20. Reznikov, Inc. provides an incentive compensation plan under. which its president receives a bonus equal to 10% of the corporation's income in excess of P600,000 before income tax but after deduction of the bonus. If income before income tax and bonus is P1,920,000 and the tax rate is 32%, the amount of the bonus would be a. 120,000 b. 132,000 c. 174,360 d. 192,000

20. Reznikov, Inc. provides an incentive compensation plan under. which its president receives a bonus equal to 10% of the corporation's income in excess of P600,000 before income tax but after deduction of the bonus. If income before income tax and bonus is P1,920,000 and the tax rate is 32%, the amount of the bonus would be a. 120,000 b. 132,000 c. 174,360 d. 192,000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 5SEQ: The balance in the unearned rent account for Jones Co. as of December 31 is $1 ,20(). If Jones Co....

Related questions

Question

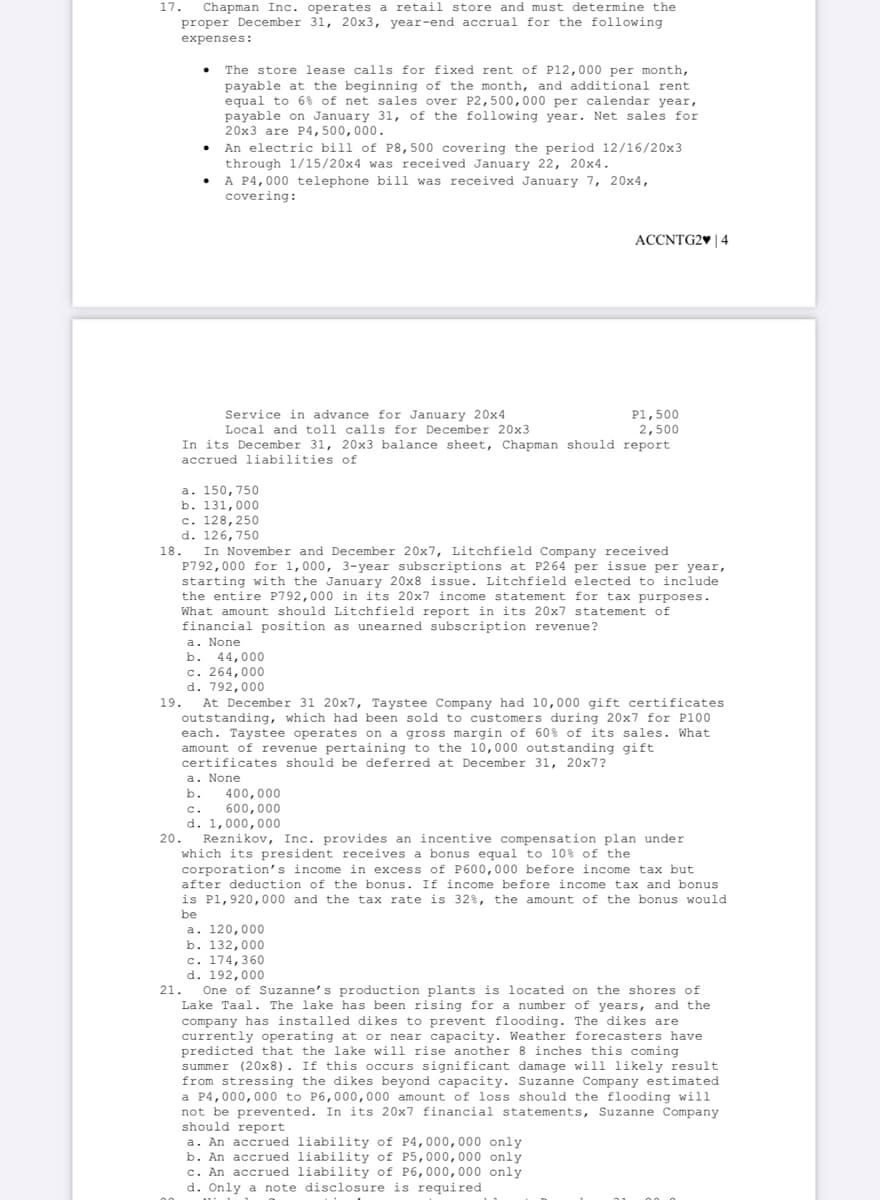

Transcribed Image Text:17. Chapman Inc. operates a retail store and must determine the

proper December 31, 20x3, year-end accrual for the following

expenses:

18.

.

Service in advance for January 20x4

Local and toll calls for December 20x3

In its December 31, 20x3 balance sheet, Chapman should report

accrued liabilities of

a. 150, 750

b. 131,000

c. 128, 250

d. 126, 750

.

19.

The store lease calls for fixed rent of P12,000 per month,

payable at the beginning of the month, and additional rent

equal to 6% of net sales over P2,500,000 per calendar year,

payable on January 31, of the following year. Net sales for

20x3 are P4,500,000.

An electric bill of P8,500 covering the period 12/16/20x3

through 1/15/20x4 was received January 22, 20x4.

A P4,000 telephone bill was received January 7, 20x4,

covering:

In November and December 20x7, Litchfield Company received

P792,000 for 1,000, 3-year subscriptions at P264 per issue per year,

starting with the January 20x8 issue. Litchfield elected to include

the entire P792,000 in its 20x7 income statement for tax purposes.

What amount should Litchfield report in its 20x7 statement of

financial position as unearned subscription revenue?

20.

ACCNTG2♥ | 4

21.

a. None

b. 44,000

c. 264,000

d. 792,000

At December 31 20x7, Taystee Company had 10,000 gift certificates

outstanding, which had been sold to customers during 20x7 for P100

each. Taystee operates on a gross margin of 60% of its sales. What

amount of revenue pertaining to the 10,000 outstanding gift

certificates should be deferred at December 31, 20x7?

a. None

b. 400,000

c.

600,000

d. 1,000,000

P1,500

2,500

Reznikov, Inc. provides an incentive compensation plan under

which its president receives a bonus equal to 10% of the

corporation's income in excess of P600,000 before income tax but

after deduction of the bonus. If income before income tax and bonus

is P1, 920,000 and the tax rate is 32%, the amount of the bonus would

be

a. 120,000

b. 132,000

c. 174,360

d. 192,000

One of Suzanne's production plants is located on the shores of

Lake Taal. The lake has been rising for a number of years, and the

company has installed dikes to prevent flooding. The dikes are

currently operating at or near capacity. Weather forecasters have

predicted that the lake will rise another 8 inches this coming

summer (20x8). If this occurs significant damage will likely result

from stressing the dikes beyond capacity. Suzanne Company estimated

a P4,000,000 to P6,000,000 amount of loss should the flooding will

not be prevented. In its 20x7 financial statements, Suzanne Company

should report

a. An accrued liability of P4,000,000 only

b. An accrued liability of P5,000,000 only

c. An accrued liability of P6,000,000 only

d. Only a note disclosure is required

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub