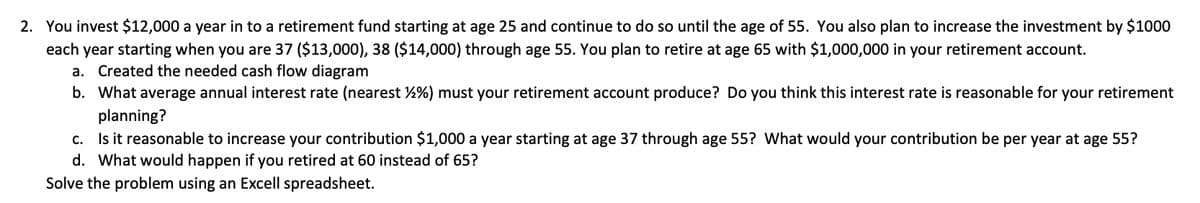

2. You invest $12,000 a year in to a retirement fund starting at age 25 and continue to do so until the age of 55. You also plan to increase the investment by $1000 each year starting when you are 37 ($13,000), 38 ($14,000) through age 55. You plan to retire at age 65 with $1,000,000 in your retirement account. a. Created the needed cash flow diagram b. What average annual interest rate (nearest %%) must your retirement account produce? Do you think this interest rate is reasonable for your retirement planning? c. Is it reasonable to increase your contribution $1,000 a year starting at age 37 through age 55? What would your contribution be per year at age 55? d. What would happen if you retired at 60 instead of 65? Solve the problem using an Excell spreadsheet.

2. You invest $12,000 a year in to a retirement fund starting at age 25 and continue to do so until the age of 55. You also plan to increase the investment by $1000 each year starting when you are 37 ($13,000), 38 ($14,000) through age 55. You plan to retire at age 65 with $1,000,000 in your retirement account. a. Created the needed cash flow diagram b. What average annual interest rate (nearest %%) must your retirement account produce? Do you think this interest rate is reasonable for your retirement planning? c. Is it reasonable to increase your contribution $1,000 a year starting at age 37 through age 55? What would your contribution be per year at age 55? d. What would happen if you retired at 60 instead of 65? Solve the problem using an Excell spreadsheet.

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3PB: Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate...

Related questions

Question

Transcribed Image Text:2. You invest $12,000 a year in to a retirement fund starting at age 25 and continue to do so until the age of 55. You also plan to increase the investment by $1000

each year starting when you are 37 ($13,000), 38 ($14,000) through age 55. You plan to retire at age 65 with $1,000,000 in your retirement account.

a. Created the needed cash flow diagram

b. What average annual interest rate (nearest 2%) must your retirement account produce? Do you think this interest rate is reasonable for your retirement

planning?

c. Is it reasonable to increase your contribution $1,000 a year starting at age 37 through age 55? What would your contribution be per year at age 55?

d. What would happen if you retired at 60 instead of 65?

Solve the problem using an Excell spreadsheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning