2018 and a balance sheet as o (Answ Gross profit: 20. Selvam does not keep his t prepare trading and Profi Machinery Cash at bank Sundry debtors Stock Bills receivable Bank loan Sundry creditors Cash sales Cash purchases Wages Partia Advertisement Drawings Adjustments: Write off depreciation 10% c

2018 and a balance sheet as o (Answ Gross profit: 20. Selvam does not keep his t prepare trading and Profi Machinery Cash at bank Sundry debtors Stock Bills receivable Bank loan Sundry creditors Cash sales Cash purchases Wages Partia Advertisement Drawings Adjustments: Write off depreciation 10% c

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 12EB: Clovis Enterprises reports $845,500 in credit sales for 2018 and $933,000 in 2019. It has a $758,000...

Related questions

Question

Transcribed Image Text:2018 and a balance sheet as on that date.

(Answer: Opening capital:

Gross profit: 1,35,000; Net profit:

Machinery

Cash at bank

Sundry debtors

Stock

Bills receivable

Bank loan

Sundry creditors

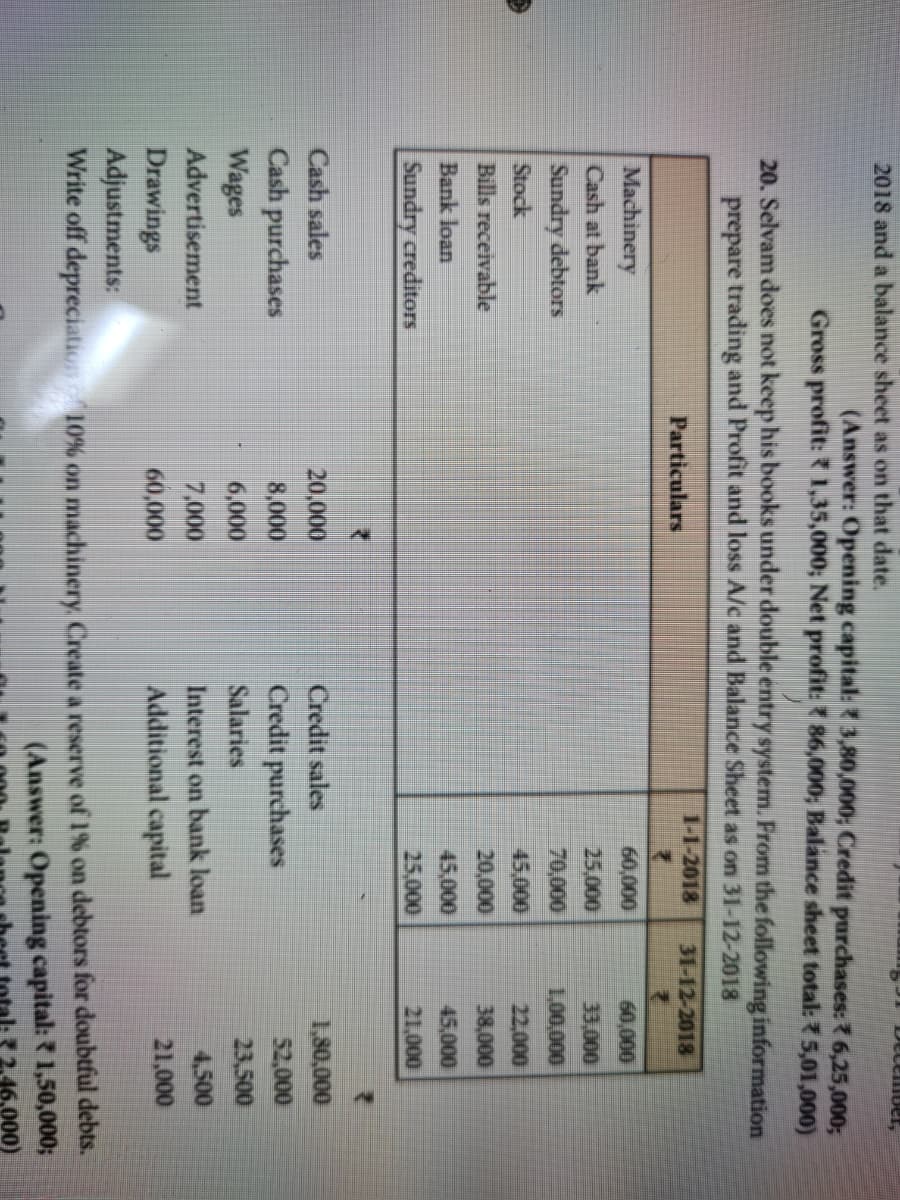

20. Selvam does not keep his books under double entry system. From the following information

prepare trading and Profit and loss A/c and Balance Sheet as on 31-12-2018

1-1-2018

Cash sales

Cash purchases

Wages

Particulars

R

20,000

8,000

6,000

7,000

60,000

3,80,000; Credit purchases: 6,25,000;

86,000; Balance sheet total: 5,01,000)

December,

60,000

25,000

70,000

45,000

20,000

45,000

25,000

Credit sales

Credit purchases

Salaries

Interest on bank loan

Additional capital

31-12-2018

{

60,000

33,000

1,00,000

22,000

38,000

45,000

21,000

1,80,000

52,000

23,500

4,500

21,000

Advertisement

Drawings

Adjustments:

Write off depreciation 10% on machinery. Create a reserve of 1% on debtors for doubtful debts.

(Answer: Opening capital: ₹ 1,50,000;

46.000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning