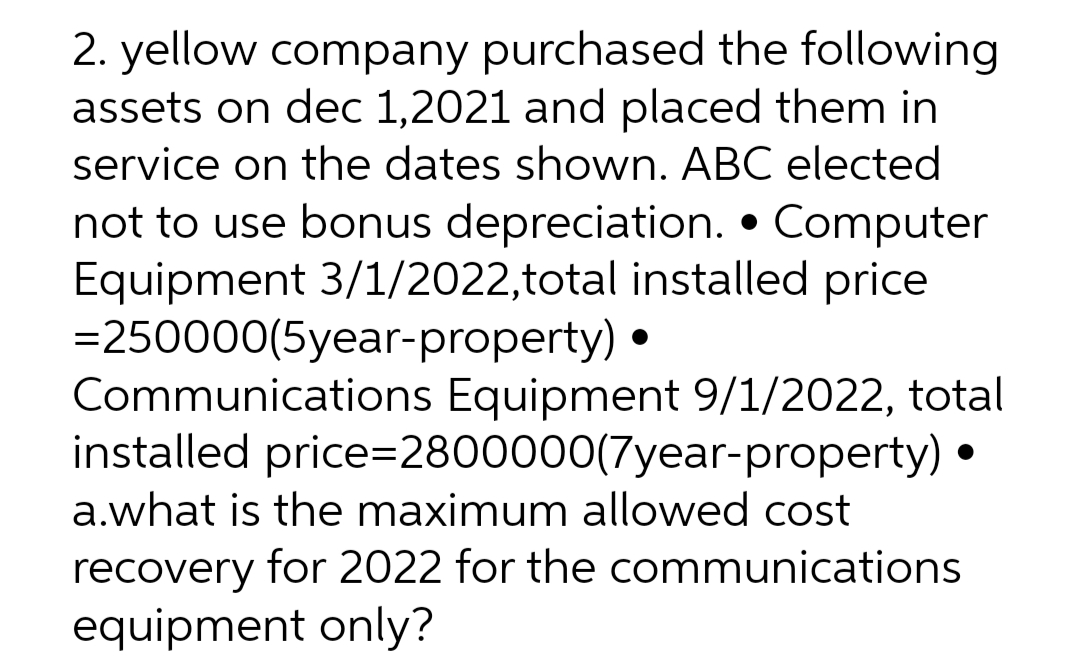

2. yellow company purchased the following assets on dec 1,2021 and placed them in service on the dates shown. ABC elected not to use bonus depreciation. • Computer Equipment 3/1/2022, total installed price = 250000(5year-property) • Communications Equipment 9/1/2022, total installed price=2800000(7year-property) • a.what is the maximum allowed cost recovery for 2022 for the communications equipment only?

2. yellow company purchased the following assets on dec 1,2021 and placed them in service on the dates shown. ABC elected not to use bonus depreciation. • Computer Equipment 3/1/2022, total installed price = 250000(5year-property) • Communications Equipment 9/1/2022, total installed price=2800000(7year-property) • a.what is the maximum allowed cost recovery for 2022 for the communications equipment only?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 11MCQ

Related questions

Question

Please help me

Transcribed Image Text:2. yellow company purchased the following

assets on dec 1,2021 and placed them in

service on the dates shown. ABC elected

not to use bonus depreciation. • Computer

Equipment 3/1/2022,total installed price

= 250000(5year-property) •

Communications Equipment 9/1/2022, total

installed price=2800000(7year-property) •

a.what is the maximum allowed cost

recovery for 2022 for the communications

equipment only?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning