On January 1, 2020, Cullumber Corporation issued $900,000, 7%, 5-year bonds for $828,000. The bonds were sold to yield an effective-interest rate of 9%. Interest is paid annually on January 1. The company uses the effective-interest method of amortization. (a) Your answer has been saved. See score details after the due date. Prepare a bond discount amortization schedule which shows the amortization of discount for the first two interest payment dates. (Round answers to O decimal places, eg. 5,275.) Annual Interest Periods Issue date Interest to Be Paid 63000 63000 CULLUMBER CORPORATION Bond Discount Amortization Effective-Interest Method-Annual Interest Payments 7% Bonds Issued at 9% Interest Expense 74520 75557 Discount Amortization 11520 12557 $ Unamortize

On January 1, 2020, Cullumber Corporation issued $900,000, 7%, 5-year bonds for $828,000. The bonds were sold to yield an effective-interest rate of 9%. Interest is paid annually on January 1. The company uses the effective-interest method of amortization. (a) Your answer has been saved. See score details after the due date. Prepare a bond discount amortization schedule which shows the amortization of discount for the first two interest payment dates. (Round answers to O decimal places, eg. 5,275.) Annual Interest Periods Issue date Interest to Be Paid 63000 63000 CULLUMBER CORPORATION Bond Discount Amortization Effective-Interest Method-Annual Interest Payments 7% Bonds Issued at 9% Interest Expense 74520 75557 Discount Amortization 11520 12557 $ Unamortize

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

Ee 342.

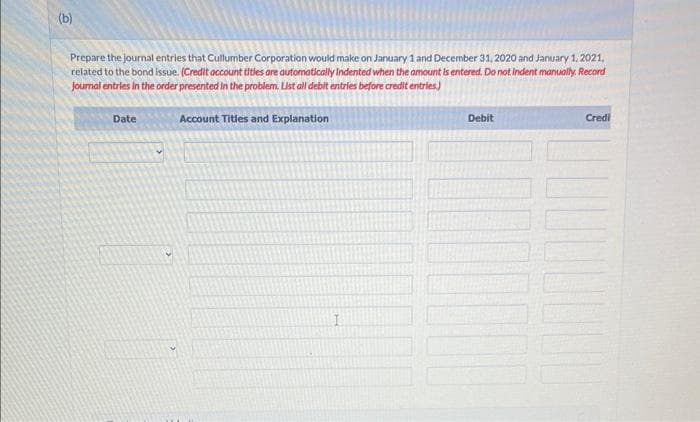

Transcribed Image Text:(b)

Prepare the journal entries that Cullumber Corporation would make on January 1 and December 31, 2020 and January 1, 2021.

related to the bond issue. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually. Record

Journal entries in the order presented in the problem. List all debit entries before credit entries)

Date

Account Titles and Explanation

I

Debit

Credi

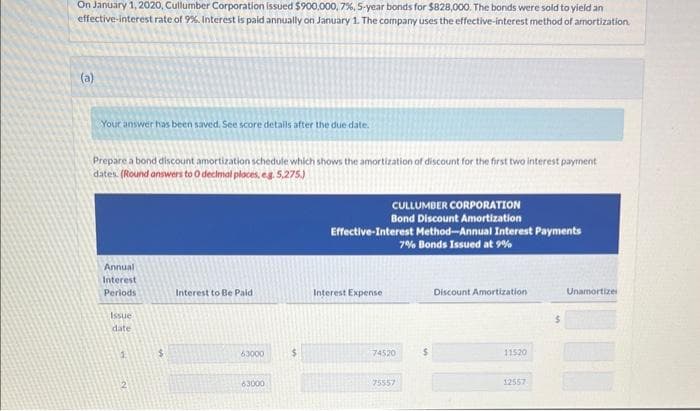

Transcribed Image Text:On January 1, 2020, Cullumber Corporation issued $900,000, 7%, 5-year bonds for $828,000. The bonds were sold to yield an

effective-interest rate of 9%. Interest is paid annually on January 1. The company uses the effective-interest method of amortization.

(a)

Your answer has been saved. See score details after the due date.

Prepare a bond discount amortization schedule which shows the amortization of discount for the first two interest payment

dates. (Round answers to O decimal places, eg. 5,275.)

Annual

Interest

Periods

Issue

date

Interest to Be Paid

63000

63000

CULLUMBER CORPORATION

Bond Discount Amortization

Effective-Interest Method-Annual Interest Payments

7% Bonds Issued at 9%

Interest Expense

74520

75557

Discount Amortization

11520

12557

$

Unamortize

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College