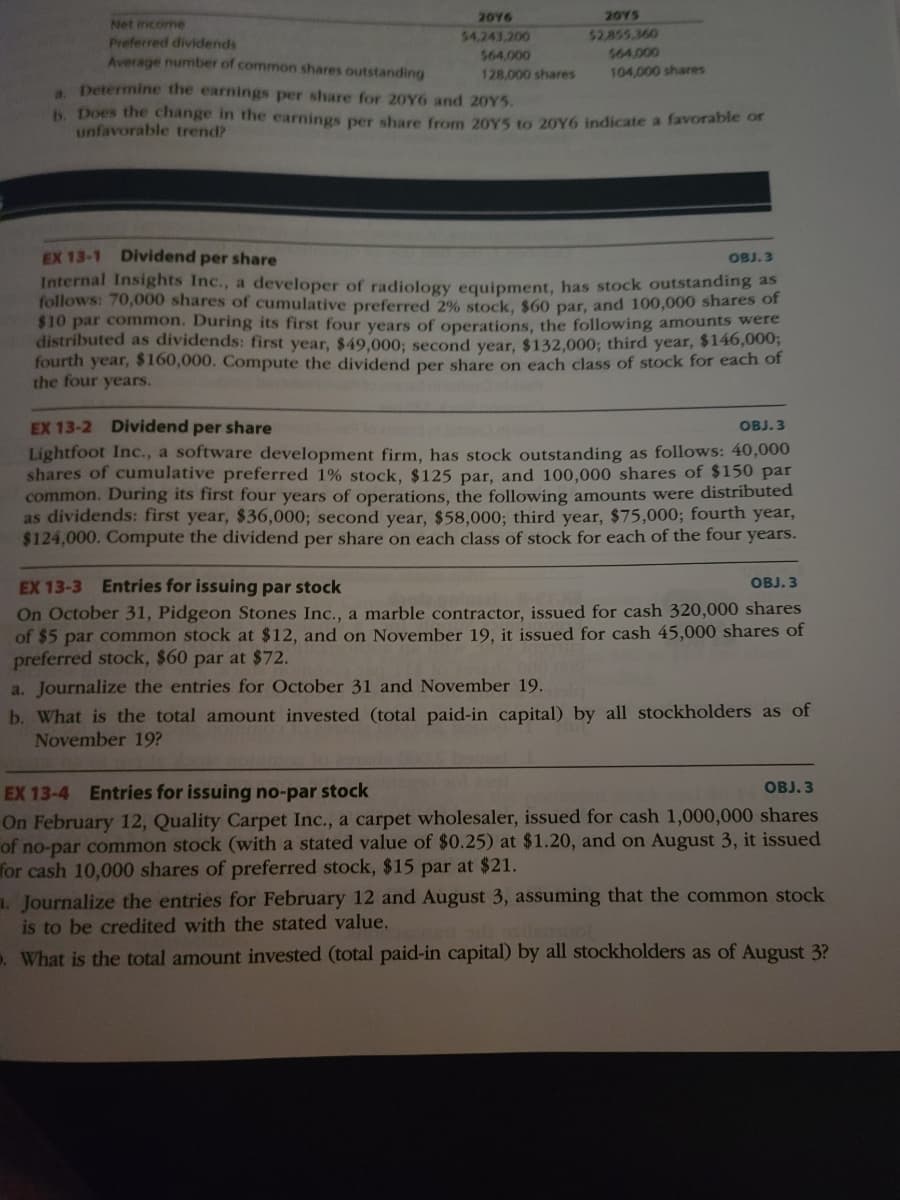

2016 20Y5 Net income Preferred dividends Average number of common shares outstanding $4.243,200 $2,855.360 564,000 $64.000 128,000 shares 104,000 shares Determine the earnings per share for 20Y6 and 20YS. b. Does the change in the earnings per share from 20Y5 to 20Y6 indicate a favorable of unfavorable trend?

2016 20Y5 Net income Preferred dividends Average number of common shares outstanding $4.243,200 $2,855.360 564,000 $64.000 128,000 shares 104,000 shares Determine the earnings per share for 20Y6 and 20YS. b. Does the change in the earnings per share from 20Y5 to 20Y6 indicate a favorable of unfavorable trend?

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter12: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 4FPE

Related questions

Question

Transcribed Image Text:20Y6

20Y5

Net income

Preferred dividends

Average number of common shares outstanding

$4,243,200

$2,855,360

564.000

564.000

128,000 shares

104,000 shares

Determine the earnings per share for 20Y6 and 20Y5.

b. Does the change in the earnings per share from 20Y5 to 20Y6 indicate a favorable of

unfavorable trend?

EX 13-1 Dividend per share

Internal Insights Inc., a developer of radiology equipment, has stock outstanding as

follows: 70,000 shares of cumulative preferred 2% stock, $60 par, and 100,000 shares of

$10 par common. During its first four years of operations, the following amounts were

distributed as dividends: first year, $49,000; second year, $132,000; third year, $146,000;

fourth year, $160,000. Compute the dividend per share on each class of stock for each of

the four years.

OBJ. 3

EX 13-2 Dividend per share

OBJ. 3

Lightfoot Inc., a software development firm, has stock outstanding as follows: 40,000

shares of cumulative preferred 1% stock, $125 par, and 100,000 shares of $150 par

common. During its first four years of operations, the following amounts were distributed

as dividends: first year, $36,000; second year, $58,000; third year, $75,000; fourth year,

$124,000. Compute the dividend per share on each class of stock for each of the four years.

EX 13-3 Entries for issuing par stock

On October 31, Pidgeon Stones Inc., a marble contractor, issued for cash 320,000 shares

of $5 par common stock at $12, and on November 19, it issued for cash 45,000 shares of

preferred stock, $60 par at $72.

a. Journalize the entries for October 31 and November 19.

OBJ. 3

b. What is the total amount invested (total paid-in capital) by all stockholders as of

November 19?

EX 13-4 Entries for issuing no-par stock

OBJ. 3

On February 12, Quality Carpet Inc., a carpet wholesaler, issued for cash 1,000,000 shares

of no-par common stock (with a stated value of $0.25) at $1.20, and on August 3, it issued

for cash 10,000 shares of preferred stock, $15 par at $21.

a. Journalize the entries for February 12 and August 3, assuming that the common stock

is to be credited with the stated value.

. What is the total amount invested (total paid-in capital) by all stockholders as of August 3?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning