20. At 1 July 2020, a company had peepaid insurance of RMK200. On I January 2021, the company paid RM38,000 for insurance for the year to 30 September 2021. What figures should appear for insurance in the company's financial statements for the year ended 30 June 2021? a) Insurance expense RM27,200 : Prepayment RM19,000 b) Insurance expense RM39,300 : Prepayment RM9,500 ) Insurance expense RM36,700: Prepayment RM9,500 d) Insurance expense RMS5,700; Prepayment RM9,500

20. At 1 July 2020, a company had peepaid insurance of RMK200. On I January 2021, the company paid RM38,000 for insurance for the year to 30 September 2021. What figures should appear for insurance in the company's financial statements for the year ended 30 June 2021? a) Insurance expense RM27,200 : Prepayment RM19,000 b) Insurance expense RM39,300 : Prepayment RM9,500 ) Insurance expense RM36,700: Prepayment RM9,500 d) Insurance expense RMS5,700; Prepayment RM9,500

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 2MCQ: In December 2019, Swanstrom Inc. receives a cash payment of $3,500 for services performed in...

Related questions

Question

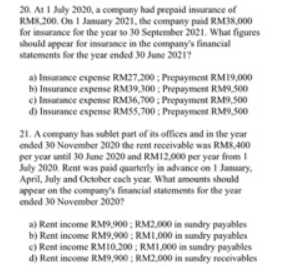

Transcribed Image Text:20. At 1 July 2020, a company had prepaid insurance of

RM8.200. On 1 January 2021, the company paid RM38,000

for insurance for the year to 30 September 2021. What figures

should appear for insurance in the company's financial

statements for the year ended 30 June 2021?

a) Insurance expense RM27,200 : Prepayment RM19,000

b) Insurance expense RM39,300 : Prepayment RM9,500

c) Insurance expense RM36,700 : Prepayment RM9,500

d) Insurance expense RMS5,700 ; Prepayment RM9,500

21. A company has sublet part of its offices and in the year

ended 30 November 2020 the rent receivable was RMR,400

per year until 30 June 2020 and RM12.000 per year from I

July 2020. Rent was paid quarterly in addvance on I January,

April, July and October each year. What amounts should

appear on the company's financial statements for the year

ended 30 November 2020?

a) Rent income RM9,900 ; RM2,000 in sundry payables

b) Rent income RM9,900 : RMI,000 in sundry payables

c) Rent income RMI0,200 ; RMI,000 in sundry payables

d) Rent income RM9,900 ; RM2,000 in sundry receivables

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning