2.cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker3D&takeAssignmentSessionLocator=&inprogress3false eBook Show Me How Calculator Print Item Entries for Issuing Bonds and Amortizing Discount by Straight-Line Method On the first day of its fiscal year, Chin Company issued $18,200,000 of five-year, 9% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 11%, resulting in Chin receiving cash of $16,828,145. a. Journalize the entries to record the following: 1. Issuance of the bonds. 2. First semiannual interest payment. The bond discount is combined with the semiannual interest payment. (Round your answer to the nearest dollar.) 3. Second semiannual interest payment. The bond discount is combined with the semiannual interest payment. (Round your answer to the nearest dollar.) If an amount box does not require an entry, leave it blank. Round your answers to the nearest dollar. 1. 2. 3. Check My Work Previous Next 4:26 PM 3/27/2020 b. Determine the amount of the bond interest expense for the first year. C. Why was the company able to issue the bonds for only $16,828,145 rather than for the face amount of $18,200,0007 The market rate of interest is the contract rate of interest. Therefore, inventors willing to pay the full face amount of the bonds. Previous Next Check My Work All work saved. Save and b Submit Assgrment for Grading 42 PM Prtsc Delete Insert CHD DIN F10 FI1 F12 FF D00 000 D00 000

2.cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker3D&takeAssignmentSessionLocator=&inprogress3false eBook Show Me How Calculator Print Item Entries for Issuing Bonds and Amortizing Discount by Straight-Line Method On the first day of its fiscal year, Chin Company issued $18,200,000 of five-year, 9% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 11%, resulting in Chin receiving cash of $16,828,145. a. Journalize the entries to record the following: 1. Issuance of the bonds. 2. First semiannual interest payment. The bond discount is combined with the semiannual interest payment. (Round your answer to the nearest dollar.) 3. Second semiannual interest payment. The bond discount is combined with the semiannual interest payment. (Round your answer to the nearest dollar.) If an amount box does not require an entry, leave it blank. Round your answers to the nearest dollar. 1. 2. 3. Check My Work Previous Next 4:26 PM 3/27/2020 b. Determine the amount of the bond interest expense for the first year. C. Why was the company able to issue the bonds for only $16,828,145 rather than for the face amount of $18,200,0007 The market rate of interest is the contract rate of interest. Therefore, inventors willing to pay the full face amount of the bonds. Previous Next Check My Work All work saved. Save and b Submit Assgrment for Grading 42 PM Prtsc Delete Insert CHD DIN F10 FI1 F12 FF D00 000 D00 000

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Long-Term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 12.2APR

Related questions

Question

100%

Transcribed Image Text:2.cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker3D&takeAssignmentSessionLocator=&inprogress3false

eBook

Show Me How

Calculator

Print Item

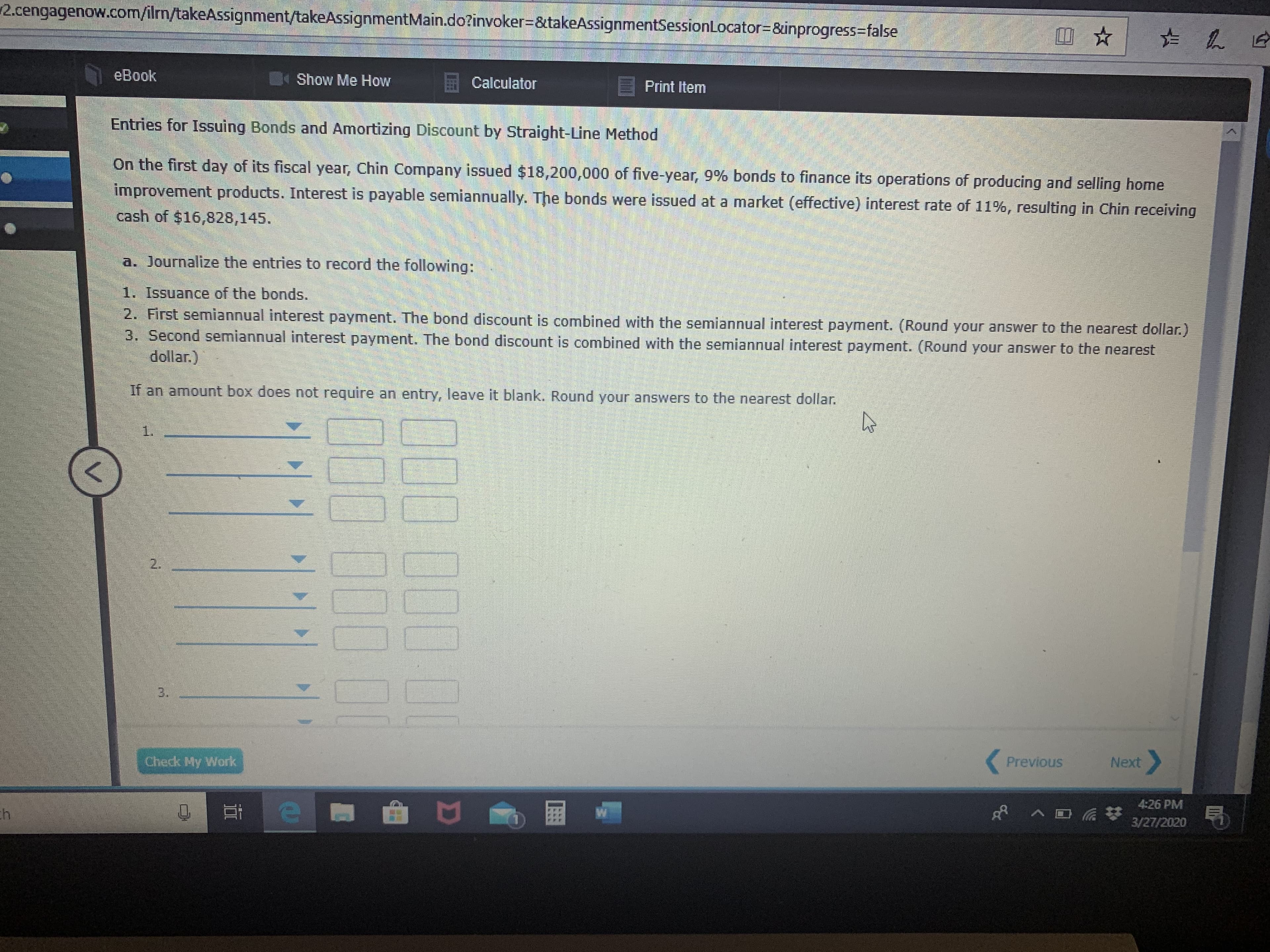

Entries for Issuing Bonds and Amortizing Discount by Straight-Line Method

On the first day of its fiscal year, Chin Company issued $18,200,000 of five-year, 9% bonds to finance its operations of producing and selling home

improvement products. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 11%, resulting in Chin receiving

cash of $16,828,145.

a. Journalize the entries to record the following:

1. Issuance of the bonds.

2. First semiannual interest payment. The bond discount is combined with the semiannual interest payment. (Round your answer to the nearest dollar.)

3. Second semiannual interest payment. The bond discount is combined with the semiannual interest payment. (Round your answer to the nearest

dollar.)

If an amount box does not require an entry, leave it blank. Round your answers to the nearest dollar.

1.

2.

3.

Check My Work

Previous

Next

4:26 PM

3/27/2020

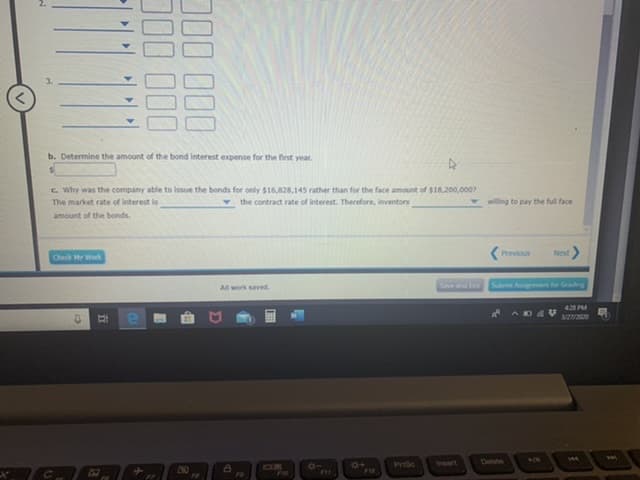

Transcribed Image Text:b. Determine the amount of the bond interest expense for the first year.

C. Why was the company able to issue the bonds for only $16,828,145 rather than for the face amount of $18,200,0007

The market rate of interest is

the contract rate of interest. Therefore, inventors

willing to pay the full face

amount of the bonds.

Previous

Next

Check My Work

All work saved.

Save and b

Submit Assgrment for Grading

42 PM

Prtsc

Delete

Insert

CHD

DIN

F10

FI1

F12

FF

D00 000

D00 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,